Survey: shift to online may inhibit the use of debit cards

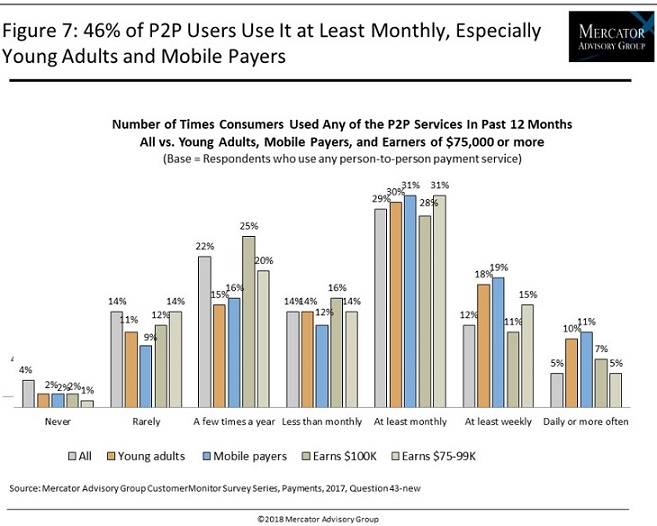

Mercator Advisory Group survey finds nearly 3 in 5 U.S. consumers and 4 in 5 young adults use person-to-person payment Services. Nearly half of person-to-person (P2P) payments users in U.S. use the service at least once a month

The latest Insight Summary Report from Mercator Advisory Group’s CustomerMonitor Survey Series reveals that 57% of all respondents and 78% of young adults aged 18 to 34 use person-to-person payment services such as PayPal, Venmo, Google Wallet, Facebook Messenger, and others accessible online and in app by mobile devices and nearly half of them use a P2P service at least once a month. The report, U.S. Consumers and Debit: Shift to Online May Inhibit Use, presents the findings of an online survey of 3,011 U.S. adults conducted in June 2017.

Using a person-to-person payment service is becoming a common way to pay back family and friends, to split at bill at restaurants or events when purchasing with a group, to pay rent or other household bills, and even to pay at a checkout in some stores and for more convenient payment from mobile devices. It is especially popular with young adults, 58% of whom use a P2P service at least once a month and 28% of whom use it weekly or more often.

As U.S. consumers make a greater share of purchases online and by mobile using a wider range of payment options, credit cards are often preferred to debit cards online. And with the rising use of online payment services, consumers may start to bypass traditional payment cards and keep funds in their payment service rather than transfer it back to their checking account.

“The rise in use of online and mobile commerce may be shifting the payment methods used. We continue to see slight declines in debit card use as consumers are faced with an ever increasing range of payment options which may circumvent debit transactions,” states the author of the report, Karen Augustine, senior manager of Primary Data Services at Mercator Advisory Group, which includes the CustomerMonitor Survey Series.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: