Challenger banks lead UK’s current account switching service with 43% share in 2020

Challenger banks continue to offer a new and alternative banking experience to customers, an aspect highlighted by the new users they attract.

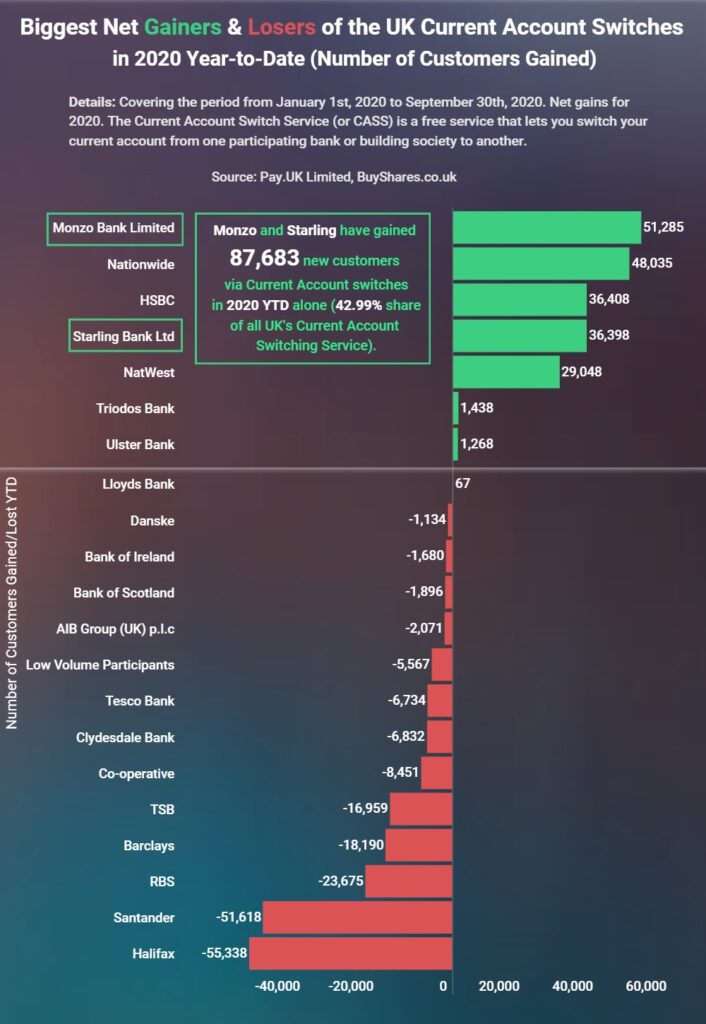

Data calculated and presented by Buy Shares indicates that UK challenger banks are leading in new customer net gains through account switches with a share of 42.99% Year-to-Date. The two challenger banks, Monzo and Starling have a cumulative net gain of 87,683 new customers. All banks have a collective net gain of 203,947 new customers.

Monzo had the highest net gain of 51,285 while Starling net gain stands at 36,398. Both Monzo and Starling are also among the biggest net gainers of Q3 2020 at 11,392 and 11,998, respectively. The research also overviewed the biggest losers of the UK’s current account switches in 2020. Halifax is the biggest loser at 55,338. Danske has lost the least customers at 1,134.

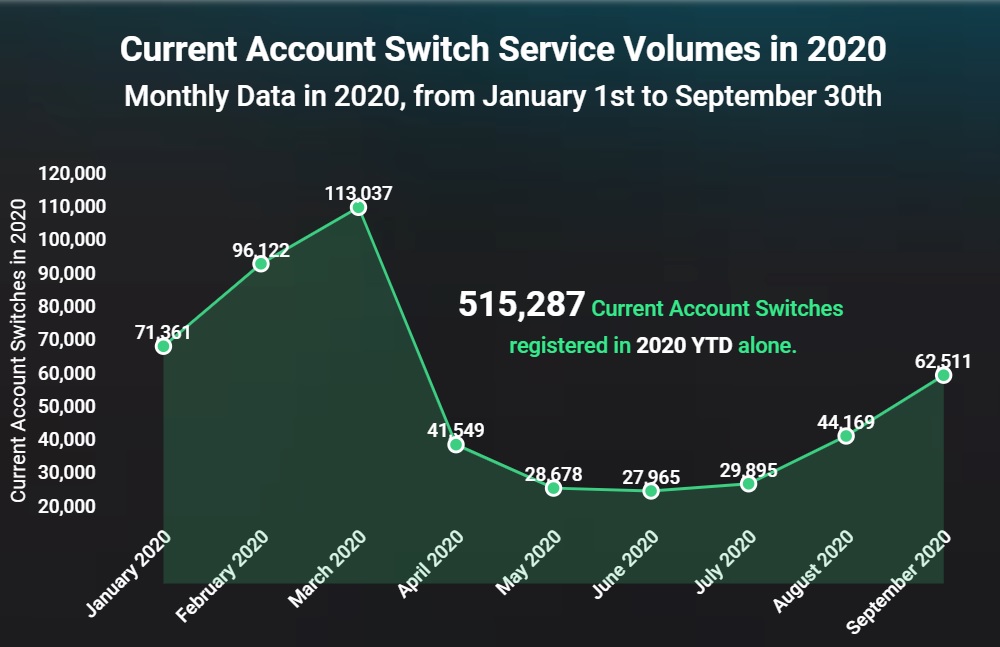

As of September 2020, the Current Account Switch Service total volume stood at 515,287. The highest volume was recorded in March at 113,037. The lowest volume was in June at 27,965.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: