98% of 2024 NFT Drops are dead. Only 0,2% of 2024 NFT drops return profits to investors.

So far in 2024, an average of 3,635 NFT (non-fungible tokens) collections have been created per month. While this shows that creators are still eager to launch projects, the sheer volume of collections indicates an oversaturated market. The supply has grown far beyond demand, leaving many projects to struggle for attention and buyers.

For the NFT space, 2024 has been an eye-opener, exposing some alarming patterns as the market develops. „The market is trying to keep the momentum it previously had with an explosion of new collections, poor participation, and sharp price declines”- according to the press release.

NFTEvening, in collaboration with Storible agency, searched for the truth by looking at the performance of 29,079 fresh 2024 NFT drops.. Let’s explore the facts that tell the story.

Key Insights:

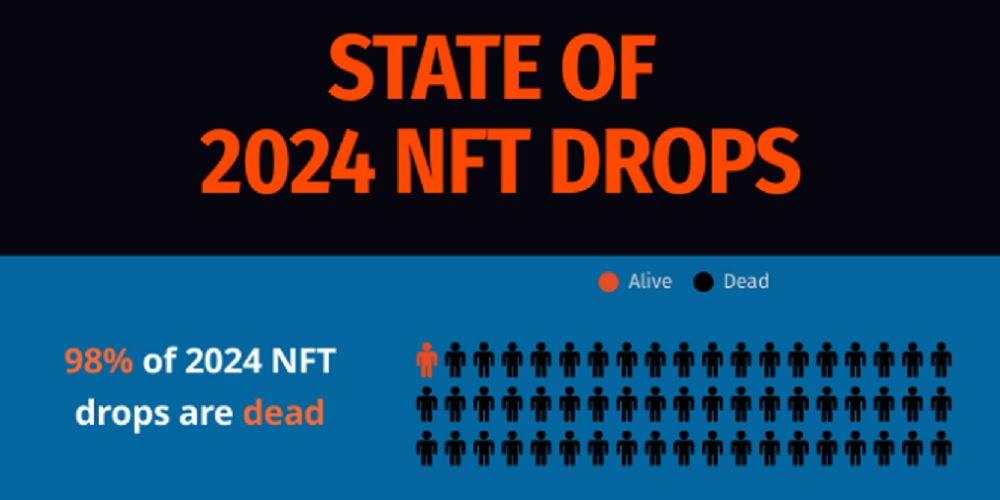

- 98% of 2024 NFT drops are dead.

- Only 0.2% of 2024 NFT drops return profits to investors.

- 64% of 2024 NFT drops have fewer than 10 mints.

- 98% of 2024 NFT drops have fewer than 10 trades in the first week.

- In 98% of 2024 NFT drops, the price falls by at least 50% within the first three days.

- 84% of 2024 NFT drops have ATH price equal to mint price.

Oversaturation of the Market

So far in 2024, an average of 3,635 NFT collections have been created per month. While this shows that creators are still eager to launch projects, the sheer volume of collections indicates an oversaturated market. The supply has grown far beyond demand, leaving many projects to struggle for attention and buyers.

98% of the 2024 NFT Drops Are Dead

We define death as the absence of trading activity since September 2024.

Based on this, we can conclude that: 98% of 2024 NFT drops are dead.

„This demonstrates how quickly projects fail, resulting in many collections lacking liquidity, community, or trading activity. The survival rate for new drops is shockingly low, indicating that most NFTs struggle to stay relevant shortly after launch. When we dig deeper into these three numbers: minting, trading, and price, the situation worsens.” – according to the NFTEvening report.

Low Minting and Trading Activity

Despite the high number of new collections, 64% of 2024 NFT drops have fewer than 10 mints. This stark figure highlights the difficulty that most creators face in getting their projects off the ground. Additionally, 98% of NFT drops have recorded fewer than 10 trades within the first week. The limited trading volume points to a lack of excitement or investor confidence in these projects.

Such low engagement suggests that many collections are failing to resonate with audiences, possibly due to a lack of uniqueness, utility, or perceived value. The fast-moving NFT trend may have left creators competing in an overcrowded marketplace where distinguishing themselves has become an uphill battle.

Rapid Price Decline

One of the most alarming trends in 2024 is the swift depreciation of NFT values after launch. 98% of 2024 drops follow the same pattern: the price falls by at least 50% in the first three days.

This sharp drop reflects the waning buyer enthusiasm and the absence of long-term interest in holding these digital assets.

Moreover, 84% of 2024 NFT drops have seen their all-time high price equal to their mint price, meaning they never appreciated in value. In a market where speculative trading once reigned, this trend suggests that buyers are either losing confidence or becoming more selective in the projects they support.

Only a Small Fraction Brings Returns

In 2024, just 0.2% of all NFT drops have generated profits for investors. Even among NFTs that are still actively traded (“alive” NFTs), only 11.9% have proven profitable, reflecting the overall difficulties faced by most projects. These figures reveal how selective and cautious investors need to be, as the vast majority of NFTs struggle to retain or grow their value, making profitability a rare outcome in the current market landscape.

What Does This Mean for the Future?

The data paints a clear picture: while NFTs continue to be a vibrant space for innovation, the market is currently flooded with projects that struggle to find traction. With oversaturation, low minting rates, and poor price performance, creators may need to rethink their strategies, focusing on building community and offering real utility to stand out.

Methodology

Data sources: Dune Analytics and OpenSea.

- First, we collected distinct NFT contracts from Dune that had minting activities between 01 January 2024 and 31 August 2024. There were 29,079 collections in total. We then double-check the data using the OpenSea API to ensure its accuracy.

- Next, we used Dune Analytics to crawl and analyze:

The mint price, the ATH price, the current price, and the price three days after the minting process have all been concluded.

7D minting volume, 7D trading volume, and trading volume from September.

What are NFTs?

Non-fungible tokens (NFTs) are a special type of crypto asset that allows holders to prove their ownership of real or digital items – but most importantly, the latter.

NFTs are tradable digital assets that contain information that essentially says, “the person in control of this crypto wallet address is the owner of a computer file, stored in this location.” The computer file can be anything from an image to a GIF or audio clip.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: