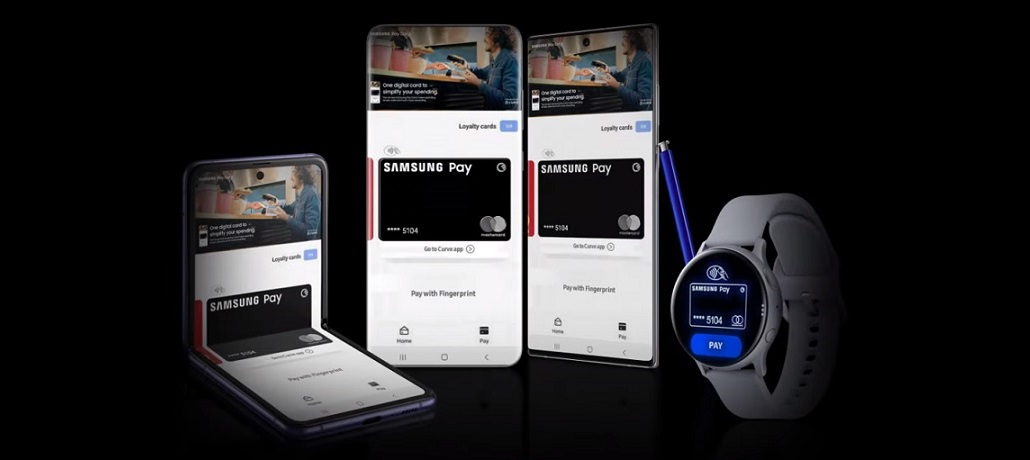

Samsung Electronics Co., Ltd has today announced that the new Samsung Pay Card, powered by Curve, will be available from August 18th[1]. With ONE simple to use digital-first card, Samsung Pay Card gives users complete control over their spending, without the fuss of having to change banks.

This isn’t another bank card. From debit cards to credit cards[2], the all-new Samsung Pay Card collates everything in one place, offering Samsung Pay users greater coverage than ever before[3]. By utilising Curve’s unique technology, alongside Mastercard’s worldwide acceptance footprint, Samsung Pay users enjoy a better banking experience through their Samsung smartphone and smartwatch[4], whilst gaining the rewards they want along the way.

ONE digital-first card: Samsung Pay Card deploys Curve technology to bring together all Mastercard and Visa banking cards in one place, modernising the banking experience without the fuss of changing banks.

It’s not too late[5]: With the unique ‘Go Back in Time’ functionality, customers can move transactions from one card to another after they’ve been made, giving customers more flexibility and control of their spending.

Get paid to spend and experience exclusive rewards: Customers can claim instant 1% cashback on top of their existing rewards from a choice of a wide range of brands[6]. As an added bonus, and exclusive to the Samsung Pay Card, customers can also earn 5% on all purchases at Samsung.com[7].

Save on fees when spending abroad[8]: Samsung Pay Card allows all customers access to the mid-market rate throughout the week, cheaper than the currency conversion fees offered by many high street banks.

Vault-like security: Samsung Knox enables customers to enjoy their mobile experience with confidence. With proactive, always-on protection straight out of the box, Samsung’s multi-layered defence-grade security offers protection to customers’ finances. In the event of a smartphone loss, access to Samsung Pay Card can be instantly locked remotely using another device from the Samsung ecosystem, without having to contact banks directly – and ‘Find My Mobile’ helps you find it.

See the full picture[9]: For a crystal-clear understanding of payments, customers can see transactions across different cards via the Timeline View in the Curve app, or recent transactions in Samsung Pay, with real-time notifications[10].

Samsung Pay, refreshed: Utilising Curve’s unique platform, the Samsung Pay Card covers all major credit and debit cards from Mastercard and Visa in the UK, meaning almost everyone can now use Samsung Pay[11]. Combined with the usage of AMEX and loyalty cards already available via Samsung Pay, this gives customers the ultimate one-stop-shop (or app), meaning they don’t have to compromise on any of their loyalty, reward or banking needs.

“Now, more than ever, people need a secure payment solution they can rely on. We’re excited to be able to put the control back into our customers’ hands, by launching Samsung Pay Card,” said Conor Pierce, Corporate Vice-President of Samsung UK & Ireland.

“At Samsung we believe in the power of innovation and, through our partnership with Curve, the Samsung Pay Card brings a series of pioneering features that will change the way that our customers manage their spending, with their Samsung smartphone and smartwatch at the heart of it. This is the future of banking and we look forward to continuing this journey with our customers.”

Shachar Bialick, CEO and Founder of Curve said: “The Samsung Pay Card, powered by Curve, changes the game for customers in the UK. By bringing Curve’s unique technology to Samsung devices it empowers millions of Samsung customers to take control of their money, access more choice, and enjoy a banking experience like never before, across all their accounts, without the need to switch banks or limit themselves to only one bank, all from the palm of their hand.”

Samsung Pay Card is available to Samsung Pay app users from August 18th.

###

[1] Existing Curve customers cannot apply for a Samsung Pay Card

[2] Valid on Mastercard and Visa branded debit and credit cards only.

[3] Combination of Samsung Pay and the new Samsung Pay Card offers users greater coverage, compatible with nearly all banks and payment solutions available in the UK. Full list of Samsung Pay compatible cards can be found on https://www.samsung.com/uk/samsung-pay/faq/

[4] All Samsung smartphone and smartwatch devices that support Samsung Pay will also support Samsung Pay Card. Full list of compatible devices can be found on https://www.samsung.com/uk/samsung-pay/faq/

[5] Move £1,000 up to 14 days after transaction. Limits may vary depending on individual Curve accounts.

[6] Choose 1% cashback from 3 merchants selected from a wide range of brands. Introductory offer for 90 days.

[7] 5% cashback on all purchases made using Samsung Pay Card on Samsung.com until 31.12.20. Offer can be used with any other Samsung.com offer.

[8] Curve provides cheap FX rates. Weekend exchange rate (0.5% for GBP, EUR and USD and 1.5% for other currencies)

SPC FX limit is £500 for a rolling 30 day period, over which spend in a foreign currency will cost 2% of transaction value

[9]Samsung Pay platform shows recently 10 transactions using Samsung Pay Card, full transactions from date of use can be viewed in supporting Curve app

[10] Real-time notifications dependent on user’s mobile network and Wi-Fi network at the time of transaction

[11] Full list of Samsung Pay issuing partners can be found on https://www.samsung.com/uk/samsung-pay/faq/

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: