The new paid-for account is intended to give customers „full financial visibility”, with other bank accounts and credit cards all in one place.

Monzo Plus users will also be able to see their credit score through the app, earn one percent interest on deposits, enjoy free FX withdrawals of up to £400 per month when traveling abroad, and get their hands on a new holographic physical card, and more secure virtual cards for when spending online.

„We built Monzo Plus to help you get a grip on your finances with features like other bank accounts, credit cards and your credit score in Monzo, custom categories for all of your spending, and virtual cards for safer online shopping,” Monzo said.

Monzo also included benefits that stretch your pennies into pounds with 1.00% AER/Gross (variable) interest on money in your balance and regular Pots up to £2,000. Save on fees with £400 fee-free cash withdrawals abroad every 30 days, for when you can go away again. And pay cash into your account for free once a month.

Finally, the company launched a new holographic card, exclusive to Monzo Plus, and offers from brands. All of this, for £5 a month with a 3 month minimum term.

See your other bank accounts in Monzo

Get a clear view of your finances by adding your other bank accounts and credit cards to Monzo. See your balances and transactions, and move money around with easy bank transfers. Terms and conditions apply.

„We use Open Banking to show your accounts, and this service is regulated by the Financial Conduct Authority”, Monzo said.

Get our new holographic card

„Our blue holographic card is exclusive to Monzo Plus, and it’s our boldest card yet,” Monzo said.

With a reflective holographic layer and our Monzo logo on hot-stamped foil. Your details are kept neatly on the back of the card for a minimalist design.

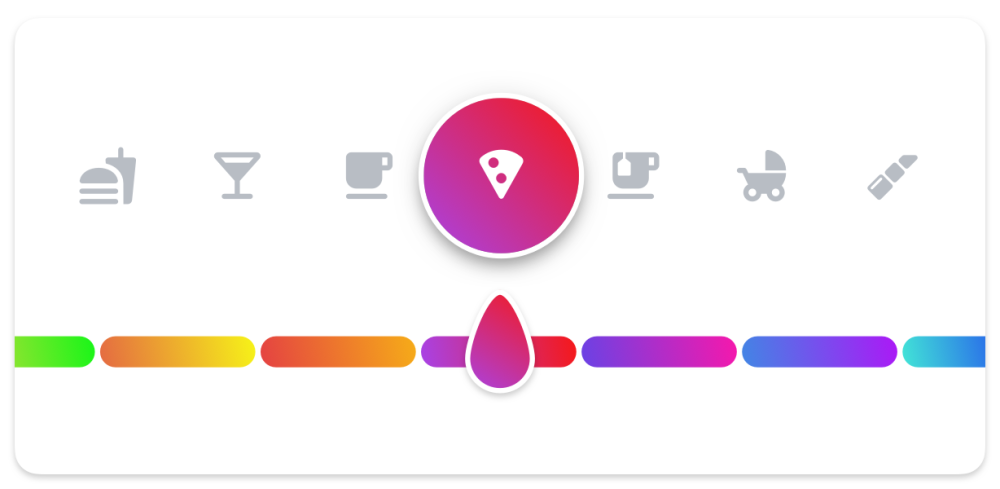

Create your own custom categories

Create your own categories to break down your spending, your way. Plus, divide single payments into multiple categories, like separating your supermarket purchase into food and wine.

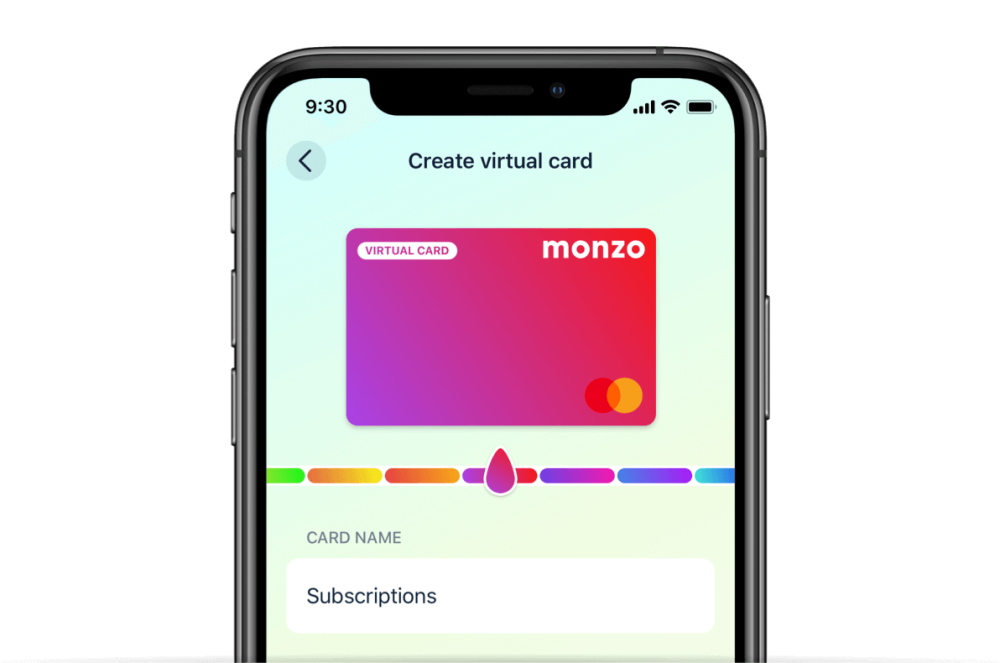

Stay safe online with virtual cards

We’re all spending more online these days, so it’s important to protect yourself. Keep your physical card details safe from fraudsters by using virtual cards for online payments.

A virtual card is a temporary debit card number you can use to make secure payments online. These are also known as virtual payments.

The money you spend comes from your balance, just like with your actual Monzo card. Virtual cards are especially handy for managing online subscriptions.

„You can have up to 5 virtual cards at any time with Monzo Plus,” the company said.

And so much more:

Plus, everything you get with our free account

You get all of this, as well as everything you get with our free, original Monzo account. Things like fee-free UK bank transfers, Pots for separating your money, instant spending notifications, customer support when you need it and more. Your eligible deposits in Monzo are protected by The Financial Services Compensation Scheme (FSCS) up to a value of £85,000 per person.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: