European Commission is proposing a new Directive to combat the fraud and counterfeiting of noncash means of payment

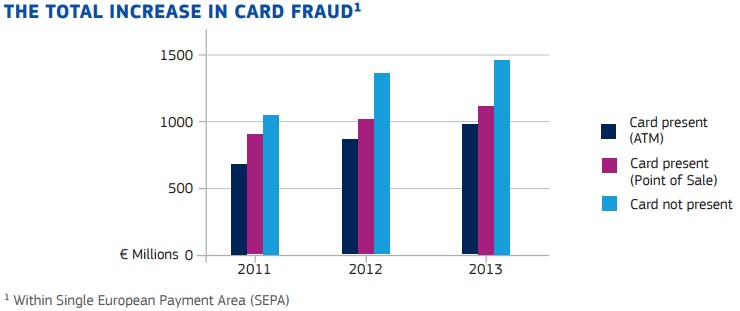

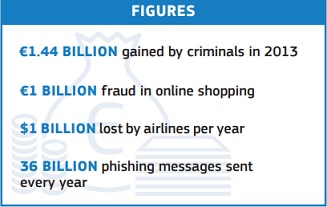

The fraud and counterfeiting of non-cash means of payment pose a serious threat to the EU’s security – they provide important income for organised crime and enable other criminal activities such as terrorism, drug trafficking and trafficking in human beings. The level of card fraud exceeds Euro 3.5 billion in 2013, within Single European Payment Area (SEPA).

In addition, non-cash payment fraud affects the trust of consumers in the security of the digital single market, reduces economic online activity and causes important economic losses. To boost Member States’ capacity to prosecute and sanction cyber criminals committing non-cash payment fraud, the Commission is proposing a new Directive to combat the fraud and counterfeiting of noncash means of payment.

Non-cash payment fraud can take different forms. Criminals can trigger the execution of payments by using payer information obtained through, for example, phishing, skimming or obtaining information on dedicated websites selling stolen credit card credentials on the darknet.

Non-cash payment fraud can take different forms. Criminals can trigger the execution of payments by using payer information obtained through, for example, phishing, skimming or obtaining information on dedicated websites selling stolen credit card credentials on the darknet.

Payments can also be fraudulently executed through counterfeit or stolen cards used to pay in stores or withdraw cash in ATMs or through the hacking of information systems to process payments. Existing data for card fraud shows that 66% is committed without the presence of the card, by using stolen card credentials.

The current rules on criminalisation of non-cash payment fraud are set out in the Council Framework Decision 2001/413/JHA dating back to 2001. It has become clear that those rules no longer reflect today’s realities and do not sufficiently address new challenges and technological developments such as virtual currencies and mobile payments.

The proposed Directive will strengthen the ability of law enforcement authorities to tackle this form of crime by expanding the scope of the offences related to information systems to all payment transactions, including transactions through virtual currencies. The law will also introduce common rules on the level of penalties and clarify the scope of Member States’ jurisdiction in such offences.

To step up effective investigation and prosecution of cyber-enabled crime, the Commission will also present proposals to facilitate cross-border access to electronic evidence in the beginning of 2018. In addition, by October, the Commission will present its reflections on the role of encryption in criminal investigations.

Source: European Commission

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: