Global anti-money laundering framework – Europol report reveals poor success rate

In 2014 EU Financial Intelligence Units (FIUs) received almost 1 million reports related to anti-money laundering framework. Over 65% of these reports are received by just two Member States – the UK and the Netherlands, according to Europol.

Although the overall number of suspicious transaction reports (STRs) continues to increase, only around 10% of these reports are further investigated – a figure that is largely unchanged since 2006. Even where further investigated, the likelihood of successful asset recovery is low, and barely 1% of criminal proceeds are confiscated by relevant authorities at EU Level. These stark findings make it impossible not to question why the success rate of the system is so poor and what can be done about it.

Europol Executive Director Rob Wainwright: “Clearly there is no lack of activity, and a great deal of time and resources are put into sending, receiving and handling millions of reports each year. However, the fact that very few are either the result of a police-directed effort or the subject of any significant feedback indicates that resources may be misdirected. In law enforcement and intelligence communities an ‘intelligence-led’ approach of using enhanced knowledge of the threat to direct operational resources into the highest priority areas is at the heart of all counter-terrorist and other major security programmes. That these conceptual principles have not fully translated in to the anti-money laundering regime partly reflects poor outcomes.”

“The anti-money laundering regime still operates at a domestic level, and has not yet fully adjusted to the reality of a problem that is defined by its international nature. While structures exist to facilitate cross-border cooperation between national units, significant barriers in international cooperation and information exchange remain, revealing the urgent need for supranational overview in increasingly global markets,” Executive Director Rob Wainwright added.

In addition, the growing demand for online services and related internet payment systems poses considerable challenges to the EU policies concerning money laundering and terrorist financing. The development of borderless virtual environments call for reflection on how to adapt policies which are meant to be supervised only at national level, while the underlying business is already transnational and globalised in its own nature.

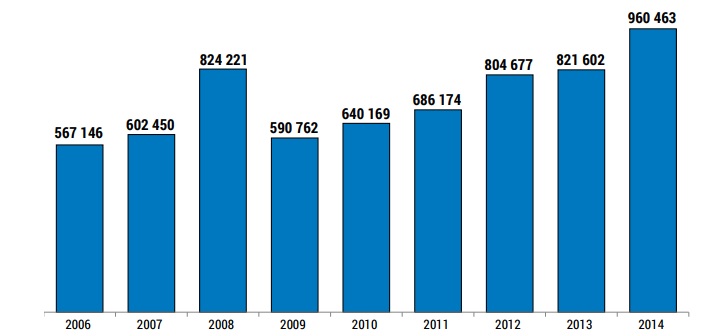

Total annual reports received by FIUs across all Member States (2006 – 2014)

Total reports across all Member States (2006 – 2014)

STR Reporting per Member State (2006 – 2014)

Furthermore, the ‘symmetrical’ exchange of information between FIUs may prevent crucial information contained in STRs reaching authorities tasked with criminal investigations. Europol could assist in overcoming this barrier through acting as a pan-European hub for STRs enabling integration with other sources of information stemming from multiple agencies across Europe and beyond.

Disrupting money laundering schemes will significantly reduce the ability of organised crime groups to grow their businesses and expand into new markets. It will help bring serious criminals to justice. It will also protect the systemic integrity of the financial sector and the global economy as a whole.

Leveraging their respective capabilities to coordinate influence and action within the law enforcement and banking sectors, Europol and the Institute of International Finance (IIF) have joined forces to identify means by which to improve levels of cooperation. Supported by the Financial Action Task Force and national regulators they will also identify opportunities for improvements in the regulatory regime.

Source: Europol

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: