„The potential for embedded finance in Germany and Europe is massive” – Solarisbank

Open a bank account at an online shop? What sounds like a fantasy is already a reality for global brands like Samsung and Amazon – and it is called embedded finance.

Research by Solarisbank and the Handelsblatt Research Institute has found considerable conversion potential for e-commerce providers to offer financial services in Germany, confirming the significant opportunity embedded finance may hold across Europe. More than a quarter of respondents, for example, would be willing to open a checking account with Amazon.

Solarisbank AG, Europe’s leading banking-as-a-service platform, today published a comprehensive study on the development of embedded finance. The study, which was conducted in cooperation with the Handelsblatt Research Institute, analyzes the market potential of this global trend, exemplified by the e-commerce industry in Germany. The term embedded finance refers to the integration of financial services into the product offering of non-banks and has gained an increasing relevance in recent years.

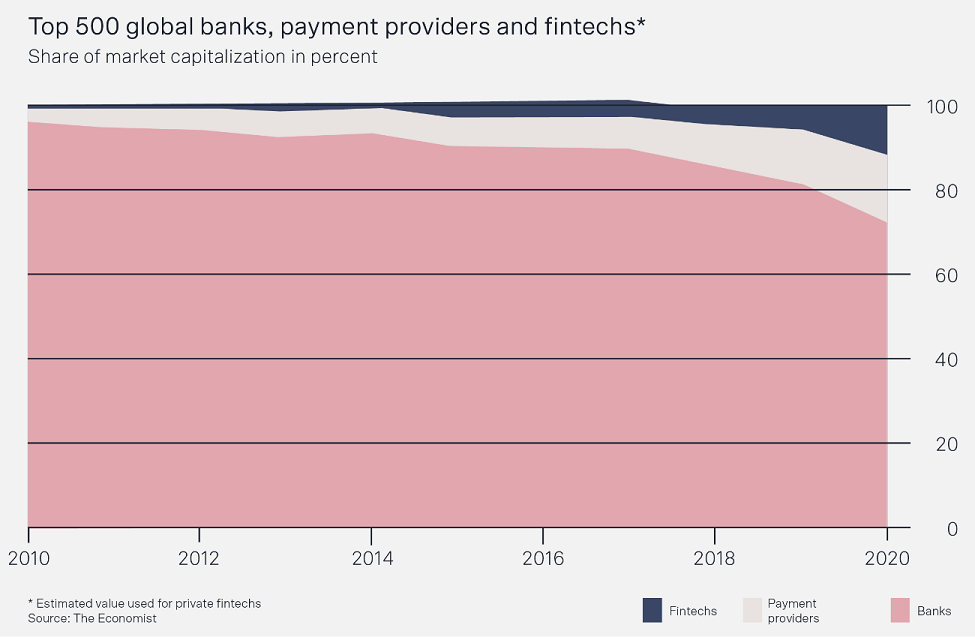

The banking sector is undergoing a massive transformation process. As the financial industry opens up through Open Banking, more and more businesses from outside the industry are entering the market and offering integrated financial services directly to their customers. The new challengers enjoy strong customer loyalty, have a large ecosystem and cooperate with Banking-as-a-Service providers such as Solarisbank.

„Several leading brands such as Samsung, Apple or Amazon already identified the benefits of embedded finance early on. They can increase customer loyalty, boost the number of customer touchpoints and generate additional revenue. We see the greatest potential in companies with customer-centric business models that make intelligent use of customer data. If they now enrich this knowledge with the payment behavior of their customers, they can offer tailored financial products of a quality indistinguishable from that of a personal financial advisor,” says Dr. Roland Folz, CEO of Solarisbank.

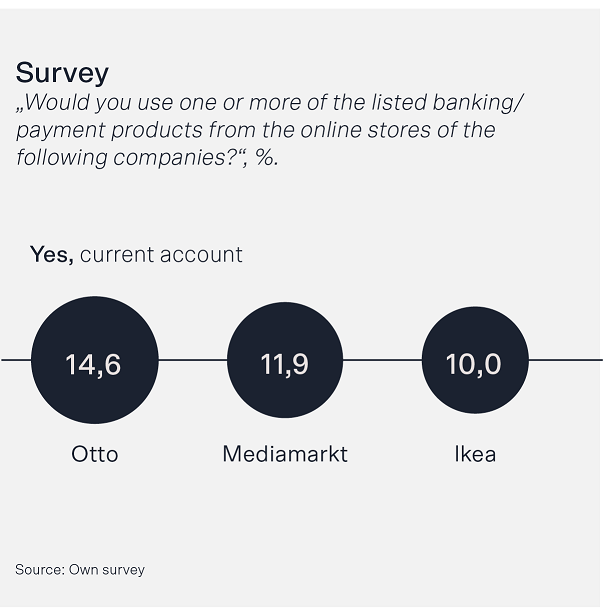

To calculate a concrete potential for the German market, the study analyzed 21 leading e-commerce providers in terms of customer satisfaction and interaction rate, as well as conducting a representative survey of the German population. The high e-commerce adoption rate of 75 percent and widespread penetration in all demographics thus indicate the overall potential of embedded finance.

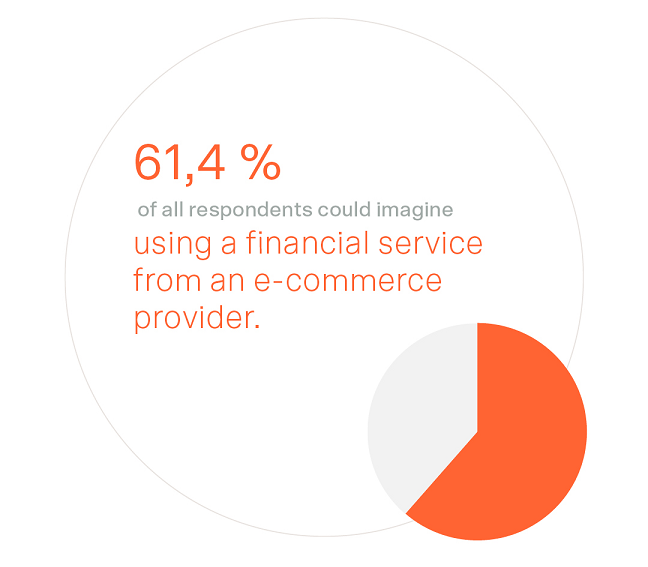

The results showed that 61 percent of all respondents can imagine using an integrated financial service from at least one of the e-commerce providers listed. More than a quarter, for example, would be willing to open a checking account with Amazon. The US e-commerce giant is clearly at the top of the list of providers compared, but by no means an exception.

„We are very impressed with the insights we have gained from the study. The potential for embedded finance in Germany and Europe is massive. The advantages for providers are obvious: new business opportunities at low marginal cost, deeper customer relationships and a multitude of data points to improve the customer experience. A key success factor for providers is undoubtedly a seamless technical integration. This is the only way to ensure a smooth customer journey,” says Jörg Diewald, CCO of Solarisbank.

Compared to Europe, where embedded finance is still in its early stages, China and the U.S. are already ahead, with large technology companies having embedded financial services into their ecosystems. Lightyear Capital estimates that the market for embedded finance will grow from around EUR 22.5 billion at present to around EUR 230 billion worldwide by 2025. Further, the financial investor Bain Capital estimates that embedded finance revenues will reach around EUR 3.6 trillion by 2030 in the USA alone.

Free download of the Embedded Finance Study

____________

Solarisbank is Europe’s leading Banking-as-a-Service platform. As a technology company with a full German banking license, Solarisbank enables other companies to offer their own financial services. Via APIs, partners integrate Solarisbank’s modular banking services directly into their own product offering. The platform offers digital bank accounts and payment cards, identification and lending services, digital asset custody as well as services provided by integrated third-party providers.

In 2019 Solarisbank established the 100% subsidiary Solaris Digital Assets GmbH to offer a licensed custodial solution for digital assets. To date, Solarisbank has raised more than EUR 160 million from a bluechip shareholder base, including ABN AMRO’s Digital Impact Fund, BBVA, finleap, Global Brain, HV Holtzbrinck Ventures, Lakestar, Samsung Catalyst Fund, SBI Group, Storm Ventures, Visa, Vulcan Capital, and yabeo Capital.

In November 2020, Solarisbank becomes first bank in Germany to fully migrate to the cloud.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: