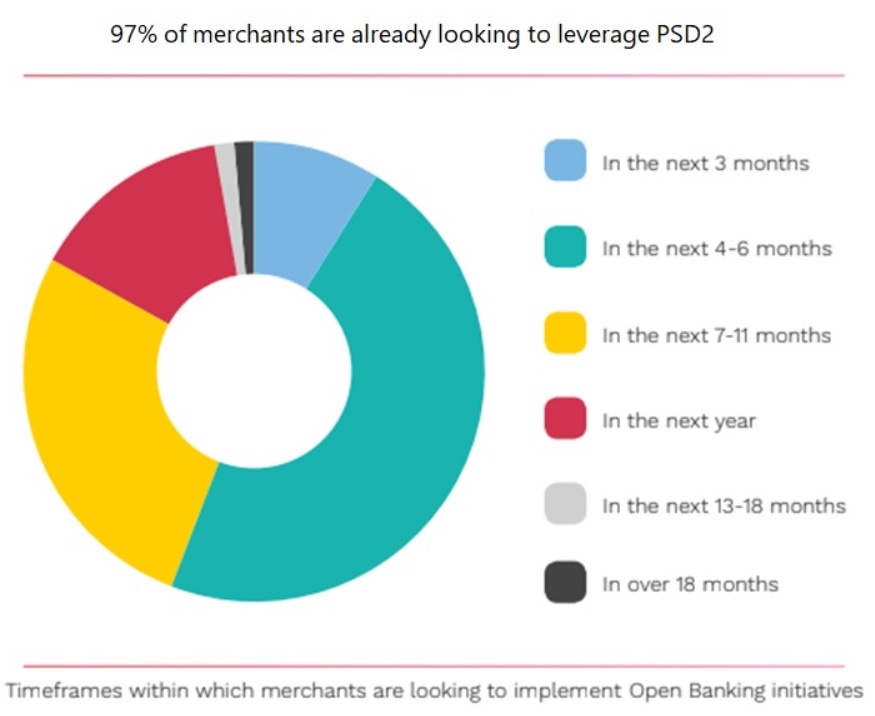

97% of merchants expected to implement initiatives within the next year. Of these, 56% expected to do so within 6 months. The findings show that the UK is at a tipping point when it comes to Open Banking implementation.

Last month, the European Banking Authority (EBA) announced an 18-month delay to the implementation of Strong Customer Authentication (SCA). However, the delay to PSD2 – which follows UK FCA’s own delay in August – seems to have come too late to harm merchants’ appetite for Open Banking Solutions.

Having already implemented the necessary technical fixes, many are now turning their focus from SCA compliance activities to the benefits that PSD2 can offer, according to ThePaypers. Could this mean that businesses are finally turning to the capabilities of Open Banking Payment methods?

The Open Banking World Series report from Nuapay, a Sentenial Service, suggests that merchants are emphatically ready to implement Open Banking initiatives. 79% of the 100 senior finance, payments and product professionals from industries including commercial aviation, supermarket retail and the subscription economy surveyed, said they were certain their company is planning to use Open Banking services and are ready to do so.

The report asked businesses when they expected to implement Open Banking initiatives. A striking 97% of merchants expected to implement initiatives within the next year. Of these, 56% expected to do so within 6 months. The findings show that the UK is at a tipping point when it comes to Open Banking implementation.

And data from the OBIE backs this up. After languishing at only a few thousand transactions per month until the start of the year, PIS payments have started accelerating – growing at 70% per month for the last 6 month. In August alone they grew 141% to more than 450,000 transactions. While this remains small in the scheme of total online payments, it demonstrates that Open Banking payments are now being used at scale in live environments.

One of the potential drivers in this growing take up is the improvement in customer experience for Open Banking payments. 87% of merchants surveyed indicated that the customer experience is important to their organisation, and improving the customer experience has been a major focus of recent updates in Open Banking. Over the last 7 months all major banks in the UK have rolled out their “App to app” payment experiences. This means for users making Open Banking payments on their smartphone, the payment will automatically open your mobile banking App and ask you to authenticate the transaction with your biometrics, without any data entry needed whatsoever.

Of course, this is still only the start. While more and more merchants are starting to adopt Open Banking payments, 76% of them believe implementing Open Banking will be a challenge.

However, the survey found that rather than viewing Open Banking as a compliance exercise, merchants see it as an opportunity to compete and innovate. 86% of the merchants that are rolling out Open Banking or are considering its use say they are ‘very’ or ‘somewhat’ confident that they will realise the opportunities of Open Banking in their organisations. Indeed, to date, there are more than 80 third party providers registered with the FCA to provide payment services or data capabilities.

Sentenial is a pioneer of Open Banking and is the industry’s provider of Account-2-Account payment solutions. Nuapay, a subsidiary company of Sentenial, is licenced by the FCA as an Authorised Payment Institution with the ability to provide accounts to businesses.

The company securely process ~£40bn in payments every year for many of the world’s leading Banks, payment providers and merchants.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: