Payhawk, the platform for payments and expense management, has raised $20 million, according to Business Wire. The round is led by the US-based fund QED Investors, which has a strong track record of investing in more than 15 fintech unicorns among Klarna and NuBank.

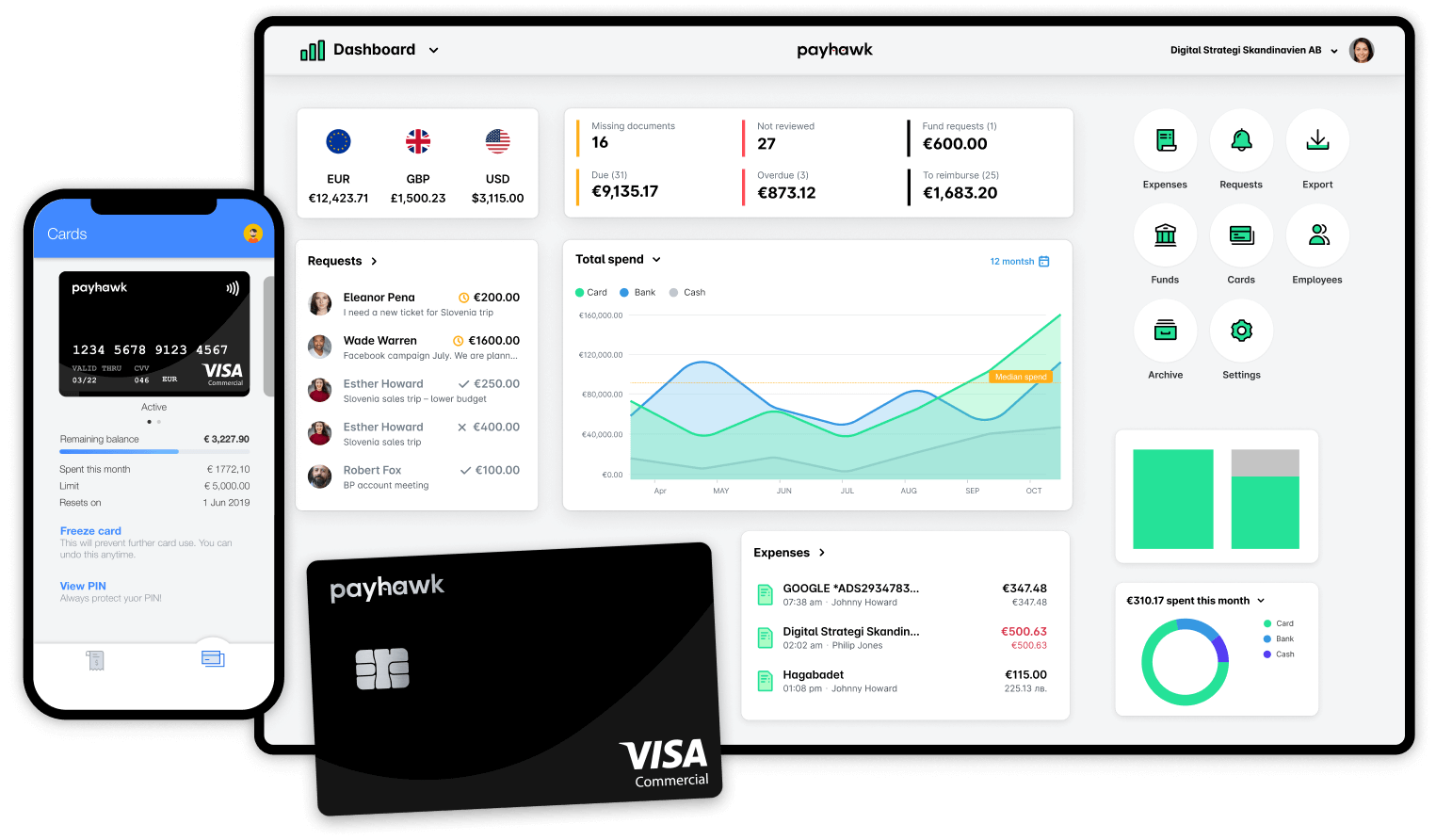

Currently, finance teams use multiple disconnected tools for payment, invoices and expense management. Payhawk acts as a one-stop-shop, combining these key elements. As a result, Payhawk empowers finance teams to reduce manual work, keep tight control of budgets in real-time, and fully automate spend.

The company has posted 10x growth in 2020, and doubled its revenue in Q1 of 2021.

The fundraise will enable Payhawk to further expand its product offering and team. The company will expand coverage of countries, currencies and payment products to include credit cards and support for USD, AUD and others.

Payhawk will also accelerate its use of AI and ML, to introduce smart workflows, and reduce the need for manual approval. The company plans to triple its marketing and sales team in 2021, in order to increase presence in the UK, Germany and Spain.

Yusuf Ozdalga, QED Investors says, “The company is growing at a phenomenal rate. The company’s product fundamentals are exceptionally strong, and industry trends are working in the company’s favour too. As budgets are more typically managed online by remote teams, there is unprecedented demand for cost-effective finance solutions.”

Payhawk CEO and founder Hristo Borisov says, “We have huge ambitions for the year ahead. Over the next year, we are keen to provide great support to finance teams across 30+ countries to manage company cards, invoices and payments in a unified and efficient way. We plan to significantly expand our integrations to existing ERP systems, and also easily connect on top of every business bank account across Europe. To do this, we need to invest in building the right setup and team to scale further, and the new funding round will enable us to do this”

Payhawk | The Financial System of Tomorrow with NextGen Visa Cards

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: