Apple Pay awareness, adoption and usage drops in the US

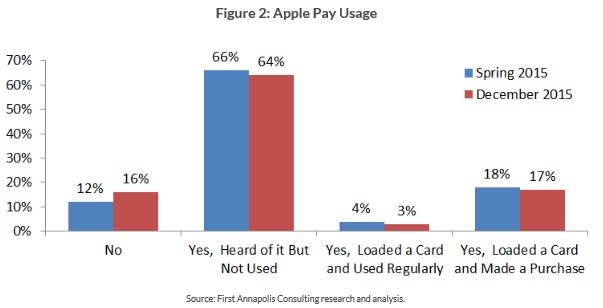

One fifth of iPhone 6 owners in the US (20%) have used Apple Pay at least once, research from First Annapolis Consulting reveals, down from 22% in spring last year. 15% say they use it regularly — more than once per month — down from 19% in the 2015 survey.

This finding, based on a survey of 1,279 smartphone users conducted in December of 2015, indicates that—while there is much energy and excitement surrounding mobile payments—actual consumer adoption and usage still has a long way to go.

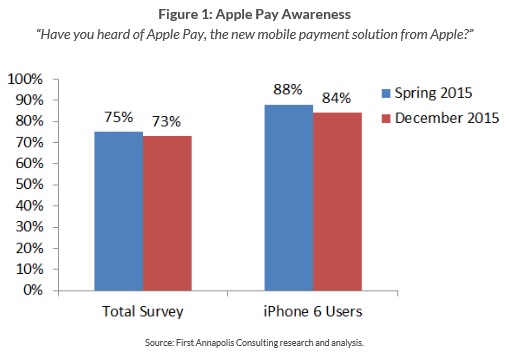

Awareness of Apple Pay is quite high. Among all survey respondents, 73% have heard of Apple Pay, while awareness jumps up to 84% for the sub-group of iPhone 6 owners. “Awareness among iPhone 6 users is down slightly from 88% in our Spring 2015 survey, though still within the survey’s margin of error. Apple has done an excellent job of promoting Apple Pay since its launch in October of 2014,” said Hugh Gallagher, a Principal at First Annapolis. “High awareness is a necessary but not sufficient condition for the success of a new payment service such as Apple Pay.”

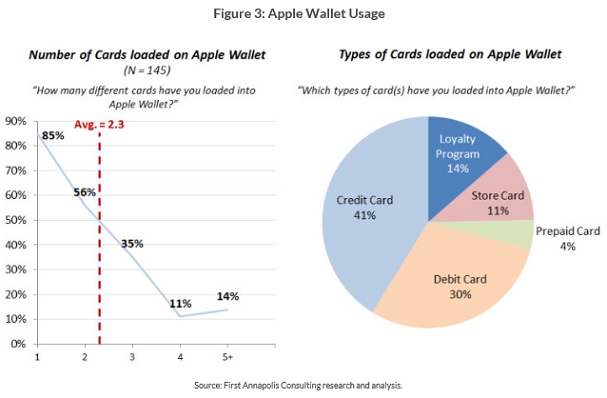

On average, Apple Pay users have loaded 2.3 cards into their Apple Wallet; 75% of cards loaded were general-purpose payment cards (41% credit, 30% debit, 4% prepaid), while 25% were proprietary retail store or loyalty cards which Apple began enabling only in the second half of 2015, according to the press release.

Despite relatively few NFC-enabled terminals in the market, the physical point of sale remains the primary channel for Apple Pay purchases. Among those that have used Apple Pay, 66% reported having made a purchase in-store, while 52% reported having made an in-app purchase.

“At this point in time, the typical financial institution can expect 1 to 2% of cardholders to use Apple Pay two or more times, based on the survey results and Apple’s share of the U.S. handset market,” said Gallagher. “This represents positive momentum for the evolution of the U.S. mobile payments market, but it also suggests a long adoption curve. Despite different stakeholder interests and mobile-related initiatives, most signs point to long-term success.”

Among those that have used Apple Pay, 60% indicated that they are “very satisfied” with their experience and 94% are at least “somewhat satisfied”. Perhaps most importantly – no consumer indicated any level of dissatisfaction with Apple Pay. “This satisfaction may very well translate into preference, which is a hallmark of the Apple franchise,” Gallagher said.

“These research results demonstrate that Apple Pay has had a moderately successful launch, with low consumer usage but positive customer experiences to date. The latter represents an important first step towards longer-term adoption. While early adoption of Apple Pay may not be as high as expected — and appears to have plateaued since the initial launch in October, 2014 — usage is likely to continue to increase with the proliferation of other mobile payment solutions (e.g., Android Pay, Samsung Pay, CurrentC, Chase Pay, etc.) which should expand the merchant acceptance base and broaden the availability and visibility of mobile payments in general,” Gallagher concluded.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: