Banks to boost spending on payment technologies in 2016 – security and anti-fraud solutions is on top of the agenda

Banks across the world are set to significantly increase spending on new payment technology in 2016, according to a new report from Ovum, the independent technology firm.

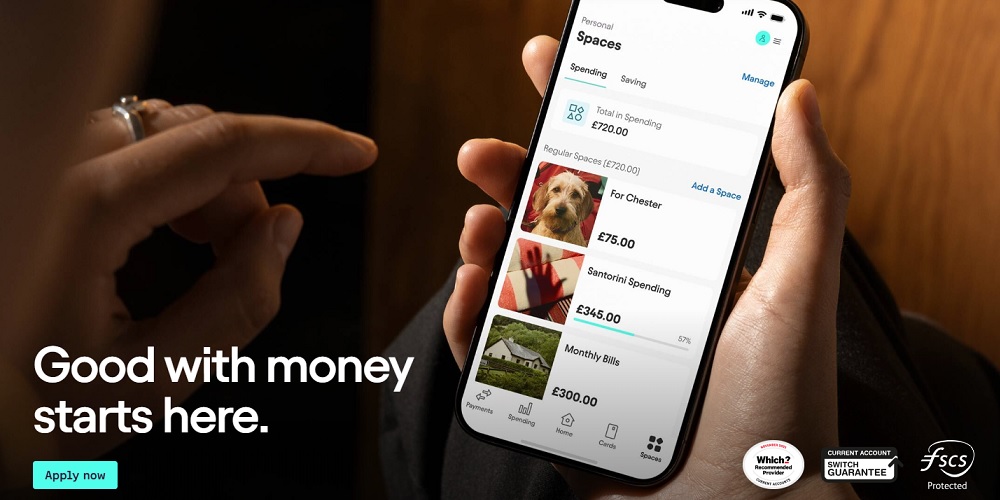

Driven by increased emphasis on security, changing consumer behaviour, and new technologies – such as Blockchain, mobile payments, and real-time payment transactions, almost two in three (61%) banks globally will increase their spending on payment technology next year.

This is up significantly on 2015, when just over half (52%) increased their IT expenditure on payment technology. Most tellingly the proportion of banks reporting significant increases in payments’ spending (over 6%) has leaped from near 10% to almost 30%. Ovum says that such a major shift is representative of the transformative levels of change happening in the payments market.

Gilles Ubaghs, Senior Analyst within Ovum’s Financial Services Technology team, comments: “Investment levels in payments have been high in recent years, driven by the need to deploy new payment services, cope with the overall rise in electronic transaction volumes, and replace ageing legacy infrastructure. 2016 will see an increase in this trend.”

The report, *2016 Trends to Watch: Payments, surveyed CIOs and other senior IT decision-makers in over 60 countries and processed data from around 6,500 interviews in 17 industries. (For the full report, see the details below.)

Security is top of the agenda for banks

Banks’ increasing investment in payment tech is aided by growing concerns over security and the need for regulatory compliance, with over 70% of retail banks reporting a rise in expenditure on security and anti-fraud technologies. The focus on security is not surprising given the need for top notch security across the explosion of new payment tools and services now emerging. Immediate payments are a close contender for top priority, with nearly 65% of banks viewing immediate payments as an opportunity across every business category.

Gilles Ubaghs, explains: “Security is always a core issue for both vendors and enterprises alike and the market is set to see renewed levels of investment activity in 2016. This will be driven by the need to find new means of authentication while reducing risk and the burgeoning growth in tokenization technologies. Investment in the US in particular is likely to be high as the country continues its shift towards EMV.”

Highlighting retail banks’ concern with adding security with new ways of paying, 34% cite biometric technology as a priority for the coming year as well as a focus on using additional information such as location data during transactions.

Apple Pay fails to spark consumer interest

The unexpected lack of success experienced by platforms such as Apple Pay has taught banks a valuable lesson; even with the best laid intentions, it remains extremely difficult to force consumers to use new products and services without incorporating a clear ‘why’ case. The customer interface is not the same as the customer experience, and banks need to create a more compelling story for consumers with their platforms.

Gilles Ubaghs, Senior Analyst within Ovum’s Financial Services Technology team, comments, “Even the magic wand of Apple has not been enough to jumpstart the mobile proximity payment market –. With similar platforms from Google and Samsung now emerging, it would appear these platforms face several years of steady slog towards mass acceptance.”

Blockchain technology to revolutionise the payments landscape

As attention moves away from Bitcoin as a currency and towards the longer term use of distributed ledger technology, Ovum’s report emphasises how enterprises from banks to merchants need to get to grips with this technology now. Blockchain and distributed ledger technologies are finally approaching practical applications as the regulatory environment begins to become clear.

Gilles Ubaghs observes, “Not every organisation will need the Blockchain in the short term, but what they will need is an understanding of where it can fit into their organisation. The scale of implications of the Blockchain suggests slow movers are likely to miss out in the long term”

Source: ovum.com

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: