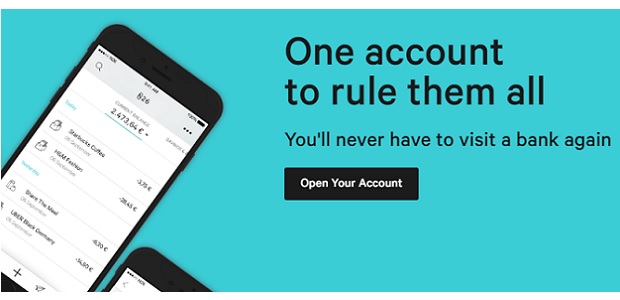

N26 just switched from „mobile only” to „mobile first” – new banking experience from the mobile app to the web browser on any screen

N26 launched N26 for web today with brand new design and functionalities. Features include a discreet mode increasing customers’ privacy, an extensive download function including PDFs and CSV files, and a dark mode offering a clean look that lets customers focus on what is important.

„N26 for web has been designed to be completely responsive, which gives customers easy and direct access to their finances on different types of devices. N26 strives for simplicity and follows a user-centric approach, which is reflected in the design of N26 for web. The clean interface provides the customer with a comprehensive visual overview and facilitates easy management of their finances. In addition, the dark mode reduces distractions and is easier on the eyes at night. „, according to the press release.

“N26 is now bringing the best banking experience from the mobile app to the web browser on any screen,” explains Valentin Stalf, CEO & Co-founder of N26. “We are excited and proud to offer our customers special features such as the discreet mode, and to deliver the same unrivaled N26 user experience across all platforms.”

The design and development of N26 for web is based on direct customer feedback and meets their demand to be able to access N26 on bigger screens, in addition to the mobile app. This is the next step for the Mobile Bank in building a state-of-the-art online banking experience regardless of the device customers are using.

Next to the design, N26 also introduced the discreet mode within N26 for web, providing an additional level of privacy. As more and more N26 customers are working and logging in to their bank accounts in co-working spaces, open-plan offices and cafes, privacy is becoming increasingly relevant.

„The discreet mode masks the account activity as well as balance in the web browser. Customers can enable and disable it with one click, if they do not wish to show their account balance.”, the bank says.

Monthly statements, as well as the account information and IBAN number, can now be downloaded as PDF in the web browser. Furthermore, customers can download CSV files, that simplify accounting and the filing of tax returns due to the easy access of information.

The launch of additional banking features is planned for later this summer, which will help customers to easily manage their personal finances.

About N26 – The Mobile Bank

N26 operates on a much lower cost base with lean organisational structures, without IT legacies and without an expensive branch network. N26 passes on these cost benefits to its customers. N26 partners with the most innovative fintech and traditional financial companies to offer its customers best-in-class products such as TransferWise (foreign exchange), Raisin (savings), Clark and Allianz (insurance), auxmoney (credit) and others.

Today N26 is one of the fastest growing banks in Europe and has more than 1 million customers across 17 European markets and over 430 employees. N26 currently operates in: Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, and Spain, and it intends to enter the UK and US markets in 2018.

N26 has raised more than $215 million from renowned investors including Allianz X, Tencent Holdings Limited, Li Ka-Shing’s Horizons Ventures, Peter Thiel’s Valar Ventures, members of the Zalando management board and Earlybird Venture Capital.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: