EFMA study among 140 global banks: threat of industry disruption is growing especially from tech companies

For the last seven years, Infosys Finacle has conducted a comprehensive financial services survey with the Efma association, to understand the changes taking place in the banking industry. The survey covers areas such as banks’ corporate and IT priorities, their challenges and their view of the competitive environment. This year, the report focuses on disruption and how banks can effectively work with start-ups to boost their innovation performance.

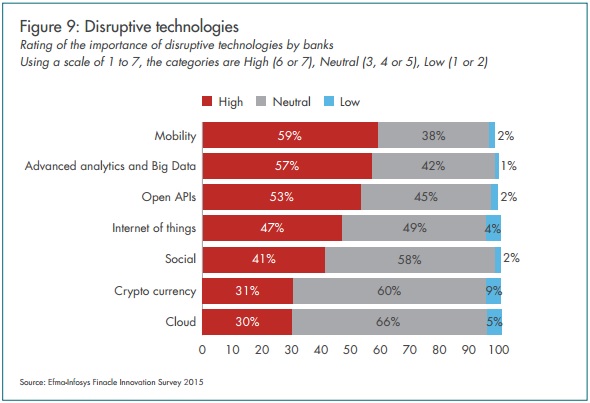

Several new technologies have emerged in recent years which are starting to have a significant impact on the banking industry. One reason is that new players are using these technologies to launch innovative products and services, which threaten to disrupt the industry. The authors of the report asked banks what the most disruptive technologies were and they found that “mobility” and “advanced analytics” were the two most disruptive with 59% and 57% of banks respectively saying that the disruption level was likely to be high or very high (see Figure 9). Cryptocurrencies were not expected to be as disruptive as other technologies (only 31% rated the likely level of disruption as high or very high), although there are nevertheless many banks who believe that the underlying technology of bitcoin, which is the blockchain, could be very disruptive.

The most notable disruptive business model which has impacted banking is Peer-to-Peer (P2P), already affecting product areas like personal and small business lending, and money transfers. 40% of respondents in Infosys survey believed that P2P will have a high or very high impact on the industry.

According to the report, banks perceive that the threat of industry disruption in retail banking is growing and 72% regard the threat as high or very high from at least one group of potential competitors (tech companies, start-ups, retailers, insurers and telcos). The highest perceived threat is from tech companies like Google and Apple, seen as high or very high by 45% of banks. The next highest perceived threat is from start-ups, rated high or very.

„In terms of where bankers perceive the growing competitive threat to be coming from, the findings are very interesting and represent an area where opinion is changing fast. As we highlighted in last year’s survey, bankers consider the threat from outside the industry (new banks or non-banks) to be at least as great as the threat from incumbent providers. In 2015 sentiment has changed. Bankers are now clearly more concerned with the threat from outside than inside the industry (72 per cent in 2015 compared to 45 per cent in 2014) for example from start-ups banks.” says Michael Reh, executive vice president of Infosys.

One of the responses of banks to these threats is that the proportion of banks increasing their innovation investment over the previous year is 84% in 2015, the same as in 2014, but an increase from just 15% in 2009.

The impact of start-ups is being felt across the whole range of traditional services provided by banks including for example current accounts, cards, payments, lending, savings and investments, and insurance. Payments and Digital Marketing are the areas where banks expect start-ups to have the most impact (see Figure 11). In Payments, 71% of banks believe the impact will be high or very high, and in Digital Marketing it is 65% who expect the impact to be high or very high. In other areas like Savings and Investment, the impact is not expected to be high by most banks.

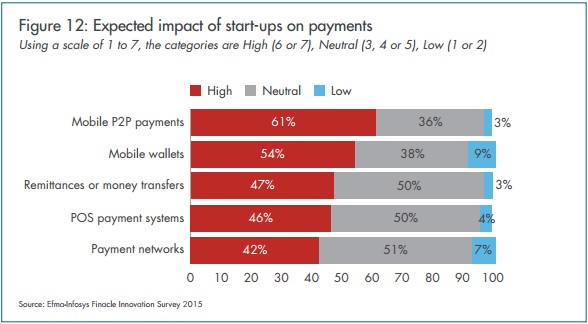

Within the payments space the segments where banks expect start-ups to have the most impact are Mobile P2P and Mobile Wallets (see Figure 12).

In terms of colaborating with start-ups, only around 40% of banks have a positive or very positive attitude to working with start-ups which highlights there are some reservations. However, 69% of banks believe that start-ups can have a high or very high impact on innovation by helping them to develop more innovative solutions, and 57% say that start-ups have a high or very high impact on their ability to get innovations to market faster.

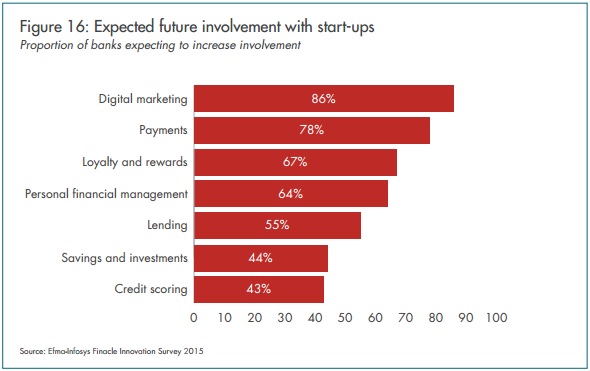

Consequently, most banks said they expect to increase their involvement with innovative start-ups. For example, 86% said they will increase their involvement with start-ups in digital marketing, and 78% said they will increase their involvement with start-ups in payments (see figure 16).

The authors of the study concludes: „There is a general feeling that ongoing changes in the industry will have profound implications for established retail banks in the next few years. The rapid evolution of disruptive technologies and disruptive business models is now starting to have an impact on the day-to-day business of banks. We cannot predict when the tipping point will be but it is essential for banks to be prepared.”

About the research

There were 140 respondents (banks) to the online survey in 2015, representing more than 70 countries around the world. Overall, 42% of respondents were from high income countries, 37% were from middle income countries and 21% were from low income countries.

Infosys defines country income levels as follows:

• High income : GDP per capita > Int$30,000 e.g. United States

• Middle income: GDP per capita Int$15,000-30,000 e.g. Hungary

• Low income: GDP per capita < Int$15,000 e.g. China

For more details download the report: Innovation in retail banking 2015 (pdf format)

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: