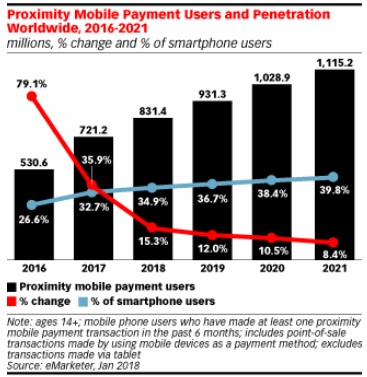

eMarketer: the number of proximity mobile payment users worldwide will surpass 1 billion people in 2020

Consumers across the globe are warming up to proximity mobile payments. In 2018, for the first time, more than one-third (34.9%) of smartphone users ages 14 and older will use a mobile phone to pay for a purchase at a physical point of sale (POS) at least once every six months, according to eMarketer.

„eMarketer expects the number of proximity mobile payment users worldwide will rise by double digits through 2020, when it will surpass 1 billion people for the first time.”

China is the global leader in proximity mobile payment adoption, accounting for 61.2% of the worldwide user base in 2018. Though China’s share will fall as the number of users in other parts of the world rises, the country will still make up of the majority (56.0%) of proximity mobile payment users in 2021.

China is the global leader in proximity mobile payment adoption, accounting for 61.2% of the worldwide user base in 2018. Though China’s share will fall as the number of users in other parts of the world rises, the country will still make up of the majority (56.0%) of proximity mobile payment users in 2021.

Most proximity mobile payment user growth worldwide will be driven by the expansion of the big three global providers—Android Pay, Apple Pay and Samsung Pay—as well as Alipay and WeChat Pay. Growing retailer acceptance of mobile payments and spreading smartphone usage will also fuel growth.

Asia-Pacific will have the highest proximity mobile user penetration rate among smartphone users (roughly 50%) throughout the forecast period, due mainly to China. Looking at the usage among the total population, however, Asia-Pacific is on par with North America, at about 20%. This is because smartphone usage, particularly that of more advanced devices, is more common in North America.

Adoption in parts of Western Europe has been held back by strong contactless card usage. Consumers appear less likely to tap and pay with their mobile phones when their credit and debit cards already offer a similar level of convenience.

Some of the biggest hurdles to proximity mobile payment adoption in emerging markets, including Latin America and the Middle East and Africa, include low bank account penetration, limited smartphone usage and the lack of payment terminals. Growth will be driven by services that do not need advanced technology to function, such as contactless stickers.

Source: eMarketer

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: