2019: What does the new year hold for payments and financial technology?

Here are the top five key themes that Daniel Doderlein, CEO of Auka and top 200 European fintech influencer, believe will make the most impact in the year ahead.

PSD2 heats up

Finally. PSD2 comes into force, as the APIs from account operators (banks) have to be released no later than September. API documentation and test environments must be released no later than six months prior to API launch.

We will see a dramatic uptick in companies trying to play the one stop shop integration partner role. But, players like Facebook, Google and Amazon may be the winners. Ultimately the APIs will be unified and made available with a lot more structure, but we will have to wait for PSD3 for that to happen. See you in 2020.

Established players will embark on an innovation frenzy

As the number of new services grows and these services prove popular – beyond the expectations of traditional players – we will see a dramatic change in how big and traditional players address the threat.

Those such as Visa and MasterCard, especially in Europe, will partner, invest and buy companies that represent the next wave in payments and related financial services. It’s still early but eventually, they’ll venture beyond their current model with banks as distributors only. We will see big banks acting similarly. Smaller banks will adapt and innovate, with product development going beyond the lip service innovation initiatives we have seen up until now.

We will also see some extreme efforts to win going solo. Some of these efforts will fail miserably, while some will succeed. If fast enough with a new service that addresses a wide audience – if not the whole market – some players will win and thus steal customers from others. Telcos and retailers will join in as they can address the whole market utilising PSD2 APIs.

More than anything else, 2019 will see a big growth in narrow-band services (targeting a specific problem or audience). This will drive a flood of SME services making the pan-European business a lot cheaper, faster and more digital.

GDPR, PSD2 and other penalties

As regulation is tightened and we pass the big PSD2 dates, the regulator’s focus will be on the actual execution of the law. Who isn’t adhering and will be hit first by a group-wide turnover based fine? It’s likely to be a big fish that slip up first and are used as an example. Who will be hit first by aggressive SCA enforcement or lack of compliant API availability?

DLT revision two

We will see a brand new revision of distributed ledger technology. The good parts of blockchain will be used without the sinkhole of cryptocurrency as we know it today. It’s likely that a government-backed currency will go onto a digital ledger (distributed or central is unclear). I expect this to happen in the Nordics or Asia first. It will simply enable the world to trade, instantly, beyond borders using a digital sibling of a known analogue currency. A digital ledger, such as the example, will be backed by something currently trusted today. For example, the Krone/Krona, resulting in an e-Krone, depending on this happening first in Norway, Sweden or Denmark.

AI everywhere

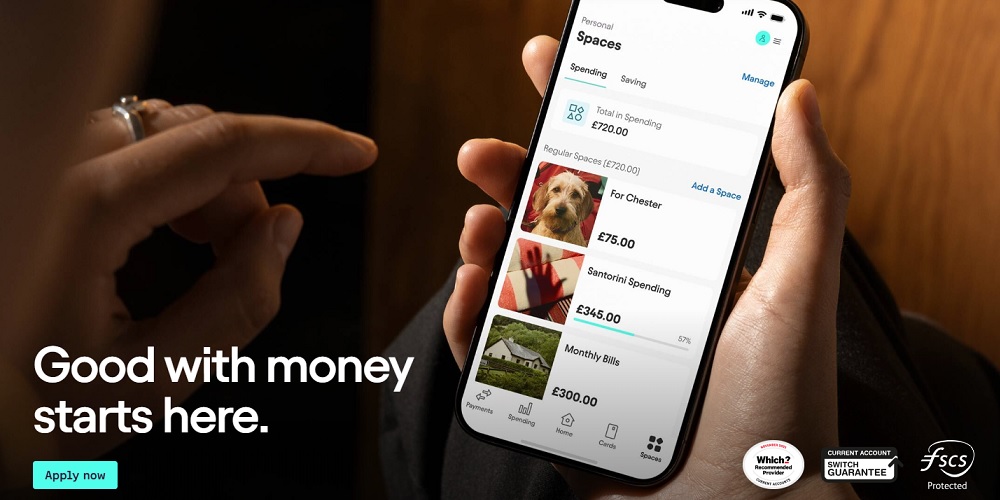

It starts seemingly slowly. As we accept that players like Amazon, Google, Apple and well-known startups like Settle from Auka, Revolut and Transferwise deal with our money, artificial intelligence will start to take over much of our financial decision making.

Just like the tech giants will fight it out when it comes to better payment solutions, the battle for who makes the most money from AI will be predominantly fought by the established powerhouses. AI startups with great ambitions will harness the power provided by these companies, solving problems and making it easier than ever for consumers to manage their money in the way that best suits them.

The initial result of this will likely come in the form of assistant services everywhere. We will quickly move beyond ‘hey Siri’ and experience voice and text assistance in a wide range of situations. One such example could be a push message when you should move your funds from one to another currency, or when there is a sale on a product you like.

About Auka

Founded in 2010, Auka is a Norwegian VC-backed technology company enabling retail banks toissue mobile payment products to its private and merchant customers. Auka has built and operatesa reliable, regulated, end-to-end payments infrastructure that connects financial institutions,merchants and consumers through the cloud.

Auka recently wins Visa Everywhere Initiative Nordics and Baltics. “Visa Everywhere Initiative is a global innovation program that tasks start-ups to solve payments and commerce challenges of tomorrow, further enhance their own product propositions and provide visionary solutions for Visa’s vast network of partners.” Visa received 164 applications from 154 Nordic and Baltic-based startups.

Auka developed the first mobile payments platform in the Nordics and launched the first mobile payments scheme in Norway. In 2018,the company launched Settle a mobile payments app that allows any person to quickly send and receive money, through a variety of funding source options, to any other person using just their phone number as an identifier. Other core functionality includes Settle for business, enabling any business to accept digital payments without relying on a card terminal.

Croatia is the first market where Auka has announced the launch of Settle. It will be available for download by all Croatians, regardless of their bank relationships or smartphone model, in early 2019. Other several EU markets will follow during next year.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: