UK neobank Monzo has announced that it is removing ATM fees and limits for countries in the European Economic Area (EEA) — which includes the EU and a few other countries — following a change in EU regulation on cross-border payments. Outside the EEA, the neobank’s policies haven’t changed: Customers can withdraw up to £200 ($261) without fees in a 30-day window, but past this threshold, a fee of 3% applies to cover Monzo’s costs.

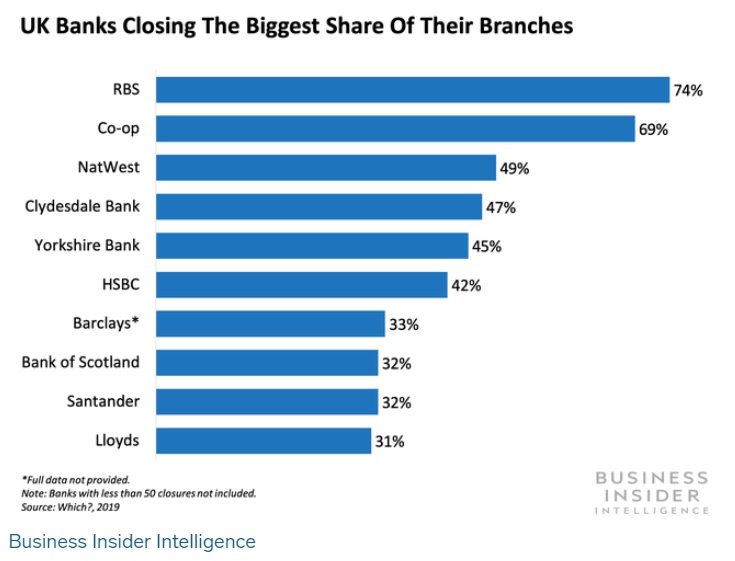

Free cash withdrawals without limits will be a particularly potent benefit in Monzo’s home market, the UK. The UK is staring down the barrel of a growing cash access crisis: Between January 2015 and August 2019, the UK saw a staggering 3,303 bank branch closures, equivalent to 34% of the overall branch network in the country, according to Business Insider.

And to make matters worse, approximately 3,000 cash machines disappeared in the UK in the last six months alone, while an additional 1,250 ATMs switched to charging a fee in March 2019. While Monzo’s policy change isn’t adding physical access points, it at least helps the neobank remove one barrier to accessing cash that would otherwise be a burden on customers.

Many major banks levy foreign ATM withdrawal fees, making Monzo’s new policy valuable beyond the UK as well. For example, Chase, Citi, and Wells Fargo all charge $2.50 plus 3% of the transaction on overseas withdrawals, while Bank of America charges $5 plus 3% of the transaction, per data from Finder. Out-of-network ATM fees may also apply on top of those charges, further exacerbating the issue.

For that reason, Monzo’s choice to eliminate fees in the EEA could help it gain an edge on incumbent banks that fail to do so. And as the neobank works to deploy its full offering in the US, the prospect of not having to pay ATM fees while traveling in the EEA could act as a perk that attracts new customers, particularly consumers who regularly travel abroad.

Remember, when you’re abroad, if you use your debit card to take out cash at an ATM or pay at a shop or restaurant, you’ll usually see the option to pay in either the local currency or in pounds.

When you’re using Monzo, you should always choose to pay in the local currency if you can. If you choose to pay in pounds, it’ll usually end up costing you more.

When you choose to pay in pounds, the shop or ATM will convert your payment using something called ‘dynamic currency conversion’ (DCC).

„This means that when they convert your payment, they can choose the exchange rate they use to make the conversion. But you can end up losing out, as the shop or ATM and their bank will usually offer you a worse exchange rate, and split the profits they make between them.” says Russell Smith, Head of Performance Marketing at Monzo.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: