PayPal is the largest non-bank lender with over $54B in total assets

an article written by Rex Pascual – researcher

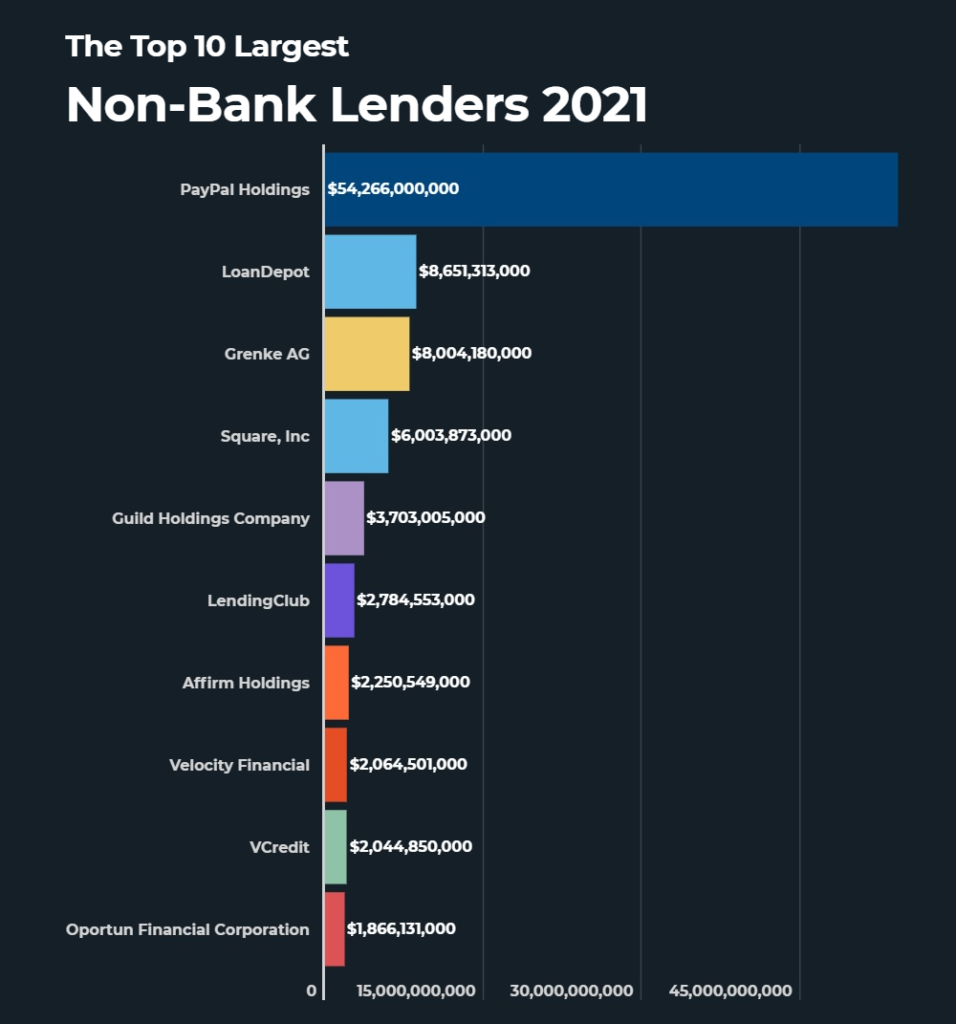

Non-bank lenders have become a popular alternative to traditional banks when it comes to acquiring loans. According to data presented by TradingPlatforms.com, PayPal is the largest non-bank lender in the world with $54.27B in total assets.

Many small businesses around the world rely on alternative financing companies for their capital with traditional banks often having strict requirements such as a good credit score. Non-bank lenders like PayPal aim to be the source of funding for these businesses often having less stringent requirements.

As of May 2020, PayPal was ranked as the 54th largest company based on market capitalization with a market cap of $144.3B. PayPal is by far the largest non-bank lender with over $54B in total assets as of February 2021. PayPal’s total assets alone make up almost 60% of the top ten non-bank lenders’ total assets combined.

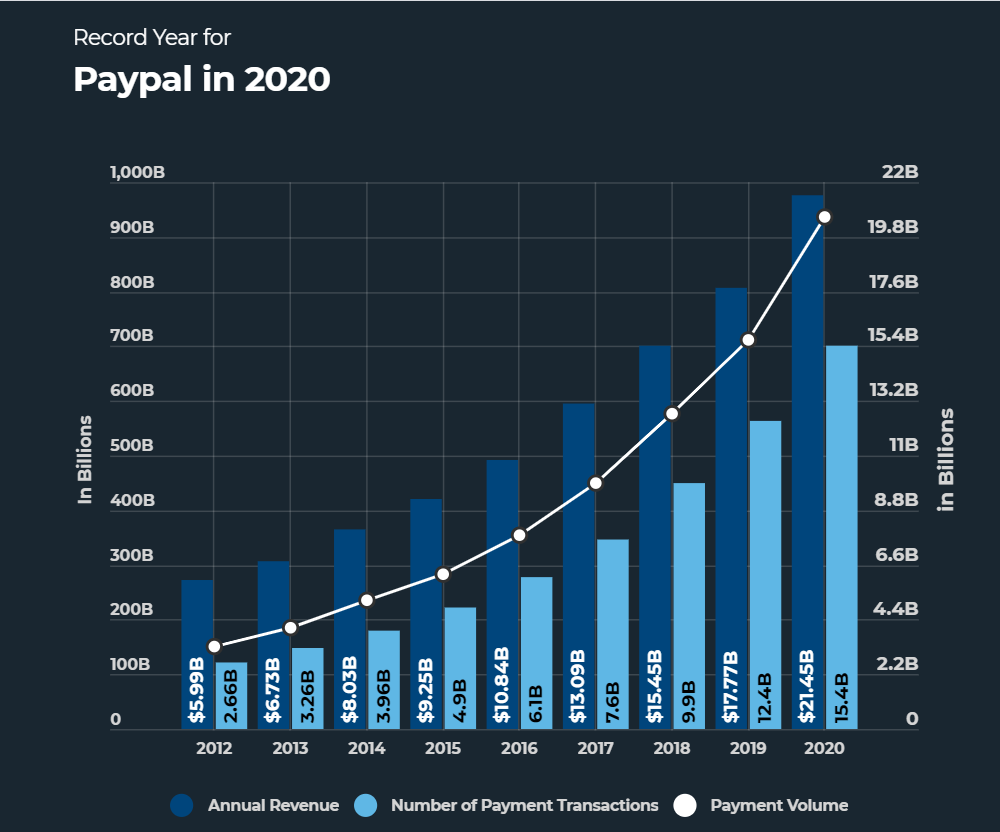

The company also experienced a record year in 2020 as digital payment options became a popular alternative to traditional, physical banks during the pandemic. PayPal’s annual revenue for 2020 increased by over 20% YoY to $21.45B. In the final quarter of 2020 alone PayPal handled $277B in total payment volume taking their total payment volume for 2020 to $936B – a growth of nearly a third YoY.

PayPal also transacted more payments than ever before growing 25% YoY to 15.4M transactions in 2020.

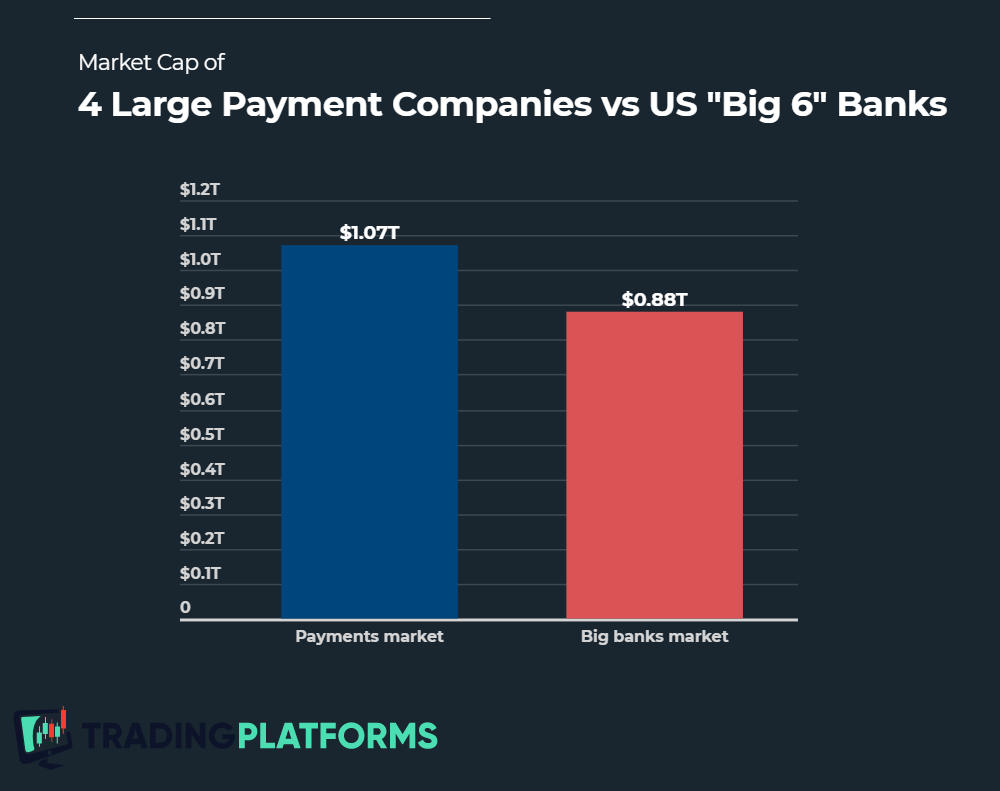

Non-banking institutions such as PayPal have become an integral part of the economy in the most developed markets. In the US the market cap of four large fintech companies; Visa, Mastercard, PayPal and Square combined for over 1 trillion dollars. This eclipsed the combined $880B market cap of the traditional “Big Six” banks in America; JPMorgan, Bank of America, Citigroup, Morgan Stanley, and Goldman Sachs.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: