Account holders will obtain exclusive access to discounts on Samsung products.

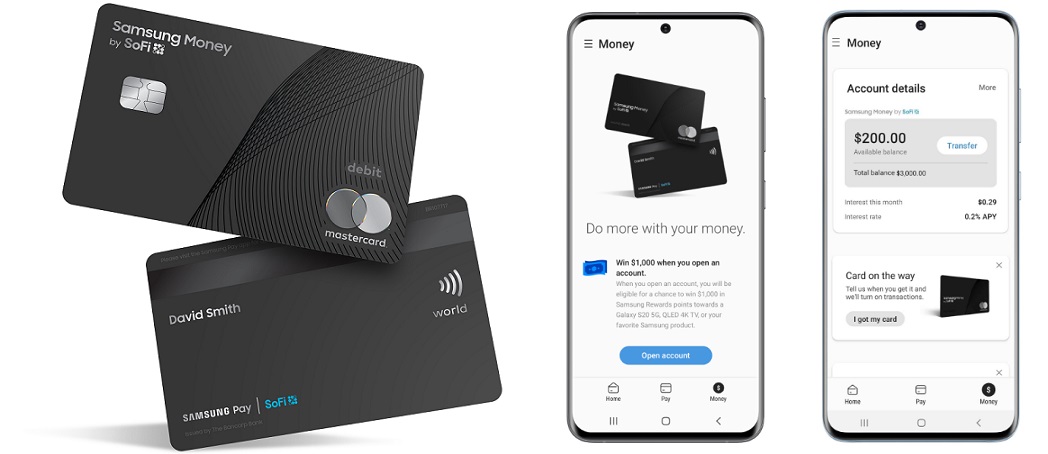

Samsung Electronics America, Inc., announced that starting today, consumers in the U.S. can sign-up for and access Samsung Money by SoFi: a mobile-first money management experience. Launched in partnership with SoFi, a leading fintech company, Samsung Money by SoFi brings a cash management account, accompanying Debit Mastercard and exclusive benefits to Samsung Pay.

New Exclusive Benefit Coming Soon

As part of the announcement, Samsung revealed that active Samsung Money by SoFi users will soon have access to an exclusive discount on Samsung’s award-winning products. Starting in just a few weeks, Samsung Money by SoFi users will receive discounts on Samsung Galaxy smartphones, tablets, wearables, TVs, laptops, washers, refrigerators and more on Samsung.com. This program will reward loyal account holders with a discount, on top of any offers available on Samsung.com. Once live, and once an account is funded, users will see a banner in the Samsung Money section in the Samsung Pay app. Clicking that banner will provide access to the discount.

About Samsung Money By SoFi

Instant Activation: As soon as you fund your new Samsung Money by SoFi account, your digital debit card will be provisioned in your Samsung Pay wallet, with your physical card arriving shortly by mail. To activate your card, there’s no need to dial a 1-800 number. Simply tap the card on your phone and watch the screen for confirmation.

No Account Fees: Samsung Money by SoFi charges zero account fees, overdraft fees or transfer fees.[1] In fact, whenever you use an in-network ATM, you won’t see a charge.[2]

Added Savings and Benefits: Samsung Money by SoFi rewards users for saving, earning up to 6x[3] higher interest rate relative to the national average of transactional accounts. In addition, Samsung Money by SoFi users will earn Samsung Rewards points for every purchase they make within Samsung Pay.

Money Management at Your Fingertips: With Samsung Money by SoFi, you can use the Samsung Pay app to check your balance, review past statements and search transactions. You can flag suspicious activity, pause or restart spending, freeze or unfreeze your card, change your pin and assign your trusted contact—all without ever having to leave home or call a representative. And coming soon, an added benefit for Samsung Pay users is being able to fund your Samsung Money by SoFi account instantly from your other registered debit cards already in your Pay wallet.

Peace of Mind: Since Samsung Money by SoFi isn’t a credit card, you can only spend the cash you have on hand. And in the event of an unauthorized transaction, you’ll receive an alert and assume zero liability. For added safety, Samsung Money by SoFi comes with the defense-grade security of Samsung Knox, which protects users’ information all the way down to the chip level. And the FDIC insures every Samsung Money by SoFi account up to $1.5 million (6x that of a traditional bank account).[4] Finally, the physical debit card will not display the card number, expiration date, or CVC. Should users need that information, they can easily find it within the “Money” tab of the Samsung Pay app, which is further protected by biometric or PIN authentication.

Availability

Samsung Money by SoFi is now available to Samsung Pay users in the United States. Samsung Pay users can get started by tapping the Money tab in the Samsung Pay app. The exclusive discounts on Samsung products on Samsung.com will be available in the coming weeks.

DISCLOSURES

Samsung Money by SoFi® is a cash management account, which is a brokerage product, offered by SoFi Securities LLC. Member FINRA/SIPC. Neither SoFi nor its affiliates are a bank.

The Samsung Money by SoFi card is issued by The Bancorp Bank.[1] Samsung Money by SoFi will launch with no account fees. Fees charged will be subject to change at any time as described in the account terms and conditions.

[2] SoFi partnered with Allpoint to provide consumers free ATM access at any of the 55,000+ ATMs within the Allpoint network. Consumers will not be charged a fee when using an in-network ATM, however, third party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at SoFi’s discretion at any time.

[3] 6x based on the national average of 0.04% from the weekly rate cap as of 7/20.

[4] The cash balance in Samsung Money by SoFi cash management accounts is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC Insurance does not immediately apply. Coverage begins when funds arrive at a program bank. There are currently six banks available to accept these deposits, making customers eligible for up to $1,500,000 of FDIC insurance (six banks, $250,000 per bank). If the number of available banks changes, or user elects not to use, and/or has existing assets at, one or more of the available banks, the actual amount could be lower. Customers are responsible for monitoring their total assets at each of the Program Banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. The deposits in Samsung Money by SoFi or at Program Banks are not covered by SIPC.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: