EY Research: more than 10% of ICO funds are lost or stolen in hacker attacks

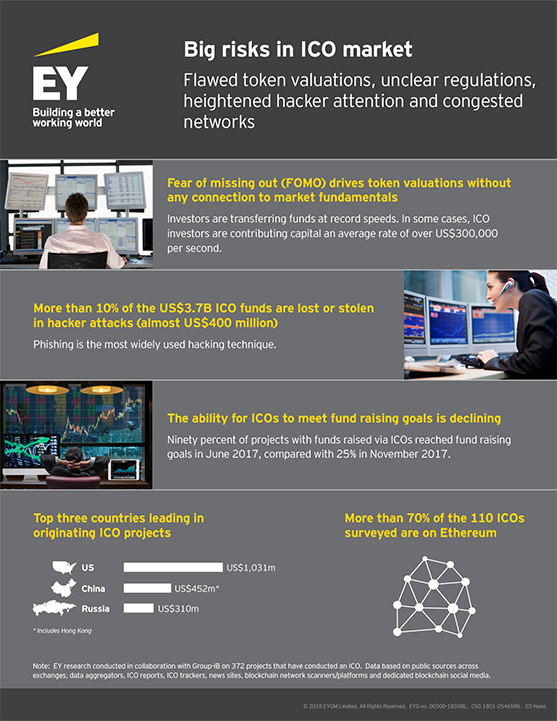

The EY research, which studied 372 ICOs around the world, found that the offerings raised US$3.7b1 in funds, twice the volume of VC investments in blockchain projects. Furthermore, the US is leading the race with the highest volume of ICOs originating from the country (over US$1b). Russia and China follow, with each over US$300m.

Investors face two significant risks the research finds. The first is regulatory: different countries have varying levels of regulatory strictness for ICOs, leaving vulnerabilities in the market. As a result, those looking to conduct illegal activity with an offering could move to jurisdictions where regulators take a light touch approach toward ICOs.

The second risk is theft from hacking: more than 10% of ICO funds are lost or stolen in hacker attacks (almost US$400m). Hackers benefit from the hype, irreversibility of blockchain-based transactions and basic coding errors that, had the ICO been carefully reviewed by experienced developers and cybersecurity analysts, could have been avoided.

Funds are misappropriated via substituting project wallet addresses (phishing, site hacking), accessing private keys and stealing funds from wallets, or hacking stock exchanges and wallets; all on top of indirect losses caused by high reputational risks for project founders.

About the survey

The survey collected data on 372 global projects that have conducted ICOs and performed a detailed analysis of the top 110 projects that collected 87% of all ICO proceeds.

Source: EY

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: