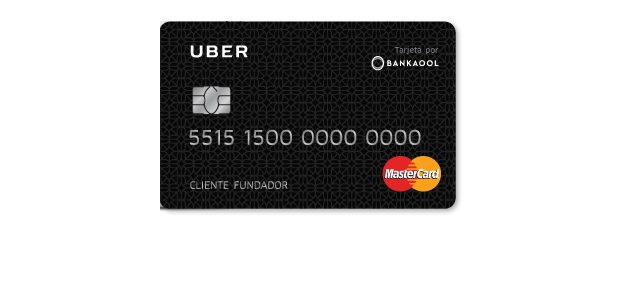

Uber is launching its own debit card in Mexico

Uber is partnering with MasterCard and Mexico’s first online bank, Bankaool, to launch its own debit cards.

The move is aimed at getting more people to use Uber in Mexico, where some card providers do not let customers use their cards be e-commerce or online payments.

The „UberCard,” which carried Uber’s branding, is linked to a bank account provided by Bankaool. Customers who get the card will get their first Uber ride using it free, up to $100.

However, the debit card can be used anywhere that accepts MasterCard, not just for Uber.

Uber launched in Mexico in 2013 and is active in 31 cities across the country.

Bankaool was founded in 2003 but only began offering 100% online bank accounts in 2014. The bank has 65,000 customers, according to the Fintech Times, and offers savings and investment products alongside current accounts.

Francisco Meré, CEO of Bankaool, says in an emailed statement: „For us, this partnership represents an excellent example how a fintech bank, with its open IT architecture, working with a technology company can bring innovative and disruptive solutions to a wider segment of the population in the different markets.”

Source: businessinsider.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: