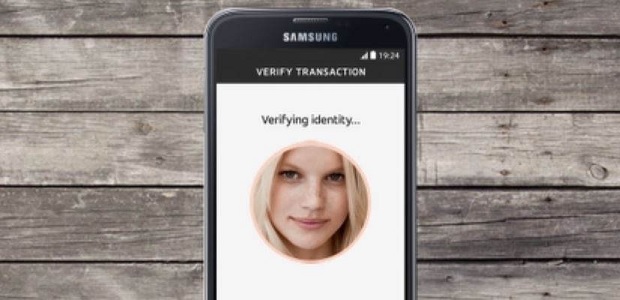

Over USD 1.67 tln of mobile biometric payments will be made annually by 2023

Goode Intelligence forecasts that over $1.67 trillion of mobile biometric payments will be made annually by 2023 and over $8.7 billion revenue will be generated for suppliers of mobile biometric technology by 2023.

Initial growth in this market is predominantly from remote (digital) payments through a combination of mCommerce and eCommerce payment transactions with the latter supported by FIDO 2.0 (WebAuthn) standards. The report further reveals that:

. 2018 saw 68 percent remote mobile biometric payment users versus 32 percent local (physical – in-store)

. By 2023 the percentage of local mobile biometric payment users will increase to 46 percent with remote payments accounting for 54 percent of total mobile biometric payment users

. Slower rates of adoption are expected for local mobile biometric payments in North America, Europe, Africa, ME and LATAM with the highest rates of adoption expected in China, India and rest of APAC.

Alan Goode, founder and CEO of Goode Intelligence and author of the report, said “Identity verification, authentication and fraud management are the three inter-connected areas where mobile biometrics is really establishing itself as an important tool for banks and payment services providers to deploy.

“The delivery of financial services is being transformed by a series of digital mega-events that include the Open Banking revolution where these banks and payment services providers are being forced, either by regulation such as the EU’s PSD2 or by pressures from FinTech providers, to open up their digital infrastructure to third parties using APIs. This, coupled with the need for speed and friction removal from a range of financial services, has created the demand for alternative identity solutions that can operate in a range of channels from traditional, for example ATMs, to the latest digital financial services including mobile, web and IoT.

“Tied to Open Banking is the need for seamless methods that financial services providers can use to engage with their customers and to prove who they are (identity) so that these customers have a convenient method to gain access to their authorised banking services (authenticate) to enable them to make payments any time, any place, anywhere (the Martini principle). Additionally, fraud levels need to be kept at acceptable levels (fraud management).

“In our opinion, fingerprint will continue to be a dominant modality due to the wide scale availability of sensors in mobile devices. Face – both 3D sensors embedded by mobile OEMs, e.g. Apple Face ID and software based solutions leveraging cloud-based AI – will also grow rapidly as it supports mobile-based eIDV applications to support identity and document verification for digital onboarding.”

The 206 page report is the third in a three-part series – Biometrics for Financial Services – that also includes Biometrics for Banking and Biometrics for Payments. It includes a comprehensive review of current global adoption, market analysis including key drivers and barriers for adoption, interviews with leading stakeholders, technology analysis with review of key biometric technologies and profiles of companies supplying mobile biometric components and systems for financial services plus forecasts (regional and global) for users, devices, transactions and revenue within the six-year period 2018 to 2023.

Further information about the Mobile Biometrics for Financial Services report can be found here

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: