Deloitte Study: Technology threatens European banking model – banks need to re-invent themselves with a new vision

European retail banks need to radically overhaul their technology infrastructure if they are to face off the competitive threats to their business from a host of new startups, says consultancy Deloitte.

The real danger to banks is not that the likes of Google or Apple will one day support a banking subsidiary with a huge balance sheet. There are many drawbacks to such a strategy: the size of the capital base required would fundamentally change their investor proposition.

Moreover, the impact of intense regulatory scrutiny would limit their ability to innovate in their core business. Non-bank entrants also need to work out how to deal with problem loans to avoid brand damage from repossession or foreclosure. One option is simply to sell

the debt pre-repossession.

We believe, therefore, that the danger is not that non-banks replicate the universal banking model but rather that by innovating around it in support of their own core business, they fundamentally undermine the traditional integrated bank business model.

Ultimately, the challenge to European banks is not that any single new entrant or model will emerge that will dominate their market. Rather, the risk is that the combination of attackers across banks’ eco-system will steadily erode their core competitive advantage,

resulting in a much smaller banking sector, much as we already see in the US

Banks will, therefore, need to re-invent themselves, with a new vision of how they can best serve the financial needs of retail and business customers, and an operating model and cost base designed around that vision.

Two clear alternatives emerge. Some banks will accept that they will not be able to subsidise loss-leading products. Instead, they will focus on providing best-value products with very efficient distribution and servicing. They will attempt to offset some price competition through their brand, e.g. a reputation for efficiency and convenience.

The second alternative is for banks to focus on using customer data, insight, knowledge and relationships, and their brand, to cross-sell. Even here, the need for efficiency remains, as new competition will limit the premium they can charge.

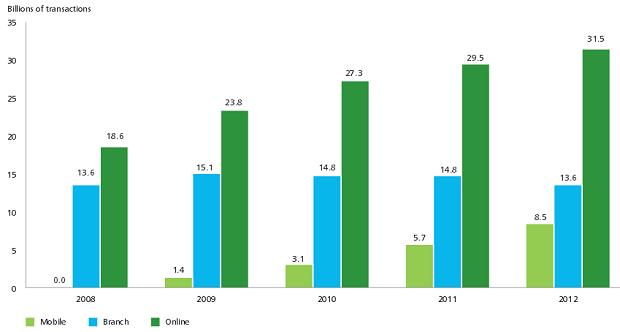

Chart – Transactions going online and mobile in the US

Source: Deutche Bank, Tower Group, Deloitte analysts

Electronic payments

Electronic payments have become key to providing convenience to customers, as the use of cash diminishes, and with it the importance of a physical presence. Payments innovation is coming primarily from non-banks, like PayPal. Moreover, cash-rich

Internet players, such as Google and Apple, are also demonstrating an interest in this space. Google Wallet, for example, invites US customers to “Shop. Save. Pay. With your phone.” Apple’s Passbook enables users to store airline boarding cards, coupons and vouchers on their iPhone. Apple has also been marketing iBeacons, a system that can send special offers from retailers to

nearby iPhones.

Regulators are giving them a leg-up by making it increasingly difficult for banks to exploit their ownership of the payments network as a barrier to entry. The danger for banks is that the current account balances that they currently own or control, will reduce.

One risk is that some of the ‘float’ associated with current accounts may come under the control of the new entrants, even if they do not go so far as to obtain the banking licences required to offer current accounts.

Another risk is that non-bank players obtain banking licences in order to offer narrowly-defined current account products (probably without offering a full suite of traditional banking products), to take market share in transactions.

Read the full Deloitte report: Banking disrupted – How technology is threatening the traditional European retail banking model

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: