Cards overtake cash for consumer payments in Australia

Cards have overtaken cash as the primary method for consumer payments in Australia, according to data released by the country’s central bank.

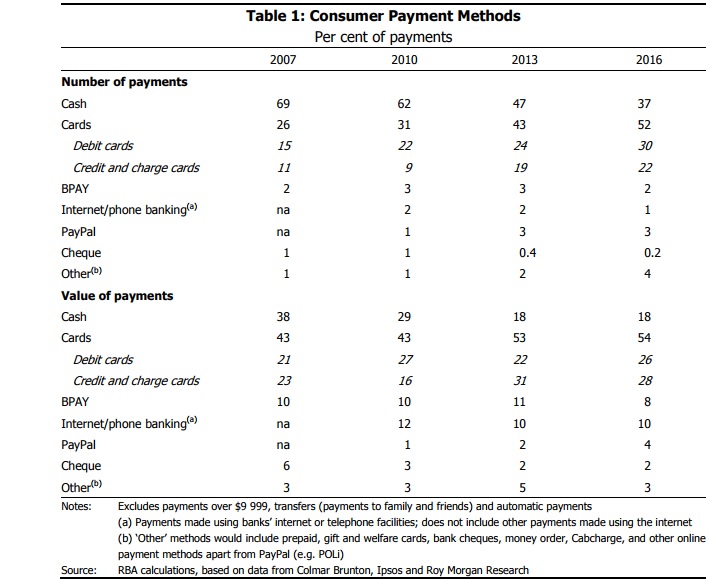

The Reserve Bank’s triennial Consumer Payments Survey (CPS) provides a detailed snapshot of how Australian consumers make payments. The 2016 CPS recorded information on around 17,000 day-to-day payments made by over 1,500 participants during a week.

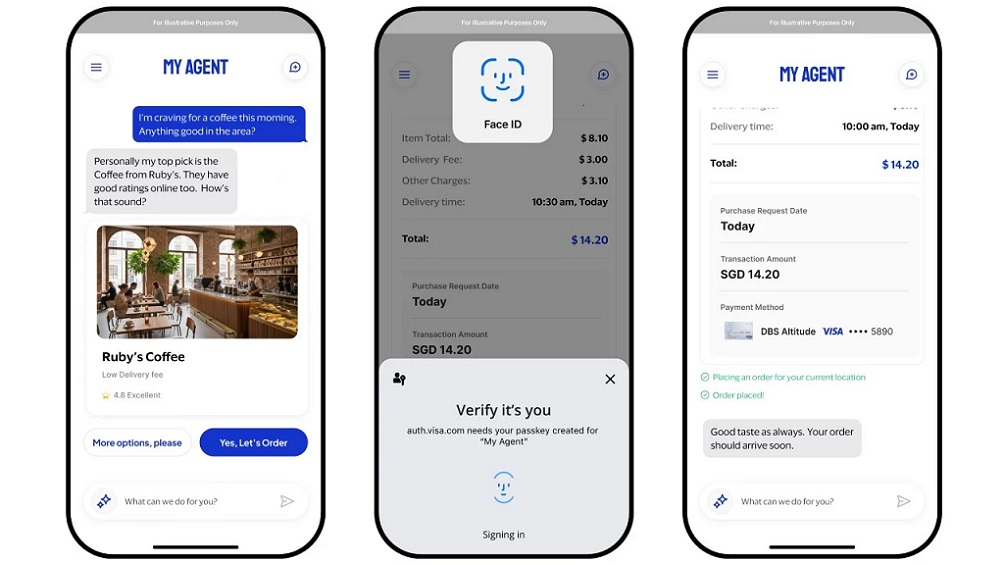

The data show that Australian consumers continued to switch from paper-based ways of making payments such as cash and cheques, towards digital payment methods (particularly debit and credit cards). „Cards were the most frequently used means of payment in the 2016 survey, overtaking cash for the first time.”, according to the press release. Contactless ‘tap and go’ cards are an increasingly popular way of making payments, displacing cash for many lower-value transactions.

Despite these trends, cash still accounts for a material share of consumer payments and is intensively used by some segments of the population. Payments using a mobile phone at a card terminal are a relatively new feature of the payments system and this technology was not widely used at the time of the survey. However, consumers are increasingly using their mobile phones to make online and person-to-person payments. Similarly, consumers are using automatic payments, such as direct debits, more frequently.

For more details download the report- How Australians Pay: Evidence from the 2016 Consumer Payments Survey

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: