At least 15 central banks are serious about getting into digital currency

Digital cash may soon start replacing the physical kind.

Central banks are the institutions that set monetary policy for a nation, manage inflation, and act as the “lender of last resort”—such as the Bank of England in the UK and the Federal Reserve in the US. In fact, no fewer than 15 such central banks around the world are taking the idea seriously, and many others are at least exploring it, according to a recent report from the International Monetary Fund (IMF), quoted by technologyreview.com.

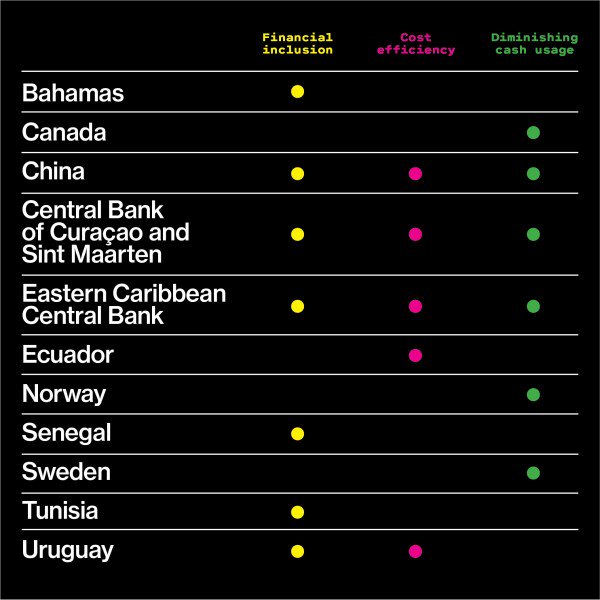

There are two main reasons for the trend, according to the report. First, new forms of digital money are “shrinking the role of cash.” Besides that, some central banks are interested in using the technology to reach the hundreds of millions of people who do not have a bank account or access to modern financial services. Finally, most central banks see the potential to reduce costs by replacing physical banknotes with digital ones. (See the table below for the rationales that central banks have given for their interest in issuing digital currency.)

It makes sense that central bankers are getting interested in digital currencies. New payment technologies, including cryptocurrencies, are changing the global financial system, and central banks need to understand how that will affect their role. “Money itself is changing,” said the head of the IMF, Christine Lagarde, in a speech accompanying the release of the new report. “Beyond regulation, should the state remain an active player in the market for money? Should it fill the void left by the retreat of cash?”

Lagarde’s comments raise a more fundamental question about the relationship between the citizen and the state, says Robleh Ali, a research scientist at MIT’s Digital Currency Initiative and a former researcher at the Bank of England. “Does the government have an obligation or a duty to provide risk free money to the general population? Does that duty persist after cash usage drops off?”

Sweden’s central bank, Riksbank, is wrestling with this issue right now. Mobile payment apps have exploded in popularity in Sweden, and cash use is declining so quickly there that Riksbank researchers think it may be just a few years before physical banknotes are no longer accepted by most retailers and households.

The state must offer an alternative to the private payment market, the bank recently argued. Left solely to private interests, like the six commercial banks behind Sweden’s hugely popular mobile payment app Swish, the payment market may become less stable, and “it may also risk eroding basic trust in the Swedish monetary system,” they wrote.

The People’s Bank of China also appears to be aggressively developing a digital currency. Last year it launched its Digital Currency Research Institute, and it has recently been recruiting cryptography experts to help it create a new form of money that is cheaper to handle and easier to trace than cash. China’s central bank also cites financial inclusion as its rationale, as do institutions in Uruguay, Senegal, and Tunisia.

Any central bank that plans to launch its own digital currency must tackle a number of complicated technical questions. Should the system rely on a centralized infrastructure, or should it function more like a decentralized cryptocurrency? “To what extent can governments use innovations that have come up in cryptocurrencies?” says Ali. And which aspects are not appropriate? Blockchain systems have the potential to be more resilient, but current iterations are inefficient and slow. They also tend not to be anonymous, unlike cash.

Finally, the risks of introducing a central-bank-backed digital currency are not well understood. One important factor is that central banks have traditionally not offered retail bank accounts, only wholesale ones held by commercial banks. Changing this dynamic is likely to disrupt the commercial banking scene in some way. For example, some have suggested that it could set the stage for a bank run, perhaps during a crisis, in which large numbers of people abandon their commercial banks and move their money into central-bank accounts that seem more trustworthy.

Ultimately, however, new technologies will disrupt the financial system whether or not central banks are ready. “To me it’s clear that there is going to be a change of some kind,” says Ali. “But I don’t think that anyone knows at this stage how it’s going to look.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: