ECB report: the total value of card fraud using cards issued in SEPA amounted to €1.44 billion in 2013 – Romania has one of the lowest rates

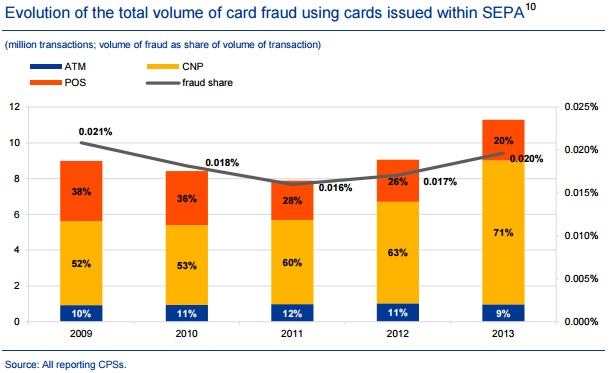

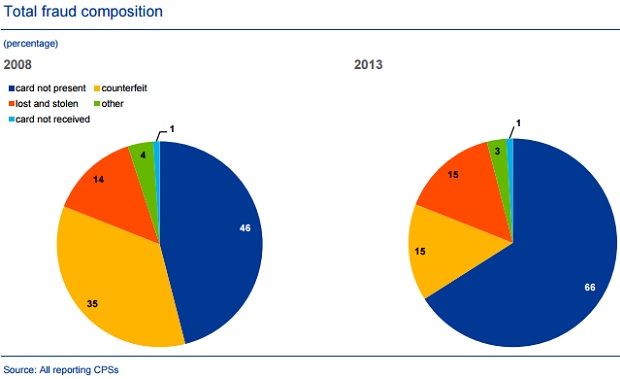

According to the fourh card fraud report, released by European Central Bank, the total value of card fraud using cards issued in SEPA amounted to €1.44 billion. This represented an increase of 8.1% compared with 2012, and an increase of 3.9% compared with 2009. Compared with 2012, CNP has become an even more important channel for fraud, whereas ATMs and POS terminals have become less important. CNP accounted for 66%, POS for 20% and ATM for only 14% of the total value of fraud.

The total number of cases of card fraud using cards issued in SEPA amounted to 11.29 million in 2013. This represented an increase of 24.7% compared with 2012, and an increase of 25.5% compared with 2009. In comparison, the total number of transactions increased by 8.3% in 2013 compared with the previous year. Therefore, fraud as a share of the total number of transactions increased to 0.020% in 2012 (i.e. by 0.003 percentage point).

In line with the trends observed for the value of fraud, the relevance of ATMs and POS terminals as channels for fraud has also decreased when looking at fraud volumes. The share of ATM fraud in terms of volume was lower than that in terms of value owing to the high average values for fraudulent ATM transactions.

In 2013 the total value of CNP fraud increased by 21% to €958 million. CNP fraud accounted for 66% of the total value of card fraud in 2013, share that has been growing steadily since 2010. An increase in CNP fraud of 40% over a period of five years was the main driver for the 4% increase in overall fraud.

CNP fraud has experienced significant increases in absolute terms, especially over the last two years. While card-present fraud decreased in 2013 both compared with the previous year and with the levels registered in 2008, CNP fraud has increased in both cases.

The combined value of ATM and POS fraud decreased by 10.3% in 2013. The values of both ATM and POS fraud also decreased individually. At ATMs, the decrease in 2013 was more pronounced and driven by lower losses on counterfeit or card-not-received fraud. At POS terminals, a 33.9% decrease in card-not-received fraud losses and a 14.5% decrease in counterfeit fraud losses in 2013 made the largest contribution to the overall decrease of 7.9%.

Fraud using counterfeit cards continued to be the most common type of ATM fraud, followed by fraud using lost and stolen cards. At POS terminals, lost and stolen cards was the most relevant category, followed by counterfeit fraud. Over the last five years the absolute value of counterfeit fraud at ATMs and POS terminals combined decreased by 51.9%, while card-not-received fraud decreased by 11.2% (albeit from a comparatively low level) and lost and stolen fraud increased by 5.8%.

As in previous years, counterfeit fraud in 2013 mostly involved transactions acquired outside SEPA. 92% of ATM counterfeit fraud and 66% of POS counterfeit fraud concerned transactions acquired outside SEPA. The total value of counterfeit fraud decreased by 21% in 2013.

All three geographical categories have seen decreases in counterfeit fraud compared with the previous year, the largest being in cross-border fraud acquired outside SEPA (23%), probably as a result of theprogressing migration to the EMV security standard in countries outside SEPA.

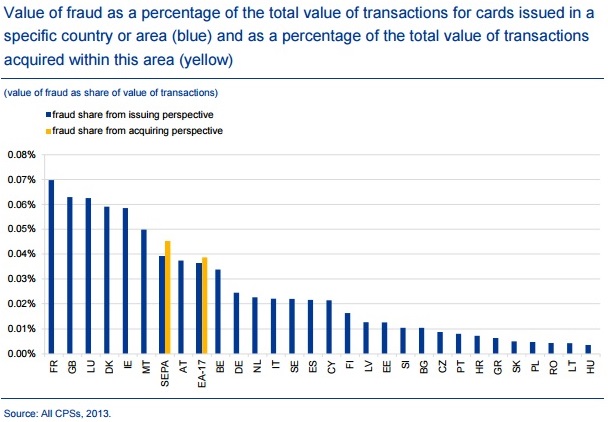

Fraud shares varied considerably between different EU Member States in 2013. From an issuing perspective, the rates of fraud were highest in France, the United Kingdom and Luxembourg and more than ten times higher than those in Hungary, Lithuania and Romania, which had the lowest rates.

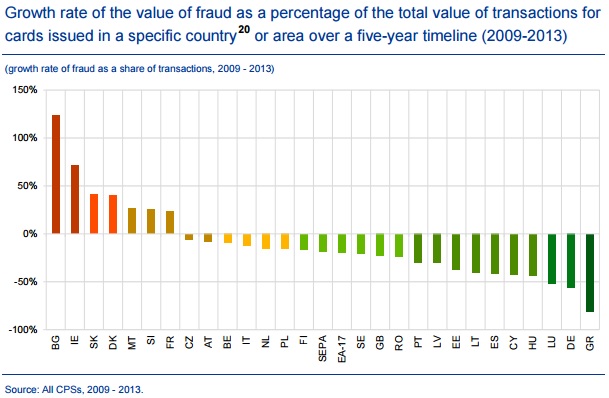

Compared with 2009, fraud as a share of the total value of transactions from an issuing perspective has diminished for the majority of EU Member States. 13 countries have performed better than the average decrease for the euro area and SEPA, which stood at around 18%. Even though growth rate of fraud as a share of transactions was highest in Bulgaria, this was due to the comparatively low level of its respective fraud

share in 2009.

Countries where the migration of cards and terminals to EMV was performed earlier mostly benefited from this before 2009, whereas countries where the migration to EMV was performed later mostly benefited from that after 2009.

For more details download the full report: European Central Bank – Fourth Fraud Card Report – July 2015

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: