Smart Payment Association white paper explores wearable tech from a payments perspective

The Smart Payment Association (SPA), the trade body of the smart payments industry, launches its latest insight paper exploring the potential of payment in driving the global wearable tech market. „This new paper from SPA explores the wearable payment technology options already on the market and looks forward to what’s on the horizon for the coming years.”, according to the press release.

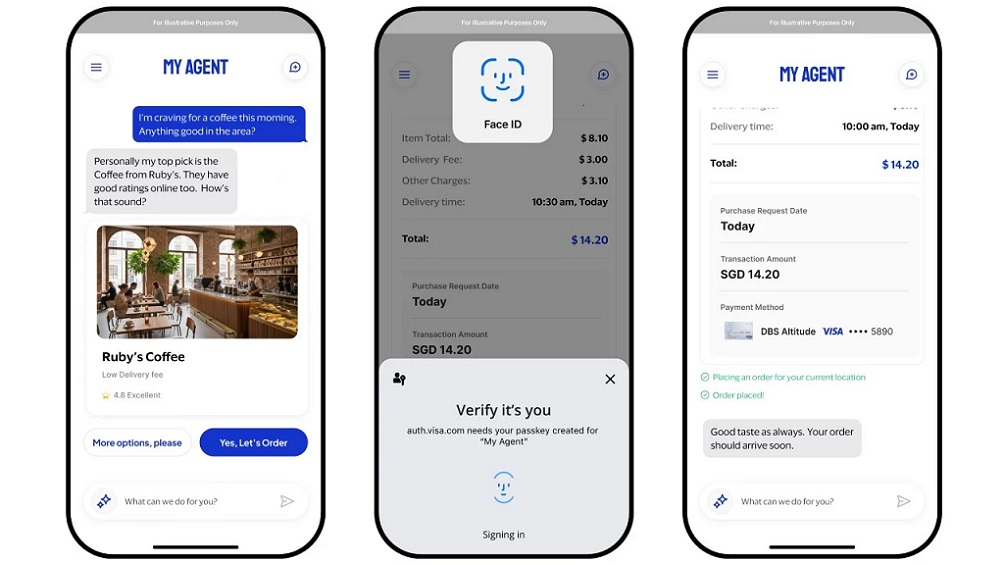

From watches, wristbands and jewellery to glasses and clothing, the popularity of wearable technology is booming. The appeal of wearable payment for consumers is easy to understand. The ability to use items worn on the body to quickly and easily pay for goods and services takes convenience to a new level.

This paper explores wearable tech from a payments perspective, analyzing the current market and evaluating the future prospects it affords consumers, institutions, and the wider payment ecosystem.

Evaluating how contactless payment is already paving the way for new wearable payment factors, the paper outlines the challenges that will need to be overcome for mass take up to succeed.

Connecting issuers, processors, acquirers, device makers and application developers through unified tokenization and provisioning of wearable devices with account credentials is just the start.

Just as critical will be the widespread availability of POS terminals capable of supporting a variety of technologies – bar codes, HCE host card emulation, WiFi, embedded secure elements – and able to differentiate between open and closed loop ecosystems.

But that’s not all. With the emergence of new form factors, it’s increasingly unclear if the payment industry or consumer manufacturers are in the driving seat. Furthermore, there is currently little clarity around the standards that apply to devices manufactured by SPA members and those created by consumer brands currently tapping into a variety of payment ecosystems.

One thing is for sure, the more sensitive the data stored on such ‘devices’, so the more tantalizing become the opportunities for cyber criminals and fraudsters. Consideration will need to be given to the personal safety and security issues facing consumers who are out and about wearing their payment device.

The paper sets out a technology roadmap for stimulating consumer appetite and take up for wearable payment solutions. And highlights how brands and financial organizations looking to test the market and adapt payment models to the wearables sector will need to navigate a complex ecosystem that includes device manufacturers, payment tech vendors, regulators and banks.

“The fast-paced evolution of wearable payment represents an unprecedented opportunity for the payment industry,” says Sylvie Gibert, President, SPA. “Consumers are hungry for convenient ‘frictionless’ payment solutions that can be combined with a variety of other lifestyle enhancing apps to make everyday life simpler. And making this happen will open the door to the next secure payment challenge – embedding secure payment authentication into connected IoT devices.”

Payment ‘on the go’ looks like being the transformational application that captures the public imagination and drives the mass take-up of wearable technologies. According to Gartner, half the consumers in major markets – including North America, Japan and Western Europe – will be using a combination of smartphones and wearables to make payments by 2018.

Scoping out the use cases and opportunities that lie ahead, it also outlines the challenges and hurdles that will need to be overcome if the mass take up of wearable payment technologies is to succeed. This includes implementing processes to ensure that the personal and biometric data digitally held in multi-functional wearable devices can be revoked the instant these are lost or stolen.

Download the SPA report: „Wearable tech: a growing payment opportunity”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: