The Open Banking Implementation Entity (OBIE) publishes latest version of the Open Banking Standard

Version 3.1.2 of the Open Banking Standard enables enhanced features and functionality, extending beyond basic compliance with PSD2 and RTS regulation.

The Open Banking Implementation Entity (OBIE) announced the publication of the latest Open Banking Standard, version 3.1.2 – including updates to the Customer Experience Guidelines (CEGs) and the Operational Guidelines (OGs). Both Guidelines include a number of minor changes and clarifications which have been made in consultation with participants in the ecosystem, and also include updated versions of the checklists.

This latest version helps banks deliver features and functionality that will enable them to move beyond basic compliance with PSD2 and RTS.

This update includes the following enhanced functionality:

. Proposition P2 (Two way notification of revocation) to allow ASPSPs to notify AISPs in real-time via a web-hook whenever a customer revokes access to their account.

. Proposition P8 (Trusted beneficiary exemptions under SCA) to allow ASPSPs to accept a payment initiation without Strong Customer Authentication for PISP payments to a trusted beneficiary.

. Proposition P9 (Status of payment) to allow ASPSPs to provide more detailed and meaningful payment status back to the PISP, beyond just initiation.

. Proposition P22 (Corporate Accounts) to cater for accounts where more than one person needs to authorise account access.

Please see links below to the latest version of each component of the Open Banking Standard:

Read/Write API Specifications v3.1.2

Dynamic Client Registration Specification v3.2.0

Customer Experience Guidelines v1.3.0

Operational Guidelines v1.1.0

Propositions P2 and P8 are included in the published roadmap as part of Release 4, originally planned for implementation by September 2019. However, implementation timelines for Release 4 have not yet been confirmed, and further updates will be provided via the Open Banking Testing Working Group.

***

1. Open Banking Ltd was set up by the Competition & Markets Authority (CMA) in September 2016 to fulfil one of the remedies mandated by the CMA following an investigation into UK retail banking.

2. The CMA’s investigation into the retail banking market (whose findings were published in August 2016) concluded that older and larger banks do not compete hard enough for customers’ business and that Open Banking should deliver a new, secure option for customers to be able to compare the deal they are getting from their bank.

3. Open Banking was created to enable innovation, transparency and competition to UK financial services. It is tasked with delivering the Application Programming Interfaces (APIs), data structures and security architectures that will make it easy and safe for customers to share their financial records by January 2018.

4. The data provided by Open Banking will enable developers to harness technology that allows individuals and businesses to share their financial records held by their banks with third parties.

5. Open Banking is a private body; its governance, composition and budget was determined by the CMA. It is funded by the UK’s nine largest current account providers and overseen by the CMA, the Financial Conduct Authority and Her Majesty’s Treasury.

6. The 9 mandated institutions (referred to as the CMA9) are: Barclays plc, Lloyds Banking Group plc, Santander, Danske, HSBC, RBS, Bank of Ireland, Nationwide and AIBG.

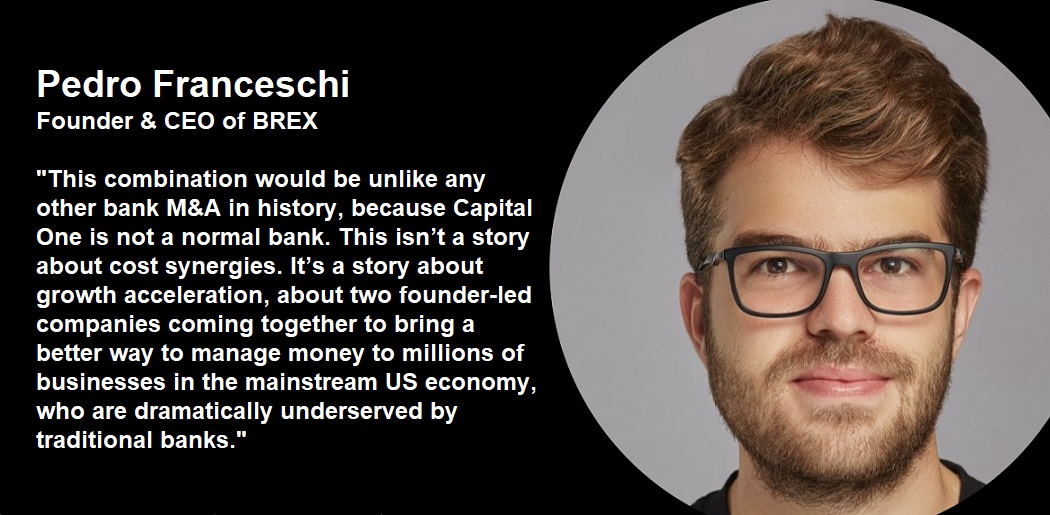

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: