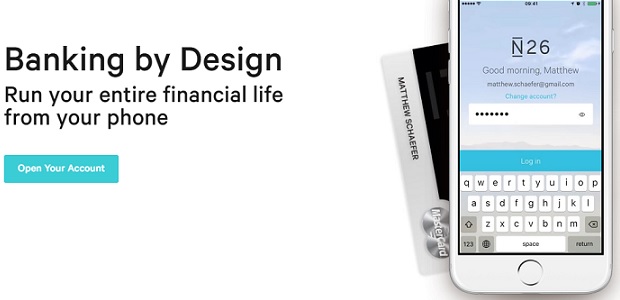

Europe’s first mobile bank now active in 17 Eurozone countries

N26 is one step closer to its vision of becoming the first truly pan-European mobile bank. The Berlin-based company announced that it is now operating and offering borderless banking in 17 countries. Enabled by its own banking licence received earlier this year, the fintech has now reopened signups for Spain, Italy, Greece, Ireland, and Slovakia. N26 is also newly available in Belgium, Estonia, Finland, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, and Slovenia.

The N26 bank account features a state of the art user experience and account benefits such as the eight minute account sign up, instant Money transfers (MoneyBeam), real-time transaction notifications and smart insights. The N26 app, website, video ID verification process and customer service will all be available in French, Spanish, and Italian – in addition to German and English.

N26 is Europe’s first mobile bank designed for the needs of smartphone users. Starting in Germany and Austria in January 2015 and following soft launches in France, Greece, Ireland, Italy, Slovakia, and Spain in December 2015, N26 has quickly become one of the most successful mobile banks with over 200.000 customers across eight markets. It attributes its rapid success to the mobile-first technology which enables the innovative features that define the company.

N26 had paused new sign ups in the six soft launched markets last spring. With the receipt of its own banking License and N26 Bank now in full operation, international customers can open their accounts right on the N26 banking platform and enjoy banking by design everywhere.

“Our team is excited to bring a different banking experience focused on design and based on the beauty of technology to many more customers all around Europe,” says Valentin Stalf, founder and CEO of N26. “The European reach will give us the scale to disrupt retail banking further and take full advantage of our highly scalable and cost efficient systems we have built over the last years.”

Instead of developing all products in-house, N26 selectively partners with the most innovative FinTechs and financial providers around the world. This approach helps N26 to always offer the best and most innovative products in every dimension of traditional retail banks. Today, users already have access to investment, overdraft and international money transfer products. N26 is working full speed to expand its offering to include the best savings, investment, credit and insurance products directly in their app.

The company is planning innovations like real-time credit and greater security through artificial intelligence. N26’s goal is to serve all Europeans within the next few years. The company has now started its expansion in markets of the Euro zone. To ensure a fast roll-out, the FinTech will hire country experts into their Berlin-based team to cater to individual banking and communications needs of the markets.

About N26

N26 is Europe’s first Mobile Bank and is setting new standards in banking. N26 has redesigned banking for the smartphone, making it simple, fast and contemporary. Opening a new bank account takes only eight minutes and can be done directly from your smartphone. Users receive a Mastercard to pay cashless or withdraw cash all around the world. They can block or unblock their card with a simple click and send money instantly to friends and contacts.

N26 was founded in early 2013 by Valentin Stalf and Maximilian Tayenthal. In less than two years N26 has acquired more than 200.000 clients in 17 countries: Austria, Belgium, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Portugal, Slovakia, Slovenia, and Spain and currently employs 160 people. Since January 2015, N26 has been available for Android, iOS, and desktop. N26 has raised more than $53 million from investors.

Source: n26.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: