1 in 4 EU citizens avoided providing personal information to social or professional networking services due to security concerns 26% of population have received phishing messages, according to Eurostat.

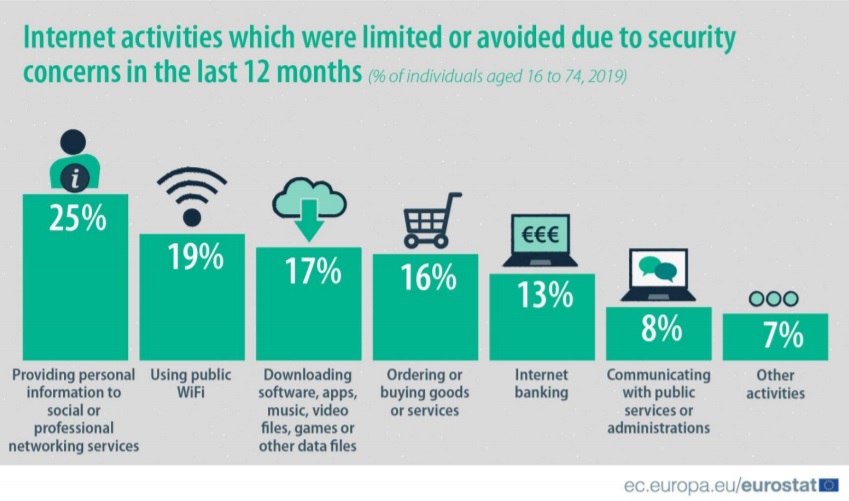

In 2019, 44% of EU citizens aged between 16 to 74 claimed to have limited their private internet activities in the last 12 months due to security concerns. The activity which people mostly avoided because of security concerns was providing personal information to social or professional networking services (25% of population).

Security concerns limited or prevented 19% of people from using public WiFi and 17% from downloading software, apps, music, video files, games or other files, while 16% reported having avoided online shopping and 13% internet banking. Communication with public services or administrations (8%) was less affected by security concerns.

1% of the EU population (2% of those who used internet in the last 12 months) experienced financial loss resulting from identity theft, fraudulent messages or redirection to fake websites.

This information, issued by Eurostat, the statistical office of the European Union, is part of the results of the survey conducted in 2019 on ICT (Information and Communication Technologies) usage in households and by individuals. The most frequently experienced security-related problems were phishing and pharming.

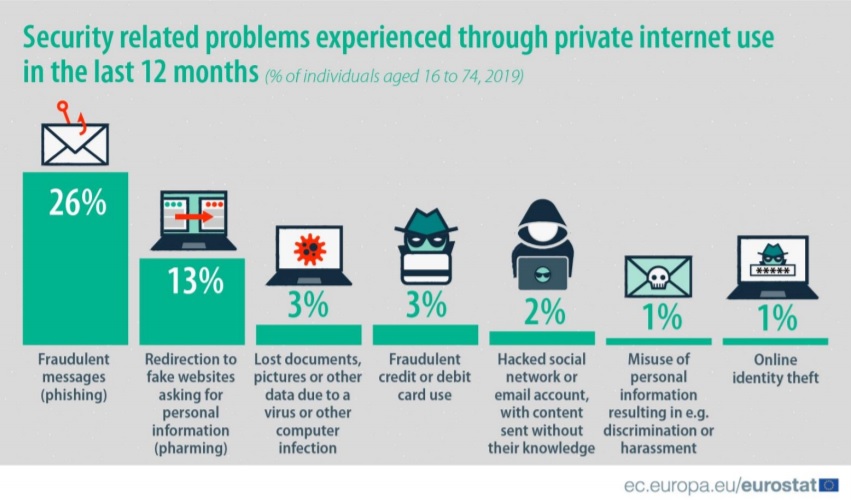

In 2019, 34% of EU citizens reported having experienced security related problems through using internet for private purposes in the last 12 months. 26% of the EU population reported that they received fraudulent messages, trying to obtain information like username and password to log on to e-mail accounts or websites used for e-banking (phishing), while 13% were redirected to fake websites asking for personal information (pharming).

3% of people suffered from fraudulent credit or debit card use, 3% from loss of documents, pictures or other data due to a virus or other computer infection, such as a worm or Trojan horse, and 2% encountered that their social network or e-mail account was hacked and content being posted or sent without the internet user’s knowledge.

Online identity theft and misuse of personal information available on internet resulting in e.g. discrimination, harassment or bullying, were reported by 1% of the population each.

Geographical information – The European Union (EU) includes Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden and the United Kingdom.

Methods and definitions – The data source is the 2019 Community survey on ICT usage in households and by individuals. The survey covered individuals aged 16-74. In most countries, it was conducted in the second quarter of 2019. Individuals were asked about security-related issues that could occur when accessing internet on any connected device, such as a desktop, laptop, tablet, smartphone or any other connected device.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: