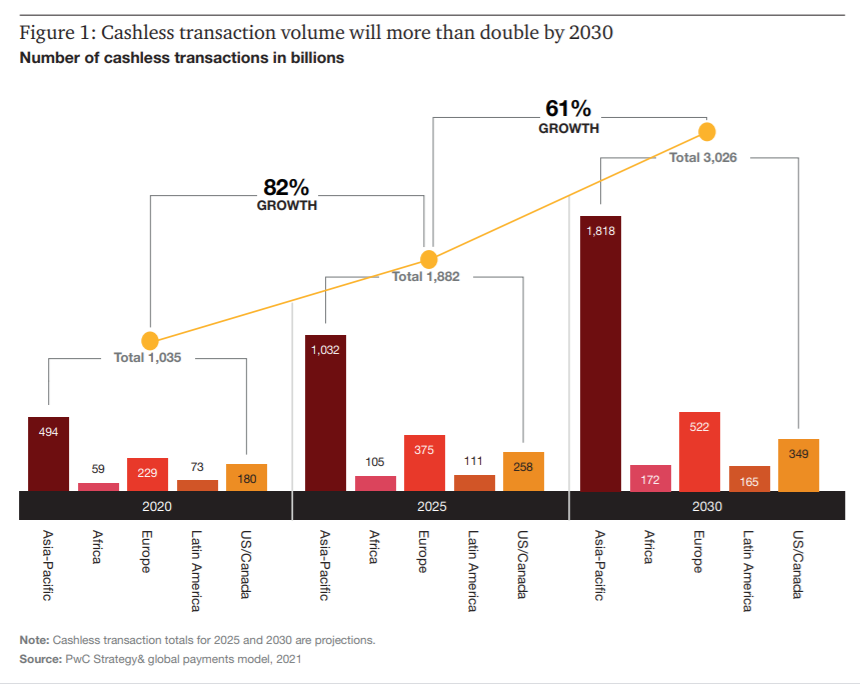

Global cashless payment volumes are set to double from 2020 to 2025, to almost 1.9 trillion transactions, and to almost triple by 2030, due to the changes brought by the pandemic, according to an analysis by PwC and Strategy &, PwC’s global strategy consulting business. There were about 1 trillion cashless transactions in 2020.

“Digital payments, such as those made with a mobile phone, buying a bus ticket via SMS or using a QR code to pay for services were possible even before the pandemic. They’ve subsequently accelerated sharply because people have been avoiding using cash in physical stores and have turned more to e-commerce. That the trend will continue during the next ten years, and the financial industry will have to go through a significant transformation to keep up,” said Diana Coroabă, PwC Romania Partner, Financial Services Leader.

The Asia-Pacific region will grow the fastest, with the cashless transaction volume there growing by 109% until 2025, then by 76% from 2025 to 2030. Africa (78%, 64%) and Europe (64%, 39%) come next, then Latin America (52%, 48%). The US and Canada region is expected to grow the least rapidly (43%, 35%).

In PwC’s latest global survey of banking, fintech and payment organisations, 89% of the respondents agreed that the shift towards e-commerce would continue to increase, thus requiring significant investment in online payment solutions. They also agreed (97%) that there will be a shift towards more real-time payments.

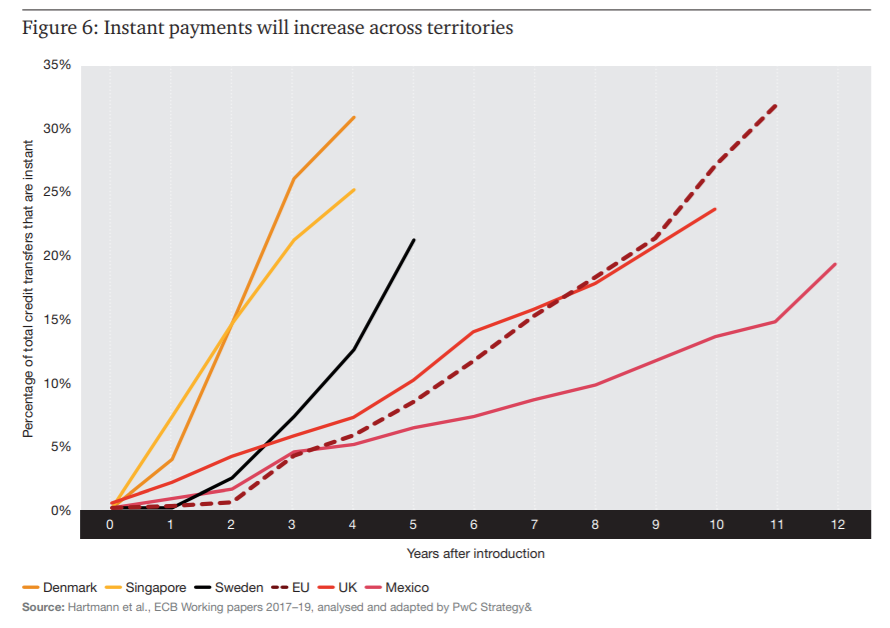

Europe is making serious steps towards instant payments, fuelling the battle of the rails. The EU has called on banks to offer instant payments across the board by the end of 2021 and has laid out a vision for all payments becoming instant. Some countries, such as the UK and Switzerland, have been pioneers and have well-established, fast payments infrastructures. Instant payments are set to become the backbone of card, mobile and online payments directly from accounts, putting account based payments into the centre of the payments evolution.

A report by FIS, a financial services technology group, predicts that digital wallets will account for more than half of all e-commerce payments worldwide by 2024, as consumers shift from card-based to account- and QR code-based transactions.

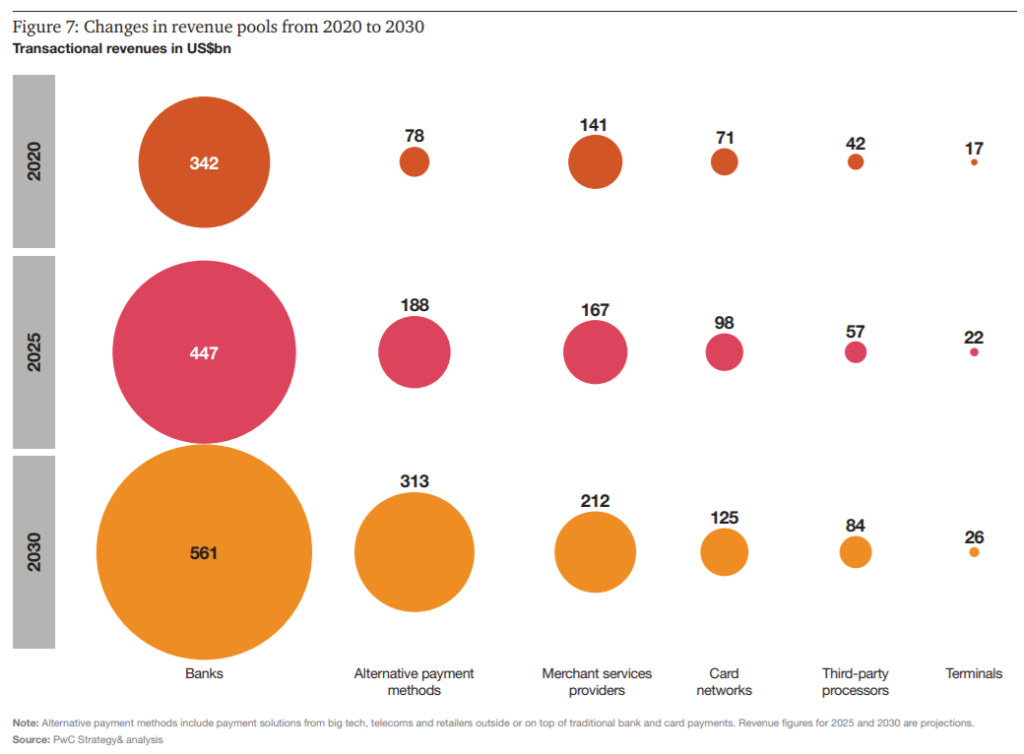

According to the FIS report, the key asset in all of this is data, which is creating new revenue streams for payments businesses that can monetise it, yet it also exposes them to issues and risks related to data privacy. Payments generate roughly 90% of banks’ useful customer data – information about who is buying what, how much, and when.

Looking ahead, 86% of our survey respondents agreed with the prediction that traditional payment providers will collaborate with fintechs and technology providers for innovation.

„There are two main rails in Europe: cards, which represent an old and expensive legacy infrastructure, and the newer model of instant payments, which is the real engine by which Europe’s independence on payments infrastructure can be built.” – Stefano Favale, Global Head of Transaction Banking Department, Intesa Sanpaolo.

„Achieving a global standard for payments infrastructures and services is a formidable challenge and will take an unforeseeable amount of time. Nevertheless, I believe that by 2025, through the European Payments Initiative and CBDC initiatives, we may be able to establish a standard European solution alongside solutions at the national level, which may involve banks forming consortia to bring their collective payments expertise to the table.” – Luca Corsini, Co-head, Global Transaction Banking, UniCredit

The global report can be found here.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: