European card issuers stand to lose $8 billion per year from a card revenue pool of $60 billion beginning in 2015

Although the next ten years should bring substantial growth in the payments and transaction-banking businesses, banks will grapple with a host of forces that will require them to sharpen their capabilities, according to a new report by The Boston Consulting Group (BCG).

The cap on interchange rates will have a significant negative impact on issuer economics in Europe, with issuers standing to lose roughly €8 billion per year (beginning in 2015) out of a pool of €60 billion in card revenues. In addition, the revenue challenges facing issuing banks will require them to sharpen their pricing models on both current accounts and payments transactions as part of a broader effort to reshape their strategic priorities. They will also need to review their operating models.

Global Overview

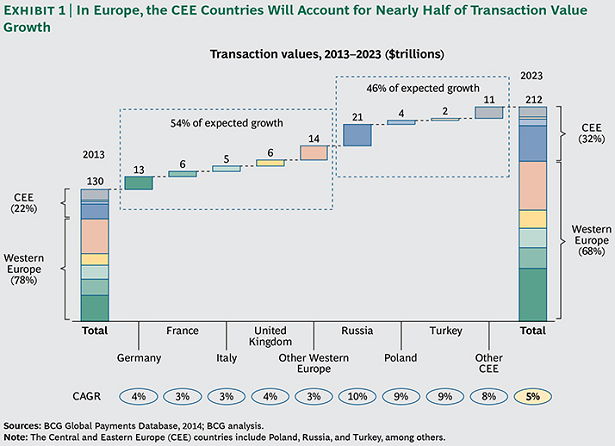

In 2013, payments businesses generated $425 billion in transaction revenues, $336 billion in account-related revenues, and $248 billion in net interest income and fees related to credit cards, according to the report. The total represented roughly one-quarter of all banking revenues globally. Banks handled $410 trillion in noncash transactions in 2013, more than five times the amount of global GDP. The value of noncash transactions will reach an estimated $780 trillion by 2023, a compound annual growth rate (CAGR) of 7 percent. Payments revenues will reach an estimated $2.1 trillion, a CAGR of 8 percent. The report says that in order to succeed, banks must broadly take three actions: approach payments as a platform, not simply as a product; identify the key initiatives that warrant investment; and pursue multiple paths in order to gain both broader experience and new customer insight.

“Never in the history of the payments industry has there been a time of such disruption and opportunity across regions,” said Stefan Dab, a coauthor of the report and the global leader of BCG’s transaction-banking segment. “Payments players, depending upon their strategic decisions over the next ten years, will have much to lose or gain.”

Wholesale transaction banking is expected to outperform retail payments over the next ten years across all markets, at 9 percent compound annual revenue growth (compared with 7 percent in retail), including small-business credit and debit cards. Of the projected $345 billion in revenue growth, emerging markets will account for about 72 percent (a CAGR of 11 percent, compared with 6 percent for mature markets). In order to move forward effectively, wholesale transaction banks need to focus on several areas: achieving sustainable regulatory compliance, seizing the working-capital opportunity, and capturing growth in RDEs. In addition, the report says that pricing is an underleveraged silver bullet for boosting top-line growth.

“Overall,” said Carl Rutstein, a coauthor of the report and the leader of BCG’s North American transaction-banking segment, “the growth in payments and transaction banking is driving stiff competition among not only traditional players but new entrants as well. Consequently, financial institutions must differentiate themselves, refine their strategies, and raise their execution skills if they want to remain competitive. In this environment, no institution can afford to stand pat.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: