Criminals in the financial system

an article written by Chris Skinner, the most influential person in technology in the UK, international best selling author, top worldwide speaker on fintech banking. Chris will give a keynote speech at Banking 4.0 – international fintech conference.

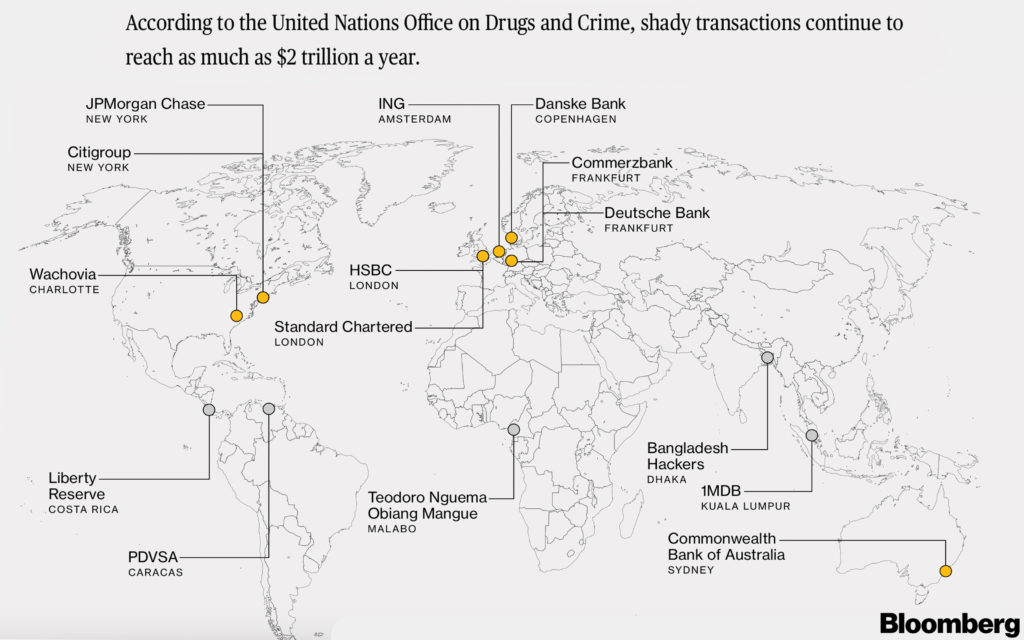

We hear a lot about how crypto and bitcoin encourages illegal activity, drugs, money laundering and such like. The reality is that such activity today is tiny when compared with the amount of illegal activity, drugs and money laundering goes through the banking system.

As of 2019, $829 million in bitcoin has been spent on the dark web. That’s about 0.5% of all bitcoin transactions. It’s a little bit less than the $2 trillion washed through the mainstream financial system.

The United Nations Office on Drugs and Crime (UNODC) conducted a study to determine the magnitude of illicit funds generated by drug trafficking and organised crimes and to investigate to what extent these funds are laundered. The report estimates that in 2009, criminal proceeds amounted to 3.6% of global GDP, with 2.7% (or USD 1.6 trillion) being laundered.

That was ten years ago and, if anything, the amounts are far higher today.

I believe this as the use of offshore companies, nested accounts, use of property purchases, movements of monies between persons who are ineffectively monitored and screened, means that the established banking systems Anti Money Laundering (AML) checks are about as effective as Britain’s Brexit negotiations. Wobbly, at the least.

The latest headlines were raised by the BBC’s Panorama programme, who found the auditing firm EY complicit in a helping criminals move money through gold in Dubai.

Documents seen by Panorama and French news agency Premieres Lignes show that Renade International – a company owned by a member of the money laundering gang – sold $146m (£114m) of gold to Kaloti in 2012 alone.

The following year the accountancy firm EY, formerly known as Ernst and Young, had been asked to conduct a review of Kaloti’s compliance with rules designed to keep gold from illegitimate sources out of the global supply chain.

The auditors discovered that Kaloti had paid out a total of $5.2bn (£4bn) in cash in 2012, but EY didn’t report suspicious activity to the money laundering authorities.

EY also helped to cover up a crime – the export to Dubai of gold bars that had been disguised as silver to avoid export limits on gold.

The audit team had been shown what appeared to be bars of silver from Morocco, but scratching the surface revealed they were really gold bars coated silver.

The BBC and Premieres Lignes have now discovered the smuggled gold was owned by the money laundering gang’s company, Renade International.

Amjad Rihan was the lead auditor for EY in Dubai in 2013 and he says he wanted to report the suspicious activity at the time. But he says his bosses watered down reports and told him not to tell the authorities.

Oh dearie, dearie me.

Meanwhile, a report by campaign group Transparency International published last week names EY, alongside other accountancy firms and legal practices, in case studies of what it describes as money laundering.

According to the report, 81 law firms ‘unwittingly or otherwise’ helped acquire assets and entities used to obtain, move and defend corrupt or suspicious wealth. It also claims 56 law firms were involved in ‘suspicious wealth’ property transactions worth £3.2 billion.

Harumph.

Similarly, my friends in the Nordic region have been badly affected by laundering through their system. From The Financial Times, April 30 2019:

Investors continued to turn their backs on the two biggest banks in the Nordic region, as their concern intensifies about the costs of a massive money-laundering scandal and slowing economies. Danske Bank, Denmark’s biggest lender, revised down its profit outlook for the year as it suffered both higher funding and general costs due to its €200bn money-laundering scandal. Its shares, which halved in value last year after criminal investigations into the bank were opened in the US, Denmark and Estonia, fell another 8 per cent on Tuesday. Nordea, the biggest bank in the Nordics, took a €95m provision for a probable fine from Danish regulators due to weaknesses in its money-laundering controls as it delivered worse than expected first-quarter results. Its shares fell 3 per cent on Tuesday.

This is why the six largest Nordic banks announced a joint KYC (Know Your Criminal) utility in July, but will it work?

KYC is a big area in banking, and it’s been something banks have been working on for decades. SWIFT has also been working on it, announcing their KYC Registry in 2014.

SWIFT’s platform, dubbed the KYC Registry, first launched in December 2014 and currently includes nearly 5,200 of the 7,500-plus banks on the SWIFT network. Beginning in Q4 2019, all 2,000 SWIFT-connected corporate groups will be eligible to join the registry and use it to upload and share their information with their banking partners.

The thing is that even with all of these crackdowns on the system, if a criminal wants to get through the network, they will find a way. They always have and always will. If it’s two or three percent of all productivity, is that acceptable? I’m not sure, especially when you see how the system doesn’t work.

So, last week, in the latest move to sort this out, the European Union announced the creation of a central authority to crack down on money laundering activity. Great. But didn’t they have an authority already out there, the EBA (European Banking Authority).

Members of the European Parliament however have criticised the EBA for failing to use its existing powers to act on the recent scandals. The EBA rejected its own internal report highlighting failings in the supervision of Danske by Danish and Estonian regulators, Brussels lawmakers have argued. Deep governance reforms would be needed to make the EBA fit to take on a bigger role.

Ah well, c’est la vie. I’m off to do some cleaning.

For more background on AML, KYC and such like, checkout this link.

About the author

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal’s Financial News. To learn more click here…

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: