UK – 1.1 billion contactless transactions in the first half of the year, compared to 1.05 billion for the whole of 2015

Spending on contactless cards in the first half of 2016 has already outstripped contactless spending for the whole of 2015, says the UK Cards Association.

Some £9.27 billion was spent using contactless methods between January and June of this year, new figures from The UK Cards Association show, more than the total 2015 contactless spend of £7.75 billion. There were 1.1 billion contactless transactions in the first half of the year, compared to 1.05 billion for the whole of 2015.

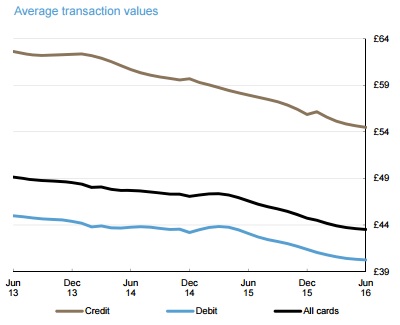

Contactless card payments accounted for 18 per cent of total purchases in June, the latest monthly card expenditure statistics show. This is in contrast to the June 2015 figure of seven per cent. The average contactless transaction was £8.60 in both May and June of this year.

Richard Koch, Head of Policy at The UK Cards Association, said:

“Contactless cards are firmly entrenched as the preferred way to pay for millions of consumers, who expect to be able to use them for everyday purchases. We anticipate the use of contactless cards will continue to increase, particularly as charities and transport operators outside London recognise the benefits this technology can bring.”

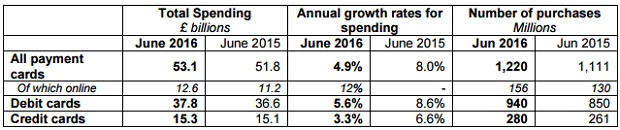

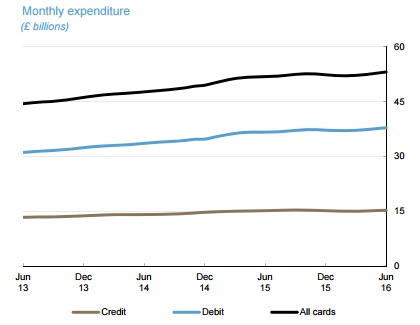

Payment card spending reached £53.1 billion in June, £0.4 billion more than in May. Both spending and the number of payments increased in the second quarter of the year, with 92 million more purchases and £1.9 billion more spending than in the first quarter of 2016.

The number of card payments within the retail sector increased by 5.2 million to 799 million, with the corresponding spend increasing by £134 million to £25 billion. The majority of the increase came from the food and drink sub-sector, while there were also increased sales of photographic goods and at gift shops.

Spending by sector

. Retail sector spending increased by £134 million to £25 billion in March, while service sector spending rose by £222 million to £28 billion

. Foreign currency and travellers cheques distributors saw a rise in spending, coinciding with the beginning of the summer holiday season and increased demand for currency exchange before the EU referendum. There was also growth in spending on leisure and travel

. The debit and credit card share of total retail sales was 77.0 per cent in June.

For more details: The UK Cards Association Report – Card expenditure statistics, June 2016

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: