Funds will be used in three key areas: US market growth, marketplaces solution launch, and to strengthen leadership in Web3.

On the heels of a highly successful year processing hundreds of billions of dollars in payments for some of the world’s largest merchants, Checkout.com raised $1 billion in its Series D funding round at a valuation of $40 billion, according to the press release.

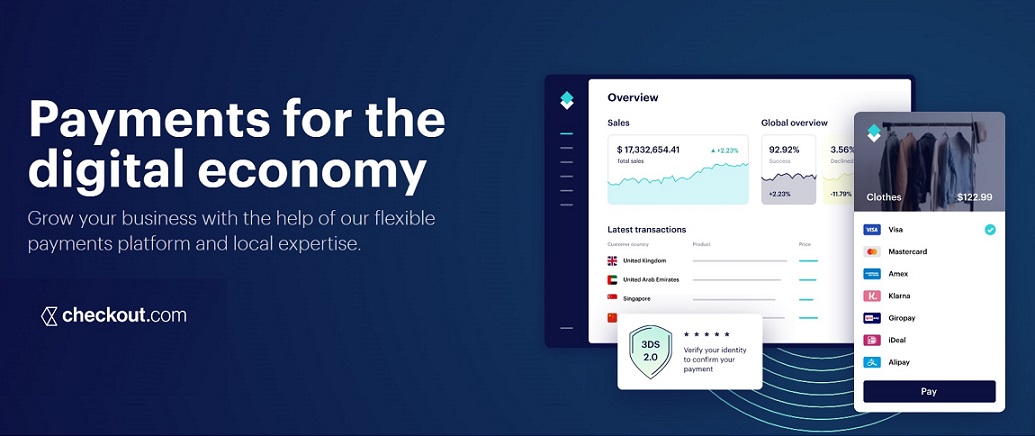

Checkout.com offers a full-stack online platform that simplifies payments processes for large global enterprise merchants. This supports its mission to enable businesses and their communities to thrive in the evolving digital economy.

The news sees Checkout.com more than double its valuation since Series C a year ago. In that time, it has grown rapidly in its home market of EMEA, tripling the volume of transactions processed for the third year in a row. Today the company serves large-scale ecommerce and services merchants like Netflix, Farfetch, Grab, NetEase, Pizza Hut, Shein, Siemens and Sony; fintech unicorns such as Klarna, Qonto, Revolut and WorldRemit; and many of the world’s largest crypto players, including Coinbase, Crypto.com, FTX, and MoonPay.

Over the past year Checkout.com opened new offices in six countries across four continents to cater to surging merchant demand.

“At our core, we help enterprise merchants to navigate the complexity of moving money around the world, whether in fiat currency or bridging the gap to Web3,” said Checkout.com founder and CEO, Guillaume Pousaz.

“By combining an elegant technology stack with industry expertise and an ‘extra-mile’ approach to service over the past decade, we’ve built deep partnerships with some of the world’s most innovative companies. Our Series D is validation of that work—but given we’re still in ‘chapter zero’ of our journey, it will also fuel our efforts to unlock the enormous untapped opportunity ahead.”

Scaling up to meet US demand

With the US as one of the largest ecommerce markets in the world, Checkout.com has invested heavily in its domestic technology infrastructure, and today offers a complete proprietary end-to-end payment processing platform in the US.

This delivers the same unrivalled performance, improved authorization rates and feature parity as the market-leading platform the company offers to merchants in other countries. It also makes Checkout.com one of the only providers in the US offering a fully cloud-based platform directly connected to local networks in all key geographies and for all major alternative payment methods.

“Much like our approach in EMEA, we will maintain our focus on the enterprise—especially fintech, software, food delivery, travel, e-commerce and crypto merchants. We’re looking to help our US customers grow domestically and internationally, and to help our non-US customers expand into the market here. We’re excited about the potential, and expect our North American employee base to grow by 200% this year alone.” – said Checkout.com’s New York-based CFO, Céline Dufétel.

Platform evolution for marketplaces

After comprehensive testing with multiple global merchants over the past several months, Checkout.com plans to launch its solution to service marketplaces & payment facilitators (payfacs) later this year. This will expand the company’s capability to service payments within online marketplaces—a sector that has seen a dramatic increase in transaction volumes given the shift to digital during the pandemic and the expansion of the gig economy for several years prior.

These new solutions will comprise identity verification technologies, split payments and treasury-as-a-service, as well as the existing capabilities of Payouts—which Checkout.com launched last year to help merchants send funds to cards and bank accounts globally via a single integration. Since then the company has successfully processed billions of dollars in payout transactions for the likes of TikTok and MoneyGram.

A generation-defining opportunity in Web3

With global ecommerce expected to keep outpacing the growth of traditional commerce—especially with the adoption of emerging technologies like crypto currencies and NFTs—Checkout.com is continuing to strengthen its position in the Web3 space.

The company’s payment rails already power the world’s leading crypto exchanges, representing almost 80% of the global trading volume. Its modular products and resilient platform are also used by fan token providers like Socios.com and blockchain-based wallets like Novi from Meta. In addition, the company is privately beta-testing an innovative solution to settle transactions for merchants using digital currencies.

“Checkout.com is a leader in the massive market for next-gen payment solutions and the key digital payments partner for many of the world’s leading companies. As a long-term investor, we are impressed by the company’s product innovation and customer-centric approach,” said Choo Yong Cheen, Chief Investment Officer of Private Equity at GIC, Singapore’s sovereign wealth fund. “That’s why we’ve been committed to its long-term future since Series A and why we’re part of Series D. We believe Checkout.com is still just getting started. And we look forward to leveraging GIC’s global network and our Bridge Forum platform to support Guillaume and his exceptional team for many years to come.”

_____________

Checkout.com says it provides „the fastest, most reliable payments” in more than 150 currencies, with in-country acquiring, world-class fraud filters and reporting through one API. Checkout.com can accept all major international credit and debit cards, as well as popular alternative and local payment methods. The company launched in 2012 and now has a team of more than 1700 people across 19 offices worldwide.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: