As consumers experience the ease of payments embedded in their brand experiences, they’ll wonder why their banks make transactions so hard. As consumers find payments, lending and insurance seamlessly integrated into brand experiences, traditional providers will need to rethink how they participate in the financial services ecosystem to stay relevant.

„As embedded finance use cases proliferate and become more widely adopted, both traditional financial institutions and fintechs will face existential brand identity decisions,” according to Morning Consult’s quarterly report The State of Consumer Banking & Payments. .

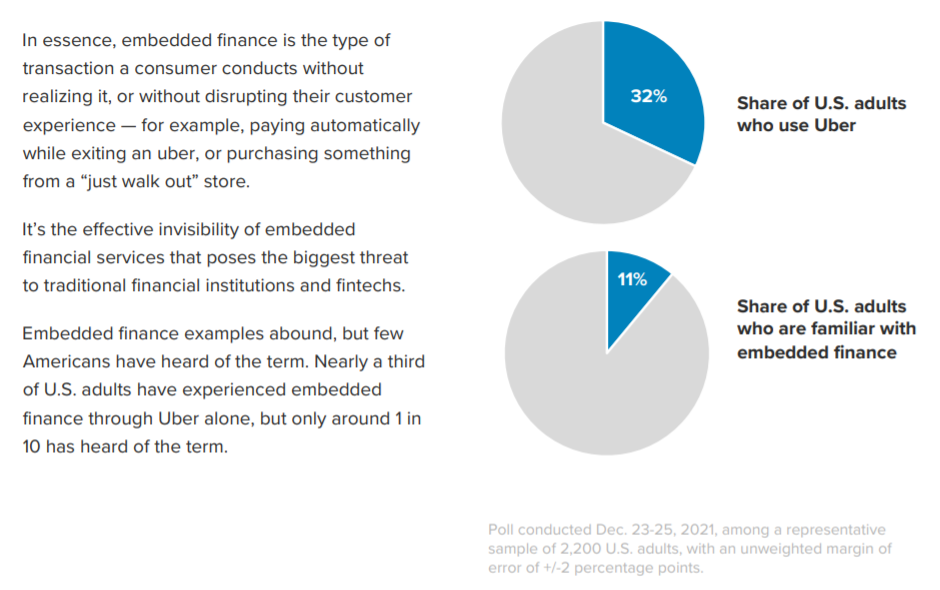

Embedded finance refers to exchanging a form of value with a nonfinancial company (e.g. paying or receiving a loan) seamlessly within that company’s ecosystem, such that it’s virtually indistinguishable from the rest of the interaction

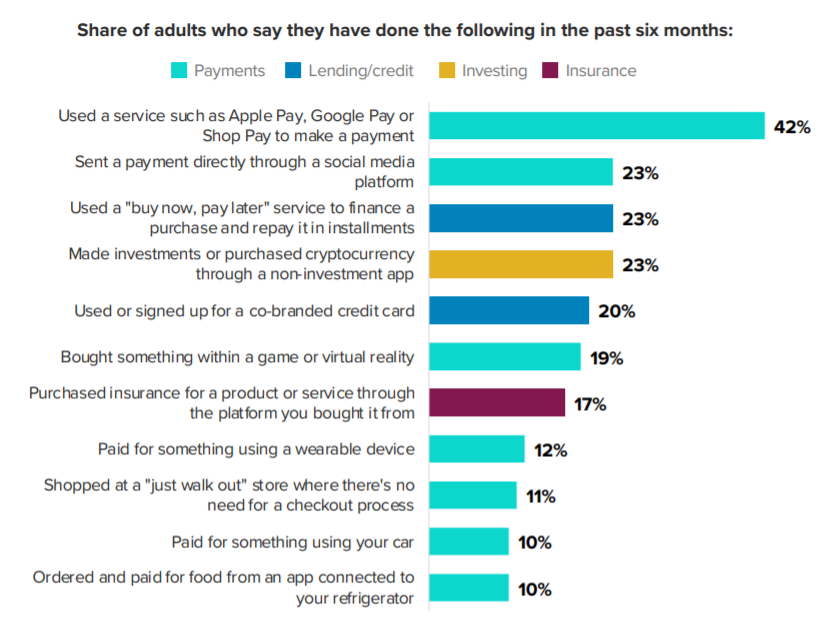

CONSUMERS ENCOUNTER EMBEDDED PAYMENTS REGULARLY

Consumers are accustomed to using nonfinancial apps to make payments. Over 40% of consumers report using Apple Pay, Google Pay or Shop Pay to make a payment. Nearly a quarter report sending a payment directly through a social media app or using a BNPL service — both of which are examples of embedded payments. But the applications of embedded finance extend beyond payments to permeate every aspect of the financial services industry.

Consumers can expect greater opportunities for embedded credit and lending, as well as insurance and investment, as nonfinancial services companies across industries build or buy the capability to offer these services. The increased ease of accessing these services will spell trouble for traditional financial services providers.

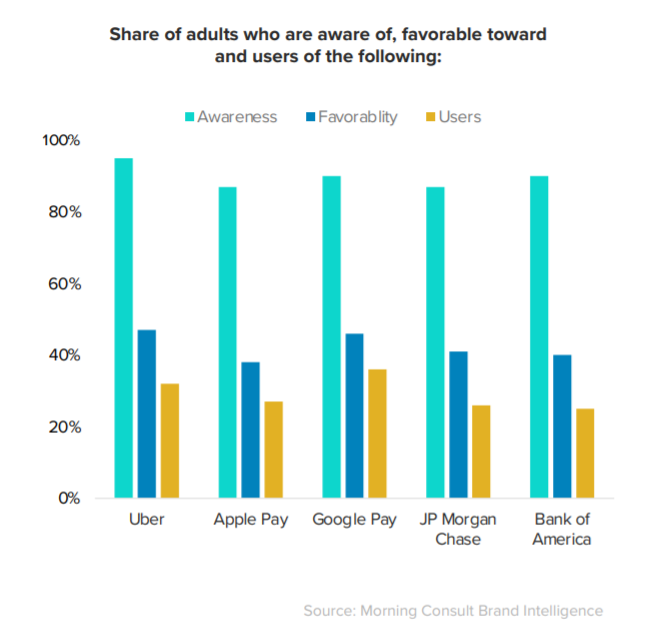

BIG TECH IS INTRODUCING CONSUMERS TO EMBEDDED FINANCE

The more consumers interact with companies without thinking about how their money travels from one place to the next, or without having to go through onerous processes to finance a purchase, the more their interactions with their traditional financial services providers will feel outdated — or worse, they’ll stop interacting with them altogether. This doesn’t just apply to traditional banks and insurance providers, either. “Fintech” will become a meaningless term because of its ubiquity, and also because of its role as a utility.

For businesses, fintech is becoming part of their technology stack, while for consumers, it’s becoming part of their experience with brands. Matt Harris of Bain Capital Ventures has described fintech as the “fourth platform,” predicting that it “will join internet, cloud, and mobile in the modern technology stack.” In the same way that we don’t think of companies with websites as “internet companies” or those with apps as “mobile companies,” companies with financial services capabilities won’t be labeled “fintechs.”

Every company will be a fintech company as a result of the embedded financial services they offer. Companies with embedded financial services are already showing their scale and brand power. Uber and Google Pay each have higher awareness, favorability and users than the largest bank by consumer deposits, JPMorgan.

WHAT IT MEANS: A FUNDAMENTAL RECKONING FOR BANKS

The former means essentially abandoning the B2C component of their branding and focusing more on the B2B vendor relationships they have with companies embedding their services. The latter will require a reimagining of the role they play in consumers’ lives — beyond providing the utility of accounts to serving the ends to which those accounts are a means.

Consumers naturally want to think about their finances, and financial services providers should be prepared to offer them actionable insights when they do, based on a hyper-detailed understanding of their financial goals and well-being, and to provide tools to help them achieve their aims. In a world where it’s easier than ever to spend, financial services providers can play the role of holistic adviser, giving consumers a complete picture of their finances in relation to their goals.

Fintechs face a third option that’s much less achievable to a traditional bank or financial services provider because of their legacy systems and regulatory hurdles: becoming a super app. This option is of course also open to nonfinancial apps. Super apps by definition must provide more than just financial services. Instead, they allow consumers to conduct nearly any transaction seamlessly from one place. The quintessential example of a super app is Grab, which, like Uber, started as a ride-hailing app but now offers food delivery, courier service and grocery orders, as well as payment, insurance and investing capabilities. Meanwhile, Klarna falls into the “aspiring super app” category, evolving from its primary focus on BNPL to offer shopping, payment and delivery services

Financial services providers will have two choices to make. Will they fade into the background as “banking as a service” providers by creating technology that can be seamlessly integrated into the tech stack of nonfinancial services companies? Or will they double down on providing financial advice through traditional services?

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: