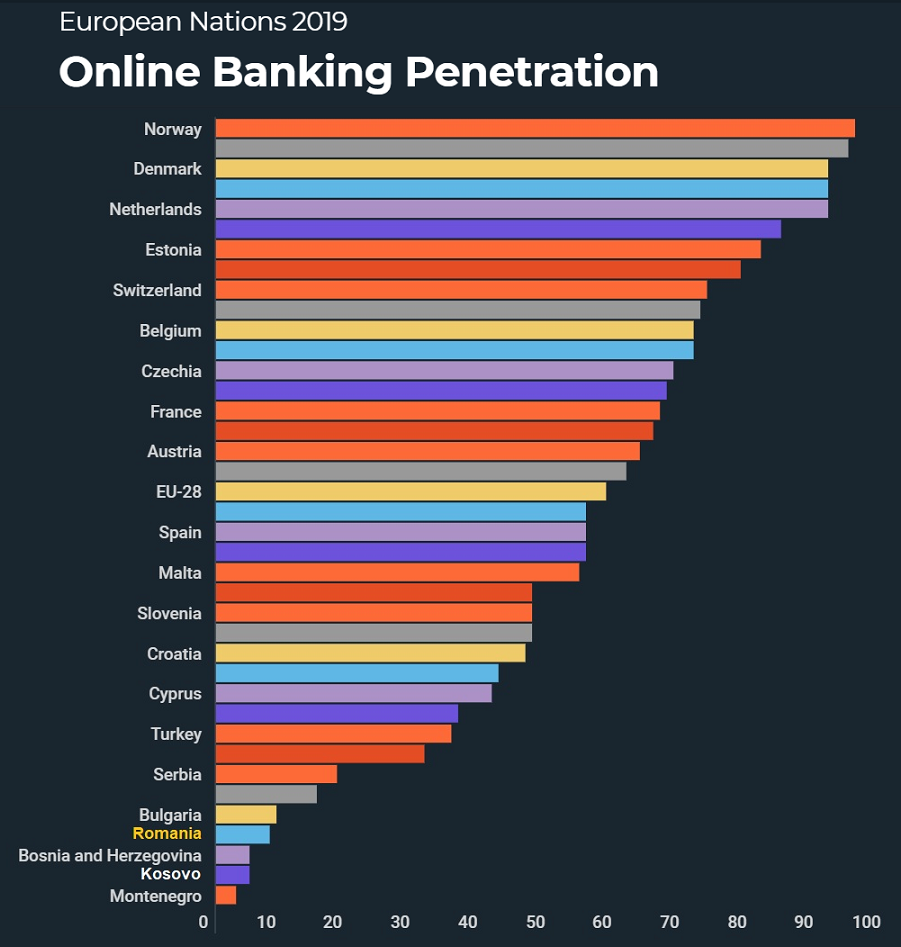

Online banking penetration in Norway reached 95% in 2020. Romania has less than 10%!

Only five countries from the European nations in the survey had less than 10% penetration – Bulgaria(9%), Romania (8%), Bosnia and Herzegovina(5%), Kosovo(5%) and Montenegro(3%).

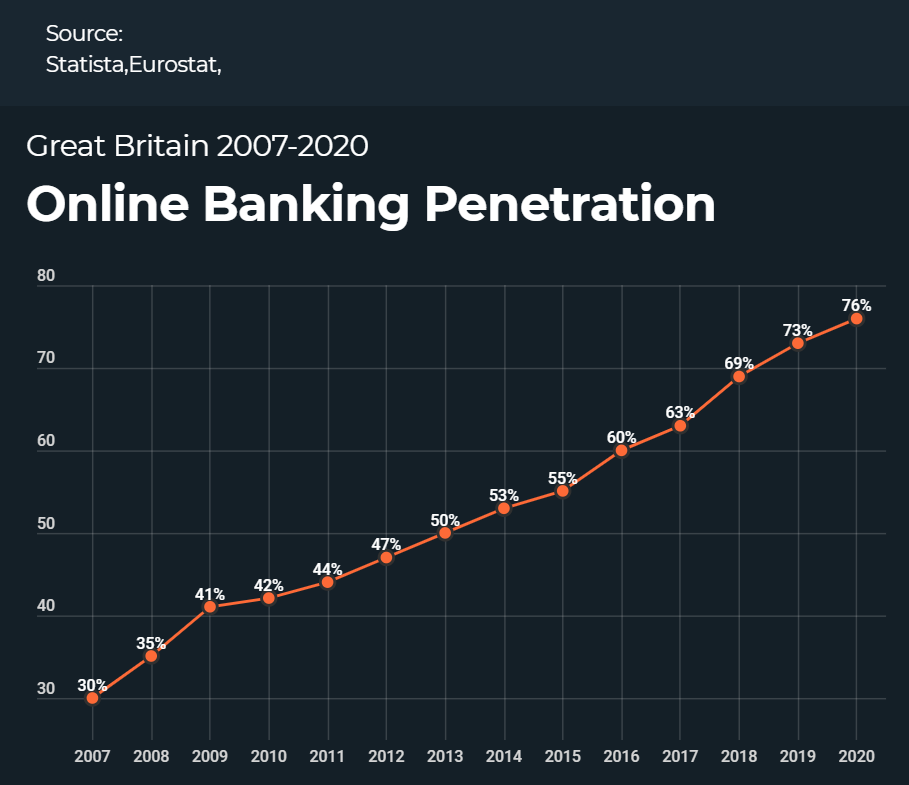

According to data presented by Trading Platforms, online banking penetration in Great Britain reached 76% in 2020 compared to 42% in 2010. In 2007 online banking penetration was at a mere 30% in Great Britain. Mobile is preferred device.

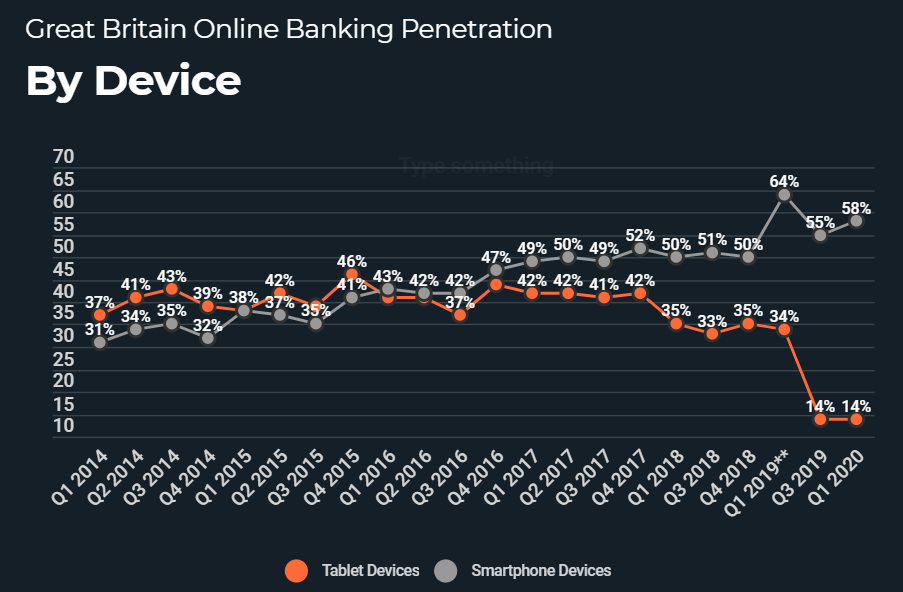

Both traditional established banks and newer digital online banks have taken advantage of the rise of mobile devices with the smartphone the preferred device to access online banking. In Q1 of 2020, 58% of survey respondents indicated accessing their online banking through their smartphone in the three months prior to the survey, while only 14% indicated they used their tablet device.

In 2019-2020 the UK ranked 8th among European nations for online banking penetration. Leading the way is Norway with an impressive online banking penetration of 95%. The use of cash has severely decreased in countries such as Germany and Austria where trust in online banking institutions have been on the rise.

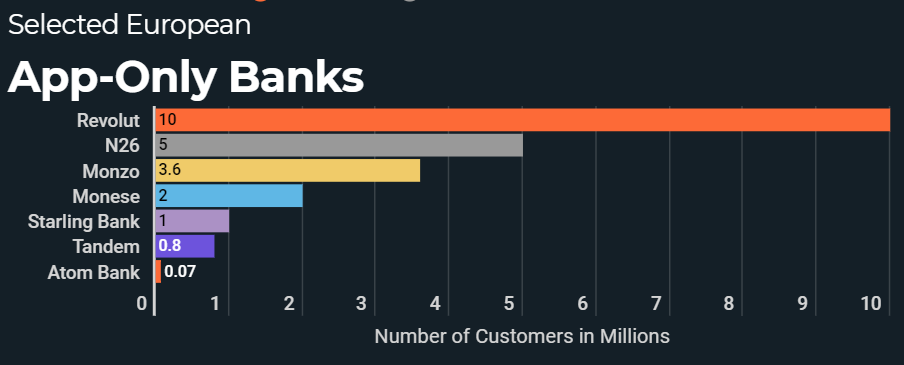

App-only Banks on the Rise in Europe

The rise of alternative payment options from traditional banks has also been on the rise in Europe. One of the more prominent ones is London based financial company Revolut who in February 2018 announced that they had secured over 1.5 million customers. By 2020, that number had grown to an impressive 10 million customers.

Projections for Revolut shows them continuing on an upward trend reaching 18 million customers by December 2021.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: