Euro Banking Association paper analyses cryptotechnologies in international payments

The Euro Banking Association issued a new information paper looking into potential benefits and use cases of cryptotechnologies in the context of international payments and more specifically correspondent banking practices. Cryptotechnologies in international payments was delivered by the EBA’s Cryptotechnologies Working Group, which brings together experts from EBA member organisations to explore promising business models for distributed ledger technology in relation to payments and transaction banking.

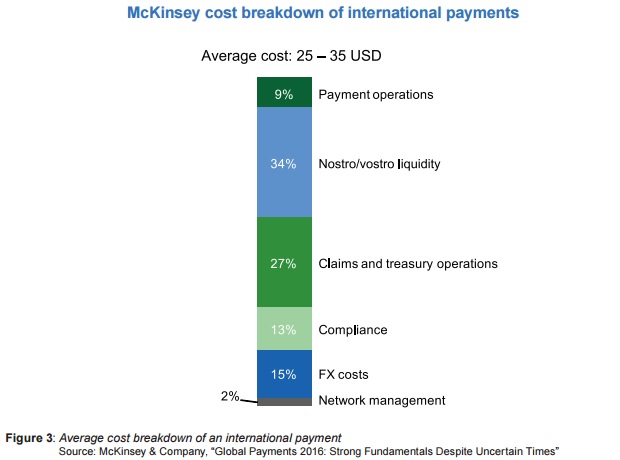

Deutsche Bank estimates the B2B cross-border payments market at 1.2 trillion USD today, and this market is expected to double by 2019. In its report “Global payments 2016: Strong Fundamentals Despite Uncertain Times,” McKinsey identifies six categories that drive the high cost of international payments for banks and the relative share of overall cost devoted to each category: payment operations, nostro/vostro liquidity, claims and treasury operations, compliance, FX costs, and network management. These drivers lead to an average cost of between 25 and 35 USD per international payment according to mcKinsey’s research. The exact breakdown of costs can be seen in Figure below.

“Having analysed the value that cryptotechnologies could bring to supply chain finance processes, we felt that international payments was another area that could strongly benefit from the use of this technology,” said José Vicente, Deputy Manager in the Marketing Department (Cards and Payments Unit) at Banco Comercial Português, and Chair of the EBA’s Working Group on Cryptotechnologies Working Group. “Our information paper shows how this technology could support industry players in meeting user expectations regarding speed, transparency and cost. We strongly believe that collaborative initiatives in this area, in particular, could unlock significant value for payment service providers and their customers.”

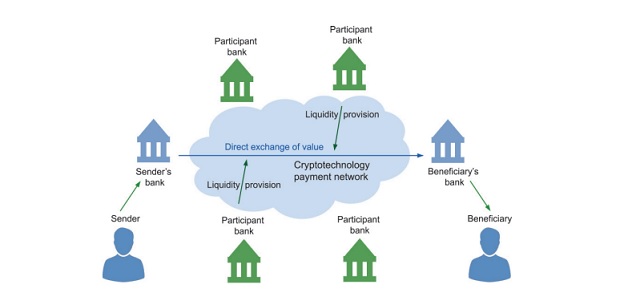

The EBA analysis explores the opportunities that distributed ledger technology holds for payment service providers in terms of lowering operating costs, modernising the international payments value chain and maintaining compliance with key regulatory requirements in markets around the world. The paper further covers specific use cases, such as distributed KYC registries and low-value P2P/B2C payments. The EBA’s Cryptotechnologies Working Group will continue to work on the topic of international payments: an evaluation of implementation scenarios in international payments and the exploration of security issues in the use of cryptotechnologies are next on the agenda of the group.

For more details download The information paper Cryptotechnologies in international payments

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: