Lithuanian fintech Paysera has appointed Gintautas Mezetis as the company’s new CEO as it plots a move into the banking business, according to Fintech Futures.

Prior to joining Paysera, Mezetis spent the last two years as head of the country’s Information Society Development Committee, where he spearheaded the launch of the Lithuanian Open Data Portal, the State IT Service Management Information System, and the State IT Consolidated Cloud Infrastructure.

Founded in 2004, Paysera provides a range of financial services products, such as a payment gateway for e-shops, money transfers, currency conversion, payment cards, an event ticketing platform and a finance management app. It also plans to launch a parcel locker network this year.

Paysera currently holds an e-money institution licence (and was the first licensed EMI in Lithuania).

Last year, it applied for a specialised bank licence in Lithuania, and the bank’s legal name will be Paysera Bank. The Lithuanian and European Central Bank’s decision is expected in H1 2022.

__________

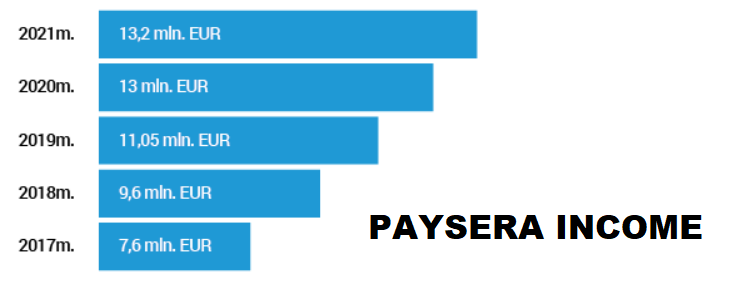

In 2021, Paysera made €13.2 million in revenue and €2.1 million profit. During that period, customers spent nearly €600 million in Paysera-operated e-shops and transferred €6.52 billion through the Paysera app and online banking (a 38% increase compared to 2020).

Paysera provides services in over 200 countries for its 700,000 customers.

In 2021, Paysera clients performed more than 6 mln transfers in 20+ different currencies.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: