In the context of a changing global banking landscape, where branch networks are shrinking, volumes of digital payments are increasing and payments are being processed in seconds, fraudsters are creatively finding new ways to steal from banks and their customers.

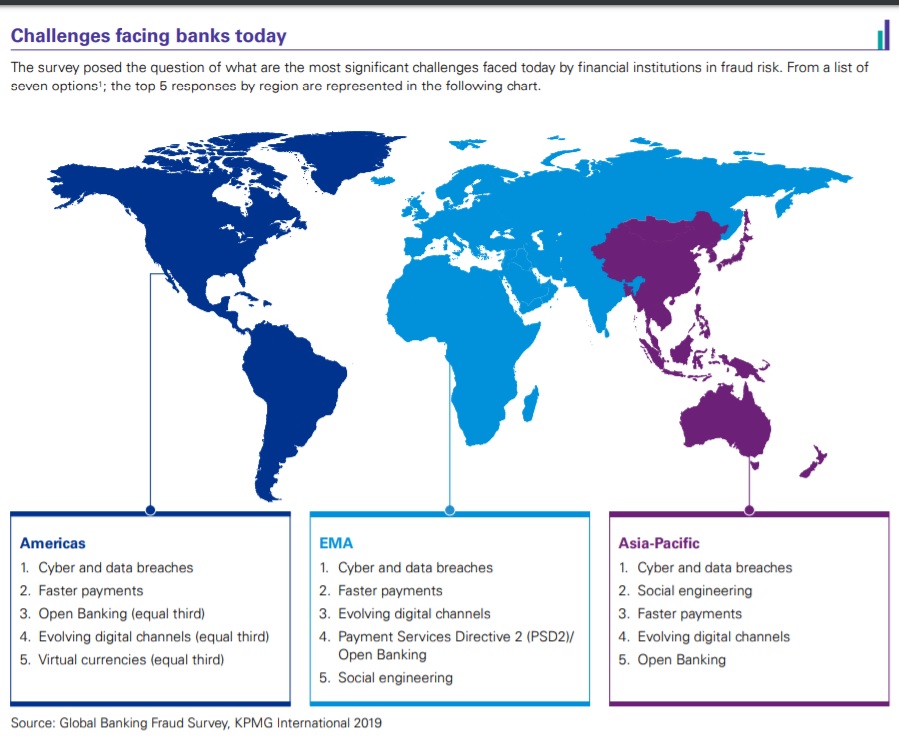

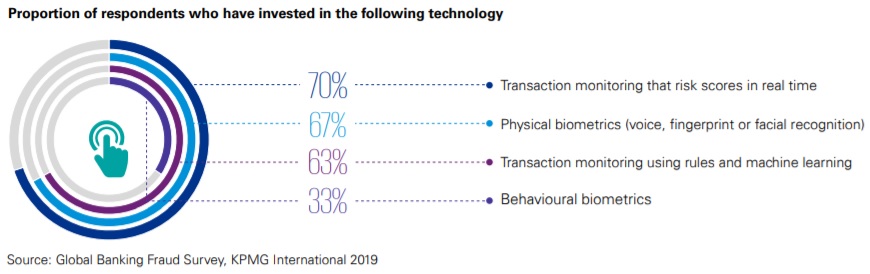

The Global Banking Fraud Survey was conducted to obtain a global perspective of how banks are tackling internal and external fraud threats. Respondents were asked about trends in fraud typologies, challenges they are facing in mitigating threats, security in a digital age and how they are structuring their teams and deploying resources to optimize their fraud risk management efforts.

Fraudsters are becoming more sophisticated and can quickly change and adapt their approaches. Banks need to be agile to respond to new threats and embrace new approaches and technologies to predict and prevent fraud.

KPMG’s Global Banking Survey was conducted between November 2018 and February 2019 across retail banks, 13 of which are in the Asia-Pacific, 5 in the Americas and 25 in Europe, the Middle East and Africa region. Eighteen have annual revenues in excess of USD 10 billion and 31 employ more than 10.000 people across the globe.

The survey questioned banking fraud risk, investigations and group security professionals on trends in fraud typologies, challenges banks are facing in mitigating internal and external threats in the period 2016-2018, security in a digital age and how banks are structuring their teams and deploying resources to optimize their fraud risk management efforts.

For more details download the KPMG report: Global Banking Fraud Survey (pdf format – 2.9 MB)

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: