Payments UK published the second report titled ‘How consumers around the world make payments’

The second report in its World Class Payments series published by Payments UK -the trade association for the payments industry – provides an overview of how different payment methods are used in various countries in Europe and around the world. It highlights some of the key differences between the way we pay in the UK compared to other countries, such as:

•The UK was the first country to introduce the global technology for chip and PIN. In fact, on 14 February this year, it will be exactly ten years since using a PIN became the norm. Some countries, notably the USA, are still to complete their rollout of the technology.

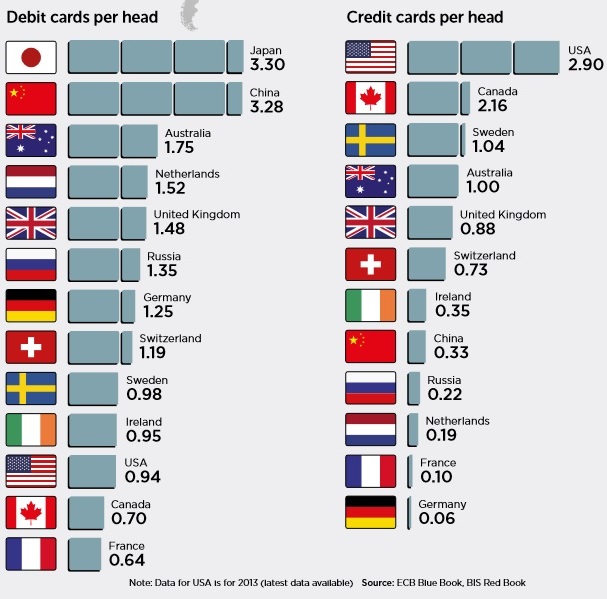

•The number of debit cards in China more than doubled between 2010 and 2014: 3.28 debit cards are held per person in China, compared with 1.48 in the UK.

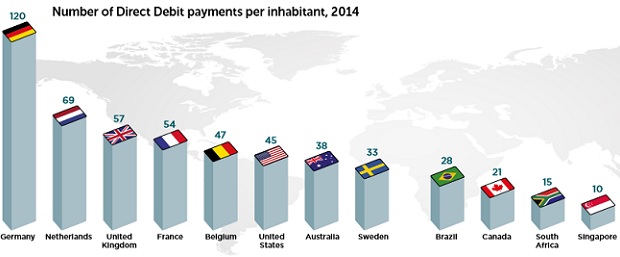

•Direct Debits are more than twice as popular in Germany than the UK, and 200 times more popular in the UK than in Russia.

•Instantaneous internet and mobile payments have been available in the UK since 2008 thanks to the Faster Payments Service. An equivalent service is yet to be launched in the USA.

•In 2014, Portugal had the highest number of cash machines per head in Europe, with 1,540 per million inhabitants. Sweden had the lowest, with 333 per million inhabitants, while the UK has 1,074 cash machines per million people.

At the end of 2014 there were 12 billion cards in circulation worldwide, a rise of 13% on 2013. China had the largest single card market in the world in 2014 in terms of number of cards issued, with almost 4,5 billion debit cards in circulation.

In 2014, UK consumers made an average of just over 200 card payments a year (including debit, credit and charge card payments). This is considerably less than countries such as USA, Australia or Canada where the number of payments is around 250 per year or greater.

Maurice Cleaves, Chief Executive of Payments UK, commented:

“This report provides a fascinating insight into how much variation exists in consumer payment behaviour around the world and the high level of choice, convenience and protection which UK consumers enjoy, compared with many others around the world.

“The UK has a great track record of leading where others follow, with both contactless payments and Paym being recent highlights. By using the findings from this report to focus on the future and what customers need next, Payments UK will ensure that customers benefit from the best possible payment services and the industry we represent remains central on the global payments stage.”

In the World Class Payments report that Payments UK published last year, an evidence-based approach was taken to understand what different customers want from payments and what the UK needs in order to stay world-class. In that report Payments UK set out 13 core payment capabilities that are needed for a payments environment to be world-class, and identified four priorities that it believes should be the initial focus to help the UK achieve its vision.

The new World Class Payments report – How consumers make payments around the world – is available to download from: www.paymentsuk.org.uk/industry-information/reports

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: