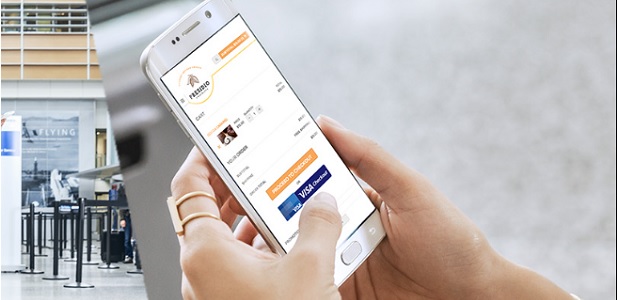

Visa Checkout introduces new interactive button for faster mobile commerce

Visa Inc. unveiled a digital “swipe” product enhancement for Visa Checkout that allows shoppers to complete their online purchase by sliding a virtual image of their credit, debit or prepaid card across the screen of a smartphone, tablet or laptop. The dynamic, new interactive button brings an engaging new way to pay with Visa Checkout, especially on mobile devices with smaller screens.

In 2014, Visa first introduced the Visa Checkout lightbox, which lets consumers pay online, on any device, without being redirected from the merchant’s site or app. The new interactive button streamlines the payment experience even further. Now, instead of a lightbox, a consumer sees a picture of her card on the Visa Checkout button, swipes it to the right, and simply enters her password inside the button itself to authenticate.

The interactive button is now available globally to merchants selling digital goods and services – such as music, movies, airline seats, and tickets – or items that customers purchase online and pick up in a physical store. Visa will extend the interactive button functionality to Visa Checkout merchants who ship goods in the coming months.

„Recent pilot tests have shown that enrolled Visa Checkout customers who used the interactive button were twice as likely to “click-through” and complete their purchase, compared to the existing Visa Checkout experience — which already boasts an industry leading conversion rate of 86 percent1. Visa Checkout participants visiting Pizza Hut, for example, were roughly twice as likely to “click-through” and pay with the Visa Checkout interactive button, while those visiting the Virgin America and Fandango websites were each more than 1.3 times as likely, when compared to the original Visa Checkout lightbox.”, according to the press release.

A recent Visa consumer survey2 found that more than two-thirds (67 percent) of millennial respondents, ages 18 to 34, reported making a purchase using their smartphone or tablet. Roughly 45 percent of millennials surveyed said they made an online purchase at least a few times a month, compared to about 40 percent of older respondents.

“This design-led innovation is proven to increase conversion, helping merchants reach new customers — especially millennials, who are increasingly using their mobile devices to make purchases,” said Shrauger.

One of the fastest-growing consumer products in the company’s history, Visa Checkout now has more than 11 million consumer accounts. Hundreds of thousands of large and small merchants and 600 financial institution partners now offer Visa Checkout in 16 countries around the world, and expansion to five European countries and India will take place by the end of 2016.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: