Open banking passes the 5 million active users milestone in the UK

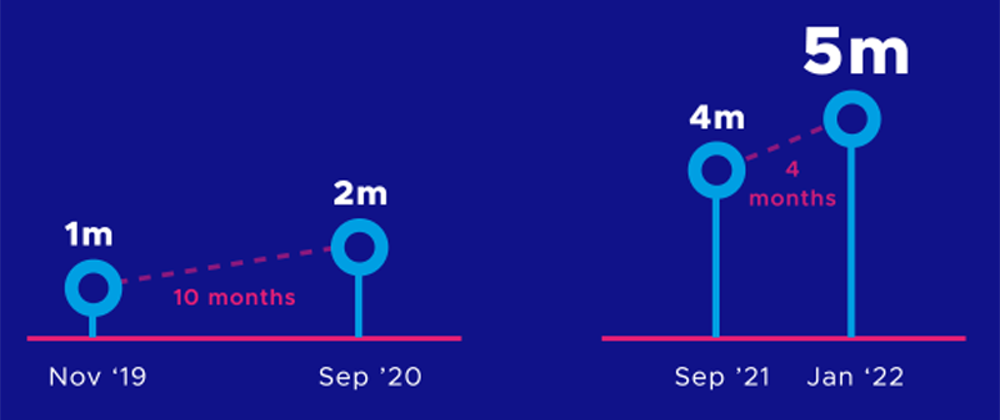

It took 10 months to grow the number of users from 1m to 2m in 2020 and only four months to increase from 4m to more than 5m.

There are now more than 5 million active users of open banking services in the UK based on data provided during January 2022 by the CMA9, the nine banks and building society mandated under the CMA Order to implement open banking in the UK, according to the press release.

This important milestone follows January’s celebration of the 4th anniversary of PSD2 making open banking a regulatory requirement in the UK, when more than 4.5 million people and businesses were using open banking services.

Accelerated speed of growth

What is especially exciting for us – and for our ecosystem – is the impressive trajectory of that growth. It took 10 months to grow the number of users from 1m to 2m in 2020. In contrast, it has taken just four months to grow from 4m to more than 5m, demonstrating the increasing appetite for consumers and small businesses to use open banking services to move, manage and make the most of their money.

Open banking payments boost adoption

Payments were the driving force behind this rapid growth – we saw nearly 625,000 additional payments in January 2022 compared with December 2021.

A significant factor in this payments growth was HMRC’s incorporation of a ‘Pay by bank‘ option into its annual self-assessment process, which took the total number of payments made via open banking to 3.86m in January 2022. This is an increase of 19.3% on December 2021.

Commenting on reaching such a significant user milestone, Charlotte Crosswell, Trustee of the Open Banking Implementation Entity (OBIE), said: “Open banking was predicated on delivering increased competition and providing consumers and small businesses with new and innovative solutions. It is therefore extremely encouraging to see that more than 5 million active users are now leveraging the benefits of open banking.

“This accelerated growth strongly represents a world-leading and thriving ecosystem bringing an ever-increasing range of real-world solutions, that in turn is driving mass user adoption.

“As open banking technology embeds and becomes easier to use, we look forward to seeing this momentum continue.”

Newly appointed CEO of the Open Banking Implementation Entity (OBIE), Henk Van Hulle, said: “What a great time to be joining the OBIE! This is great news for the open banking community. I am delighted to see such accelerated growth in end-user adoption rates. This demonstrates that the tremendous efforts of everyone across the whole ecosystem continue to bear fruit. It also shows what a superb job the team at the OBIE are doing in building and running the supporting infrastructure.”

David Beardmore, Ecosystem Development Director at the OBIE, said that as well as increased adoption, the numbers provide a clear demonstration to the wider open banking community that open banking is here to stay. “This is positive news for all involved in open banking – for those entrepreneurs who have built fintech businesses based on the foundations of open banking, for the investment community funding the continued expansion of products and services, and for government as it continues to examine how best to extend open banking functionality into other areas of the economy.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: