Romanian start-ups are invited to join a new acceleration program. The best fintechs will receive 50,000 EUR (each) in subsidy from the Luxembourg Ministry of the Economy.

Luxembourg has a new Fintech Acceleration program, dedicated to early stage startups. Beyond 50K€ in funding and mentoring program with industry experts, the program will deliver a unique value proposition to the participants. NOCASH sat down with Alex Panican, Head of Ecosystem and Partnerships at the LHoFT, and Romanian born.

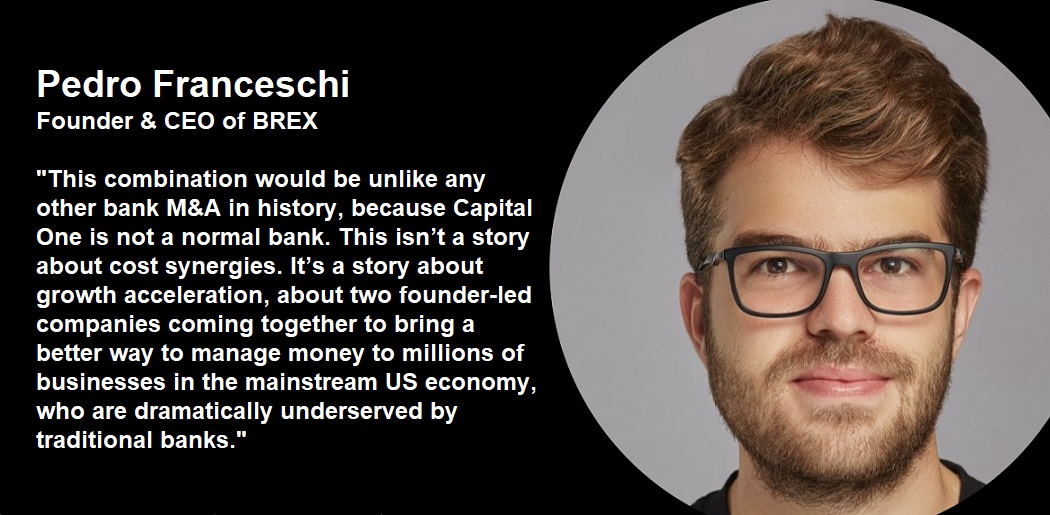

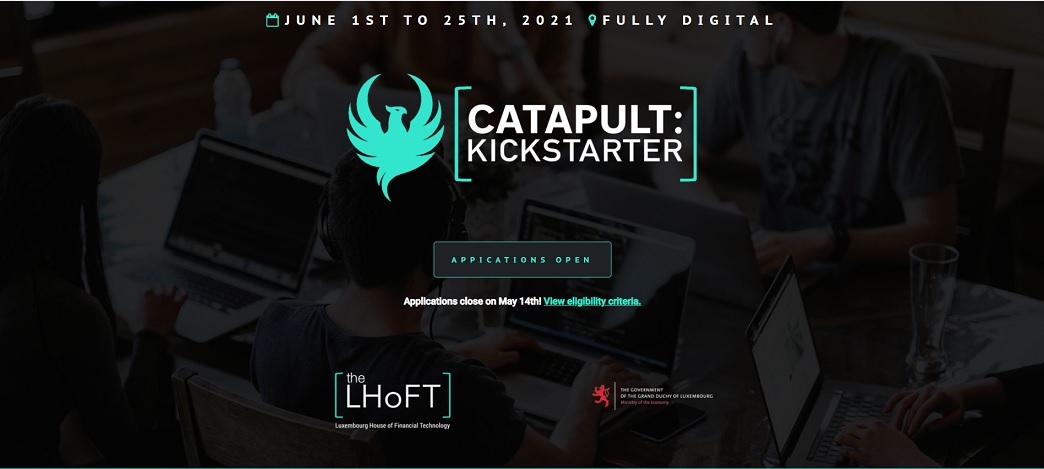

NOCASH – Alex, the LHoFT has just launched a new acceleration program, Catapult Kickstarter. Can you briefly describe it?

Alex –CATAPULT Kickstarter is a new Fintech acceleration program launched by the LHoFT Foundation, in collaboration with the Luxembourg Ministry of the Economy and key partners from the financial industry.

As you know we have run multiple programs in the last 4 years, mainly dedicated to scale ups fintechs and in the financial inclusion sphere. But we wanted to support even more the early stage startups that have brilliant ideas and connect them with the right people in the financial industry in Luxembourg.

NOCASH – What kind of fintechs are you looking for? Why Romania?

Alex – Catapult Kickstarter has been developed for fintech firms that provide innovative tools to traditional financial institutions like Banks, Asset Managers, Insurers. But Kickstarter can also benefit new financial solutions designed for the end consumers. Industry wise, we are looking for Regtech firms, Fundtech, Payment, Cybersecurity, AI and also new solutions built on the blockchain.

Romania is the perfect place to find those solutions, we have a great pool of talent and awesome entrepreneurs. At the LHoFT, in Luxembourg, we already have great fintechs from Romania, or with Romanian management, like Finqware, UiPath, Active Asset Allocation, Emailtree.ai, B4Finance or Paybyface. There’s so much expertise and creativity in this country, I am pretty sure we will have some gems from this ecosystem applying. And that makes me very proud.

NOCASH – What’s unique about the program, beyond the 50000€ in funding?

Alex – During the four weeks program, entrepreneurs will receive workshops on all aspect of their business model and funding needs. The program will also provide unique value propositions like mentoring on the procurement process of large corporations and the possibility to run a pilot program with a financial institutions. The Kickstarter accelerations program is designed to push ventures to new heights, enabling the Fintech companies to grow, develop, connect, and secure funding. As you mentioned Sergiu, the best fintechs will receive 50,000 EUR (each) in subsidy from the Luxembourg Ministry of the Economy, based on fulfilment of eligibility criteria.

Sergiu – What’s the commitment you expect from the participants?

Alex – The program will be delivered on a digital platform and will required a commitment of 4 hours per day, on average, during four weeks.

Sergiu – Where to apply?

Alex – Easy: https://catapult.lu/Kickstarter/

________________

CATAPULT: Kickstarter

What: Four-week acceleration bootcamp, 100% digital

Target: 10 B2B Fintech firms with solutions in Regtech, Wealthtech, Insurtech and Cybersecurity using Blockchain, AI and Big Data technologies.

Date: June 1st to 25th, 2021

Application call open until May 14th, 2021: https://www.f6s.com/catapultkickstarter

Contact: Alex Panican – email: alex.panican@lhoft.lu

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: