World Bank: 52% of adults have sent or received digital payments in the past year, up from 42% in 2014

The 2017 Global Findex database shows that 1.2 billion adults have obtained an account since 2011, including 515 million since 2014.

Between 2014 and 2017, the share of adults who have an account with a financial institution or through a mobile money service rose globally from 62 percent to 69 percent. In developing economies, the share rose from 54 percent to 63 percent.

Yet, women in developing economies remain 9 percentage points less likely than men to have a bank account. This third edition of the database points to advances in digital technology that are key to achieving the World Bank goal of Universal Financial Access by 2020.

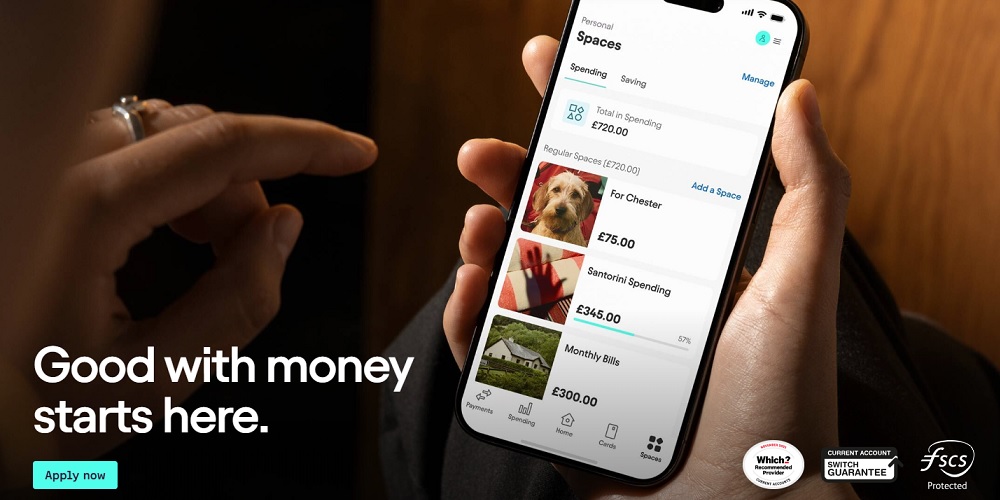

Digital technology is transforming the payments landscape. Globally, 52 percent of adults have sent or received digital payments in the past year, up from 42 percent in 2014.

Technology giants have moved into the financial sphere, leveraging deep customer knowledge to provide a broad range of financial services. Payments made through their technology platforms are facilitating higher account use in major emerging economies such as China, where 57 percent of account owners are using mobile phones or the internet to make purchases or pay bills—roughly twice the share in 2014.

Some advances have been made in helping women gain access to financial services. In India three years ago, men were 20 percentage points more likely than women to have an account. Today, India’s gender gap has shrunk to 6 percentage points thanks to a strong government push to increase account ownership through biometric identification cards.

Still, in most of the world women continue to lag well behind men. Globally, 65 percent of women have an account compared with 72 percent of men, a gap of seven percentage points that is all but unchanged since 2011.

The continued involvement of businesses will be vital for unlocking opportunities to expand financial inclusion. Companies pay wages in cash to about 230 million unbanked adults worldwide; switching to electronic payrolls could help these workers join the formal financial system. Mobile phones and the internet also offer strong openings for progress: globally, one billion financially excluded adults already own a mobile phone and about 480 million have internet access.

Download the full report here: The Global Findex Database

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: