Citi Report: between 2015-2025, Fintech boom will lead to at least 30% bank cuts in terms of staff and branches

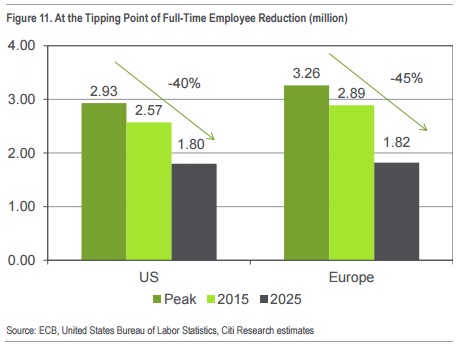

US bank Citi has forecast that the continued growth of fintech startups will mean 30% of bank staff will lose their jobs over the next ten years. The bank’s 112-page report, titled ‘Digital Disruption’, predicts that US and European banks will shed 1.7 million jobs by 2025 as the banking sector undergoes its own „Uber moment”.

While banks themselves will not be replaced, their branches will as new technology enables them to do more online or via mobile. In addition, banks are under pressure to automate more back-office processes which will also result in job cuts.

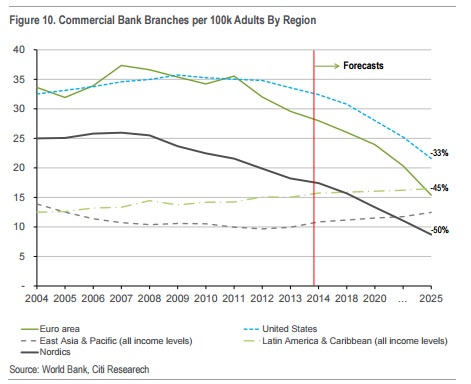

„The consumer banks in the US and Europe are at a tipping point in terms of branch distribution. Northern Europe has already done a lot — Nordic and Dutch banks have cut total branch levels by around 50% from recent peak levels. We believe that from 2013 levels (the last reported branch/population data from the World Bank), developed market banks could cut branch numbers by another 30-50%.”

The return on having a physical network is diminishing. Branches and associated staff costs make up about 65% of the total retail cost base of a larger bank and a lot of these costs can be removed via automation. The pace of staff reductions so far has been gradual (~2% per year or ~11-13% from peak levels precrisis). „We believe there could be another 30% reduction in staff between 2015 and 2025, shifting from the recent 2% per year decline to 3% per year, mainly from retail banking automation. From peak staffing levels pre-crisis, this would result in a 40- 50% decline, not far off Antony Jenkins’ forecast. If the banking system in Europe, Japan, and the US operated with the same cost/income ration as the best-in-class Nordic region, it would remove $175 billion from their cost base (or 23%) and add 39% to the pre-tax profit of the banks in 2016.”

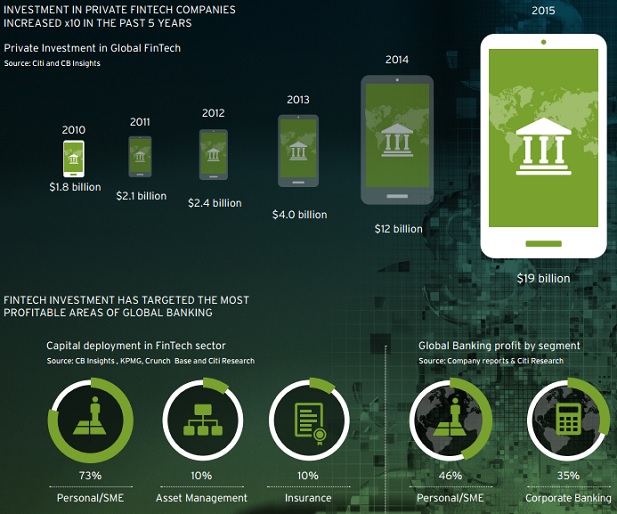

The report, written by the Citi’s Global Perspectives and Solutions (GPS) division, warns against overplaying the threat of banks’ disintermediation at the hands of non-bank competitors, as was famously predicted by Bill Gates in the 1990s, but it also highlights the increasing investment that fintech startups are attracting.

Lending and payments are two areas where fintech firms have attracted significant capital investment. Almost half (46%) of private funding for fintech startups was for lending services, while payment platforms accounted for 23%.

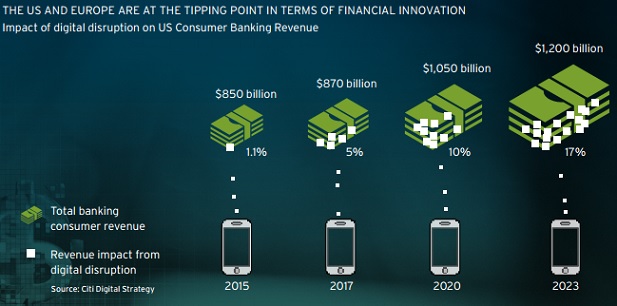

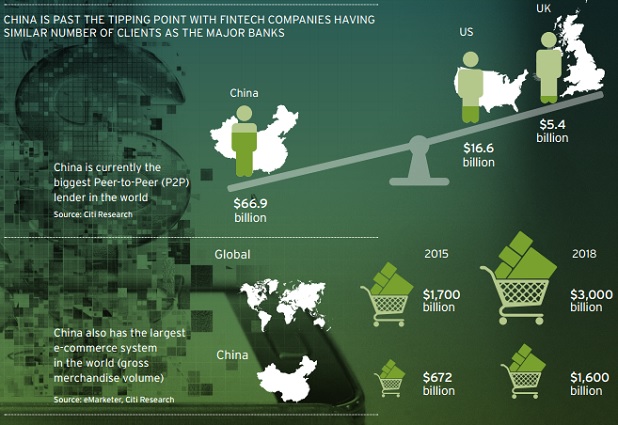

Both areas have traditionally been lucrative for banks with lending currently accounting for 56% of the profits generated by the banks that Citi analysed. But while new peer-peer lending companies have brought in a lot of venture capital, they still only account for 1% of global loans. Similarly new business models have displaced just 2-3% of consumer banking revenues in the US and even less in corporate banking.

However the report notes that the trends vary between regions, not least in Asia. In China, says Citi, the transition from physical to digital financial flows has been „breathtaking” with 96% of e-commerce sales done without a bank’s involvement.

„Incumbent financial institutions still have the upper hand in terms of scale and we have not yet reached the tipping point of digital disruption in either the US or Europe,” wrote Citi GPS managing editor Kathleen Boyle. „Given the growth in fintech investment, this isn’t likely to continue for long.”

For morew details dowload the full report (pdf format): Digital Disruption – How FinTech is Forcing Banking to a Tipping Point

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: