Members of Parliament (MPs) in the UK’s House of Commons are concerned that the country’s cash infrastructure could collapse due to people avoiding ATMs during the COVID-19 pandemic. A letter to the UK’s Chancellor, Rishi Sunak, signed by 37 MPs asked Sunak to protect the cash infrastructure that includes the country’s ATM network, according to an article in Finextra.

The letter says the UK’s ATM network, which was already fragile due to cuts to the interchange fee, is now in imminent danger of collapse due to the Covid-19 emergency.

The Covid-19 pandemic is radically changing cash usage in the UK, with ATM withdrawals falling 60% during the lockdown and three quarters of Brits reporting that their use of paper money is down.

The letter pointed out that due to cuts to the interchange fees, the fees that banks pay to ATM providers for cash withdrawals, the ATM network was already in danger prior to the pandemic.

The letter called on the Chancellor to enact legislation that would revive free-to-use ATM machines for local communities and reverse cuts to interchange fees to protect the cash infrastructure. Cuts to the fee have already led to an increase in what consumers are charged. To withdraw £10 or £20 ($10-20), consumers are being charged £1 to £2 ($1.25-2.00), instead of banks paying an interchange fee of circa 40 pence (approximately $0.50) for a ‘free’ transaction.

In addition to wanting to protect ATM providers, the MPs openly criticized the LINK network, UK’s main debit and ATM card issuer and the only way banks and credit unions can offer customers access to cash across the UK. The LINK network guaranteed that communities facing cash shortages will have their ATMs replaced by a LINK member bank.

„Whilst we welcome any measures which support access to cash, this will not address the root cause of why access to cash is declining,” MPs write. „The measure is derisory, addressing only future ATM losses and not those that have already been lost or converted to pay to use. Link’s pledge will only protect ATMs for 12 months and, while Link states this will benefit 3,800 ATMs, it will in reality only cover a small proportion of these machines which it considers ‘critical’.”

Campaigners and businesses have already written to the Chancellor urging him to reverse the cuts made to the fee paid by banks to ATM providers for every cash withdrawal, pointing out that banks have saved £200 million in the two years since interchange rates were changed.

„Link’s new scheme, which will cost banks a mere £4 million, falls significantly short in filling this gap,” says the MPs. „With banks refusing to properly fund the ATM network, customers are losing out as free to use cash machines become unviable meaning operators must start charging. This is happening as banks increasingly withdraw their own frontline services and close branches across the UK.”

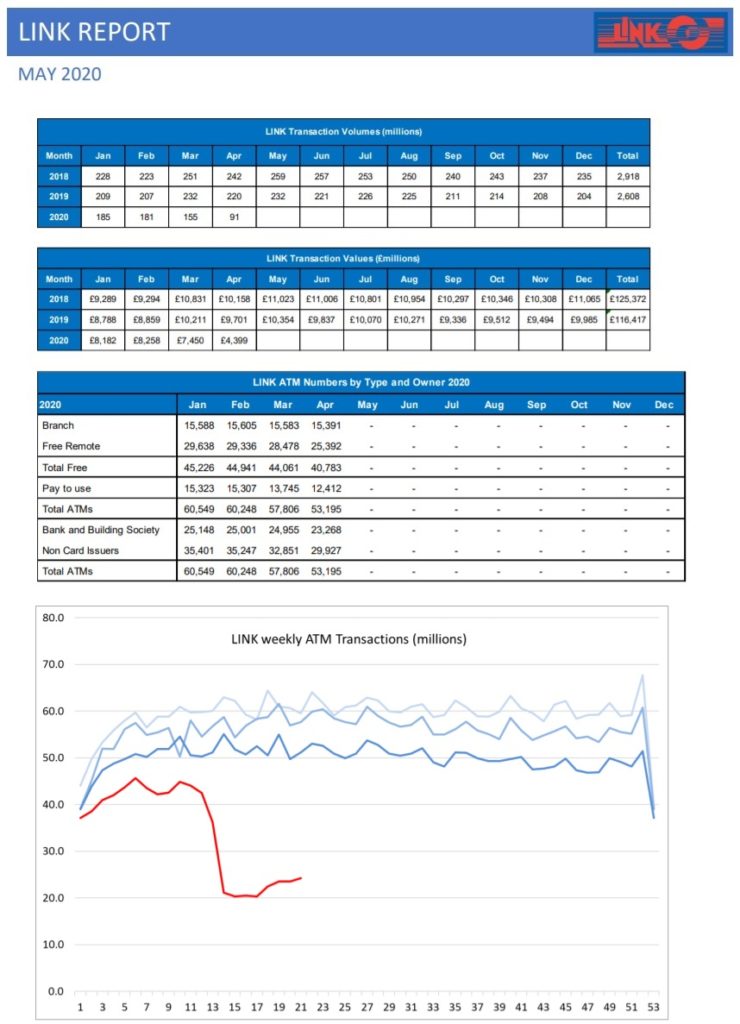

Latest LINK report

The number and value of cash withdrawals has been significantly affected by the lockdown measures taken to fight the coronavirus crisis. „However, the rapid decline that was seem at the beginning of the pandemic has now levelled off and LINK is starting to see cash usage rising.”, the company says.

The number of available ATMs (see the red line in the graphic below) has been affected by the coronavirus crisis as some businesses containing cash machines continue to be temporarily closed. To help with adherence to social distancing rules, some machines at multiple ATM locations have also been closed. Nevertheless, coverage across the UK remains good and operational performance of the network very high.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: