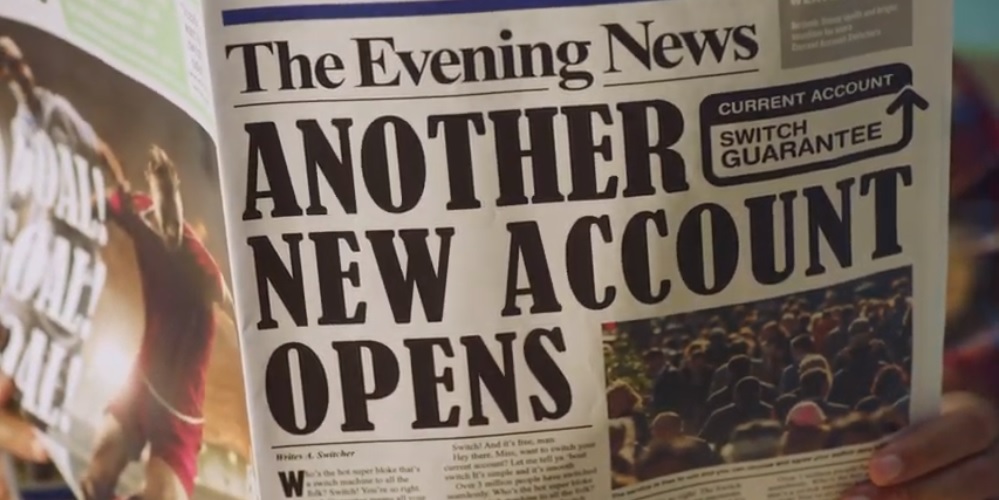

UK – Pandemic year saw the first big fall (30%) in people changing their bank account

704,560 switches took place through the Current Account Switching Service in 2020, taking the total number of switches to above 7 million since the launch of the service in 2013, but the pandemic year saw the first big fall in uptake of switching, according to altfi.com. The total number of current accounts switched in 2019 was just over 1 million.

Taking a renewed look at personal finances was a big trend last year with millions of new customers adopting fintech apps throughout the pandemic. Unfortunately, according to data from the Current Account Switching Service (CASS), there was also a 30 per cent fall in people changing their bank accounts.

The dip in total switching represents a change in consumer behaviour attributable to the pandemic, CASS claims. In the early weeks of the pandemic, data suggests that consumers were more reluctant to switch.

Later on in 2020, the market saw increased switching activity from consumers and the gradual reintroduction of switching incentives into the market from banks.

In the 4th quarter of 2020 nearly 190,000 switches were completed via CASS, a third more than in the 3rd quarter of the year. In November 2020 alone 80,980 switches occurred, the highest monthly total since March 2020.

__________

The Current Account Switch Service covers 99% of UK current accounts. The process is the same everywhere so you can feel confident when you switch, no matter which participating bank or building society you choose. Over 40 UK banks and building societies are signed-up to the Current Account Switch Service.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: