A new European body dedicated to the promotion of card harmonisation in SEPA

The European Payments Council, as one of the founding members of the European Cards Stakeholders Group (ECSG), announced the creation of this multi-stakeholder association dedicated to the promotion of card harmonisation in the Single Euro Payments Area (SEPA) which aims to support and promote European cards standardisation.

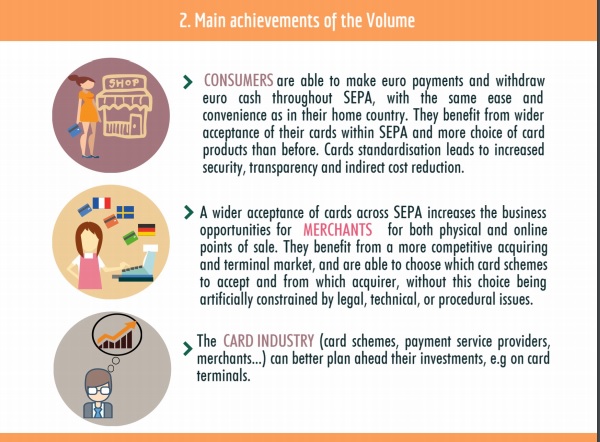

The objective of the ECSG is to contribute to making it possible for EU citizens to use their cards for payments and ATM withdrawals with the same ease and convenience throughout SEPA as in their own country, and to help remove technical, practical and commercial barriers to card harmonisation for the benefit of industry participants.

Built on the foundations of the Cards Stakeholders Group (CSG), which was created by the EPC in 2009 and has now reached maturity, the ECSG is taking over the CSG’s mission. The transformation of the CSG into the ECSG, with the formal legal status of an international not-for-profit association, reinforces the commitment from the five industry sectors which were already represented in the CSG. These sectors are the retailers/wholesale, vendors (cards, payment devices, related IT systems), processors of card transactions, card schemes, and payment service providers.

In total, the ECSG gathers 32 organisations, plus four observers, including the European Commission and the European Central Bank, which have supported the creation of this new association.

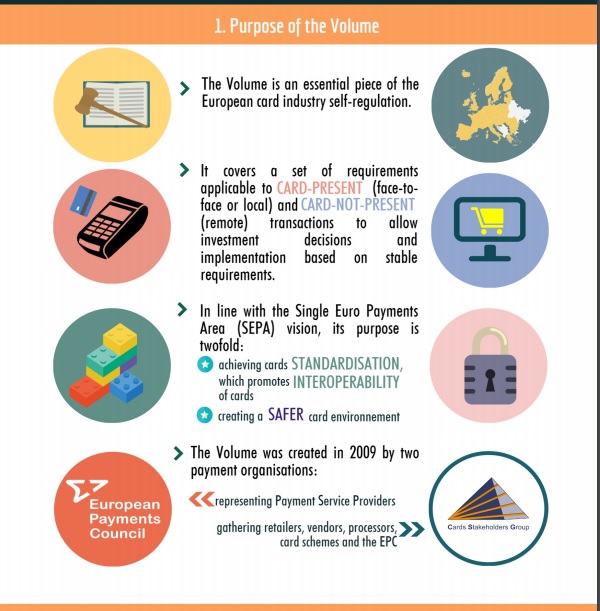

The main mission of the ECSG is to develop and maintain the SEPA Cards Standardisation Volume (the Volume), a key document for the card industry, defining guidelines for card standardisation, interoperability and security in Europe. In addition, the ECSG will promote conformance to the Volume, which is a self-regulatory initiative.

In particular, the ECSG will strive for:

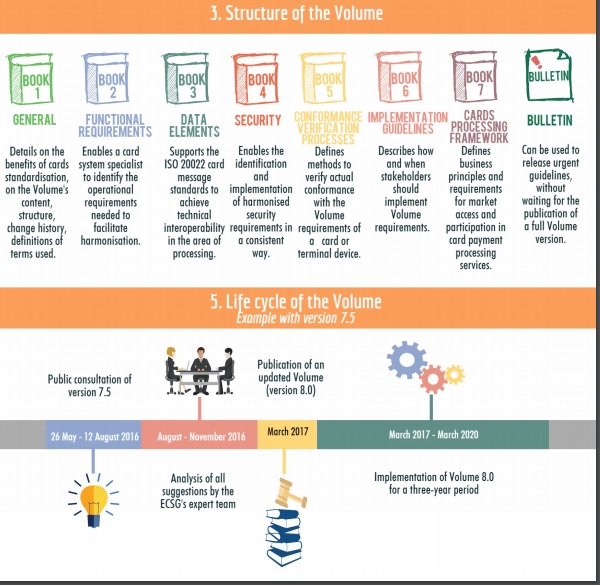

– The maintenance and evolution of the Volume in line with market needs, reflecting the evolution of card payment technology. The Volume, formerly developed by the CSG, is a key document for the card industry, aimed at achieving cards standardisation, interoperability, and security in Europe. The next Volume version (8.0) which will enter into

effect in March 2017, following a public consultation which ended in August, will be the first to be owned by the ECSG.

– The promotion of Volume conformance throughout the card payments value chain, to enable a more harmonised SEPA card payment ecosystem. This conformance process is called “labelling”. As the ECSG is a self-regulatory initiative, the labelling of card stakeholders is a voluntary self-assessment process, which is tremendously important to

contributing to the harmonisation of cards in SEPA.

In addition to the 32 member organisations, the ECSG welcomes four observers including the European Commission and the European Central Bank. These European institutions have been supportive of the creation of the ECSG, just as they have acknowledged the CSG’s achievements and the relevance of this body for European cards standardisation.

Claude Brun, Chair of the ECSG (and representative of the EPC), declares: “Having been involved with the creation of the original Cards Stakeholders Group, the establishment of the European Cards Stakeholders Group as a fully-fledged international not-for-profit association represents a major development in the efforts toward European cards standardisation. As in 2009, the Volume continues to be the focus for the association.”

Jeremy Massey, ECSG Vice-Chair, adds “As a member of the retail sector from a global organisation that relies heavily on card payments and a cards expert myself, I too have worked within CSG since 2009 and fully support its cross-sector standardisation work. Continued maintenance of these Books is important in ensuring that these efforts are sustained and explains why there is such widespread multi-sector support in the creation of this new organisation.”

Source: www.e-csg.eu

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: