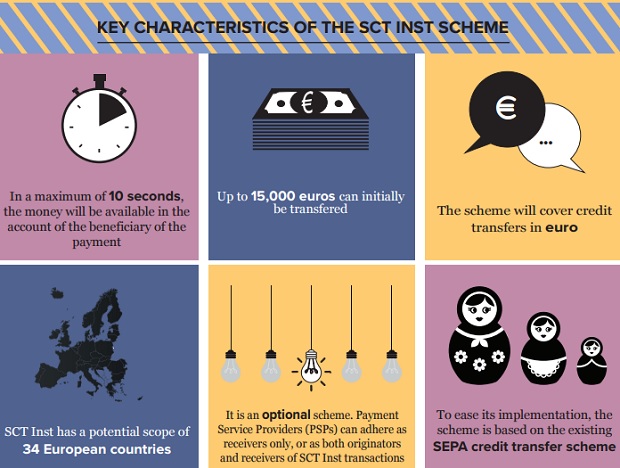

Starting with November 2017, people will be able to transfer up to EUR15,000 within 10 seconds, across borders between accounts in any of 34 Sepa countries

The European Payments Council has confirmed a November 2017 launch date for a pan-European instant credit transfer scheme that will bring real-time money transfers across the Single Euro Payments Area (Sepa). Under the SCT Inst blueprint, people will be able to transfer up to EUR15,000 within 10 seconds, 24/7/365, across borders between accounts in any of 34 Sepa countries. PSPs willing to increase the amount limit and transaction speed can bilaterally or multilaterally agree to do so.

„Today is a major milestone for European payments: the EPC publishes the first rulebook of the SEPA Instant Credit Transfer (SCT Inst) scheme. It will allow the transfer of initially up to 15,000 euro per single transaction in less than ten seconds, any time and any day, and in an international area that will progressively span over 34 European countries.”, according to a press release.

Credit transfers can currently take up to one day, and in some countries sometimes even more if the originators of the payment initiate their credit transfer during, for example, the weekend. The SCT Inst scheme will therefore offer a convenient, easy, digital-oriented, and fast alternative to conventional credit transfers.

The decision to create an instant payments scheme comes in response to concerns that the emergence of new domestic platforms, such as the UK’s Faster Payments, might end up creating a fragmented market in Europe, similar to what existed in regular payments in the past.

Javier Santamaría, chair of the EPC, says: „The SCT Inst scheme will pave the way for emerging methods of payment, such as Person-to-Person mobile payments. Today’s publication of the scheme is only the beginning of this journey towards faster pan-European payments: now is the time for all stakeholders to get ready to process the first SCT Inst transactions in November 2017. Together, we will make this scheme a success.”

Payment Service Providers (PSPs) now have one year to get ready to process the first SCT Inst transactions in November 2017, which is the starting date of the scheme. Adherence to the scheme will be possible as of January 2017 (information will be made available on the EPC website). As the scheme is optional, its success will depend on the number of PSPs which will adhere to it, at least as receivers of SCT Inst transactions.

To answer the urgent need for a pan-European instant euro credit transfer scheme (several European countries were planning to launch national schemes without interoperability between them, which would have hindered the European payments’ harmonisation), the EPC managed to create the SCT Inst scheme in just one year after the recommendation expressed by the Euro Retail Payments Board. A broad spectrum of stakeholders from organisations of the whole payment chain were involved to make this scheme happen.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: